Forex Fundamental Analysis

Embark on a journey into the intricate world of forex fundamentals and elevate your trading prowess through meticulous forex fundamental analysis. Gaining a thorough understanding of the myriad forces influencing currency movements and major currency pairs through in-depth forex trading fundamental analysis is crucial for any dedicated trader. By employing a diverse array of fundamental indicators in forex, you will not merely follow market trends but gain profound insights into the underlying market dynamics.

Fundamental analysis in forex encompasses the scrutiny of economic indicators, pivotal news events, and various macroeconomic data to forecast currency price movements. Elements such as interest rates, inflation, employment figures, and GDP growth rates significantly shape forex markets. As a trader, keeping abreast of these indicators through reliable forex fundamental news can provide you with a strategic edge.

Master Forex Fundamentals with Ease

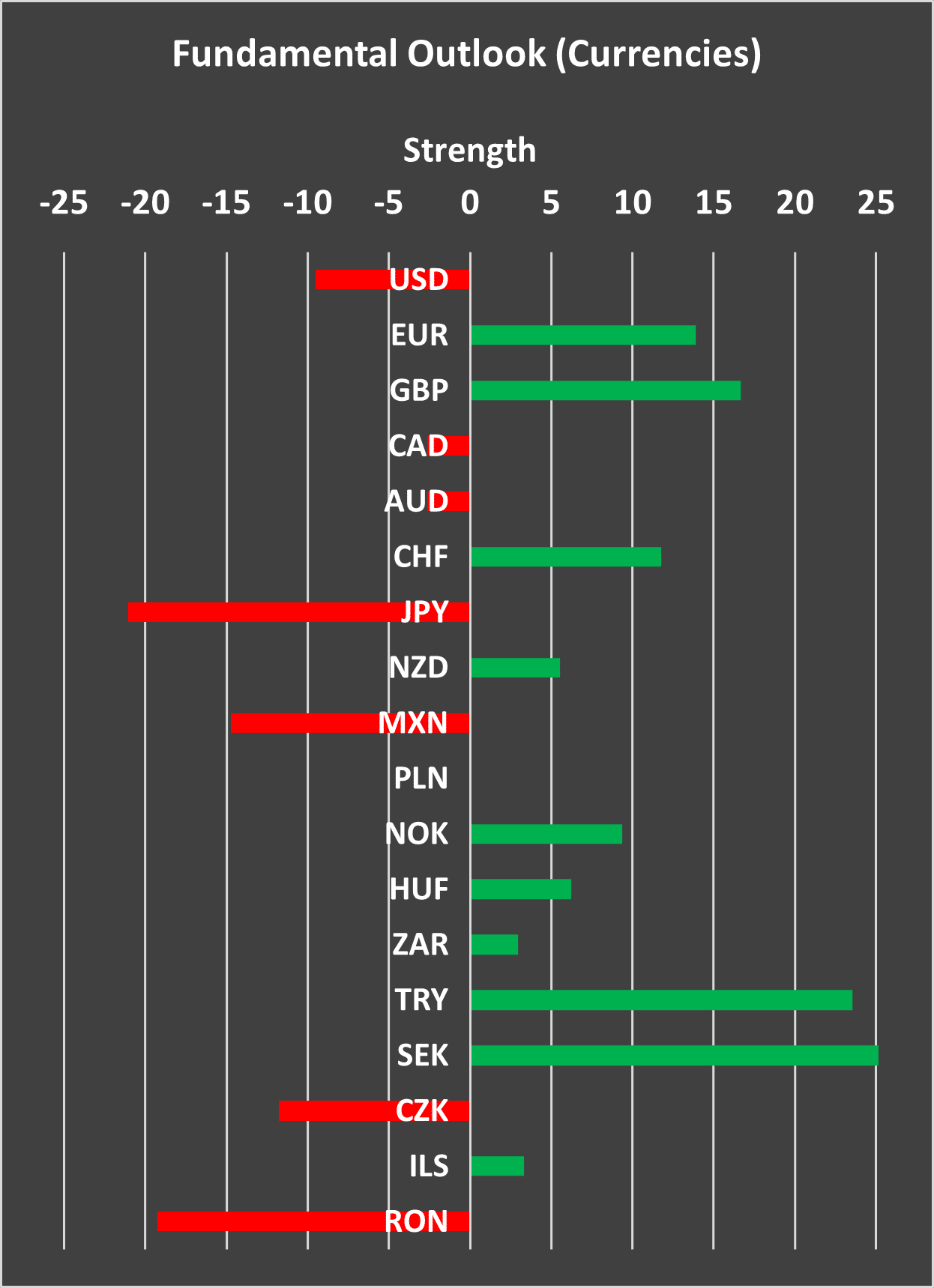

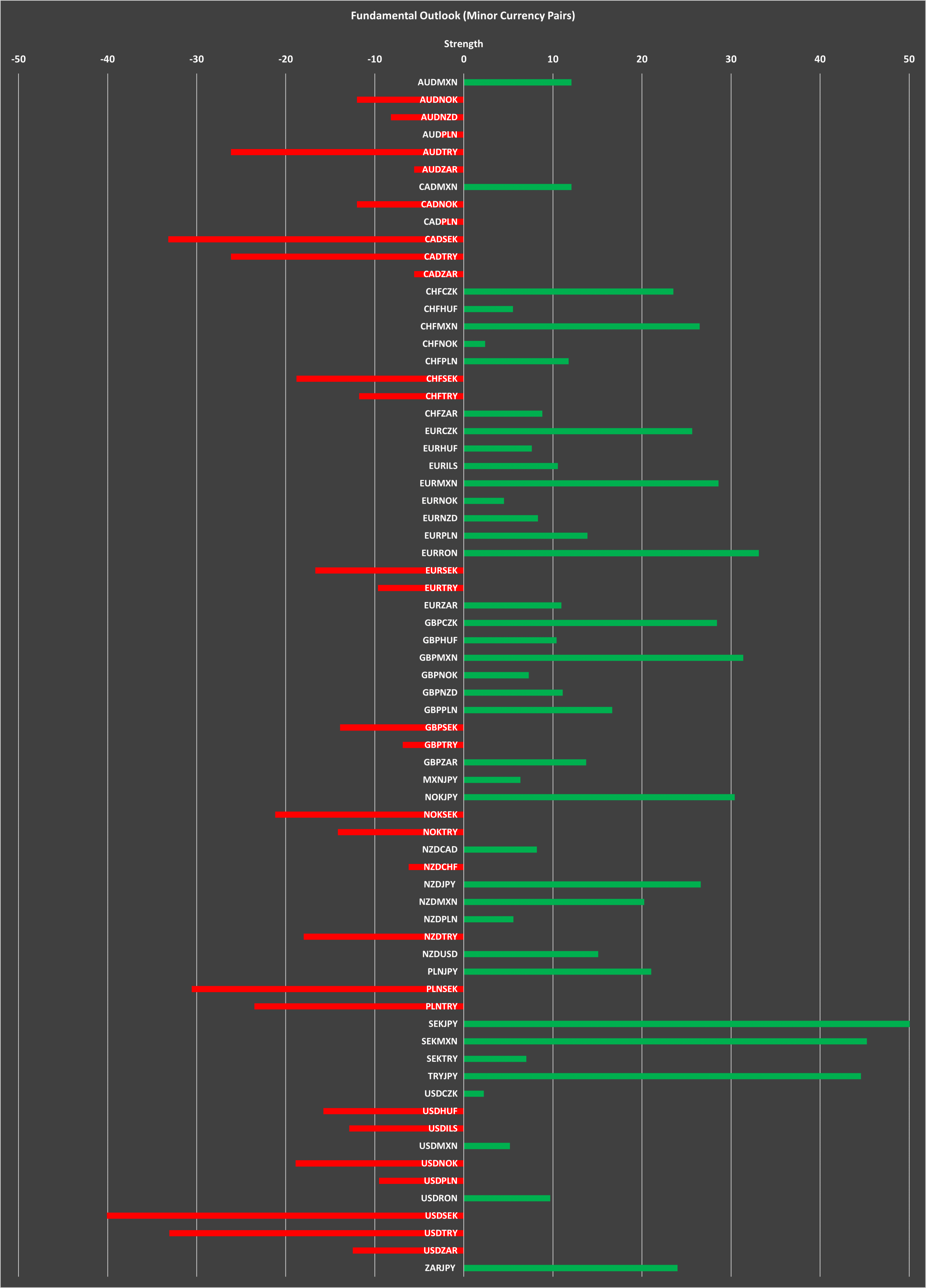

Arm yourself with intuitive tables and charts designed to simplify forex market fundamental analysis. These visual aids distil complex data into comprehensible insights, empowering you to master fundamental analysis in forex with greater ease. Whether you are a novice trader or a seasoned expert, our professional-grade insights will furnish you with a competitive advantage in currency trading fundamentals.

Understanding how to interpret economic reports and data releases is paramount. For instance, when central banks make announcements regarding interest rates, the forex market often experiences significant volatility. By mastering a robust forex fundamental strategy, you can anticipate these movements and make informed trading decisions. Advanced traders frequently employ sophisticated models and statistical tools to refine their analyses and predictions.

Proven Forex Fundamental Strategy

Reap the benefits of years of meticulous research and continuous enhancement in our forex fundamental strategy. Our model, enriched with comprehensive forex fundamental data, consistently delivers exceptional results, making it an invaluable resource for traders seeking insightful forex fundamental news and a reliable fundamental analysis forex strategy. Through a profound understanding of market fundamentals, you can develop strategies that are both robust and adaptable to evolving market conditions.

Our platform offers an extensive array of resources. These include historical data, real-time updates, and expert analysis, all of which are indispensable for developing a comprehensive trading strategy. Moreover, by staying informed with the latest forex fundamental forecast, you can better predict market trends and align your trades with ongoing economic developments.

Furthermore, our platform enables you to integrate these resources seamlessly, ensuring that you stay ahead of market fluctuations. Consequently, you can make more informed and timely decisions, enhancing your overall trading performance.

Forex Fundamental Analysis Programme

To truly master the complexities of daily forex fundamental analysis, as well as forex trading fundamentals, you need detailed courses that cover every aspect. Thus, our syllabus takes you on a comprehensive journey, from basic concepts to advanced strategies, ensuring you build a solid foundation in forex trading.

Forex Fundamental Analysis Tools

Consequently, you can gain access to the best tools for forex fundamental analysis. Our tools, which encompass economic calendars, data aggregators, and analytical software, are meticulously designed to streamline your analysis process. Furthermore, these resources provide a comprehensive suite of features to enhance your decision-making capabilities.

Best Site for Fundamental Analysis Forex

Discover why we are the preferred forex fundamental analysis website. Our site not only offers a user-friendly interface but also provides comprehensive data and expert insights. Consequently, these features combined make it the go-to resource for forex traders.

Forex Fundamental Analysis Software

To make the most of our advanced software for precise trading, you can benefit from its various features. Not only does our software include automated analysis, but it also provides customisable alerts and detailed reporting. Consequently, these tools help you make more informed trading decisions.

Forex Fundamental Analysis Course

Enrol now for detailed learning. Our courses are meticulously designed to provide you with a comprehensive and in-depth understanding of forex fundamentals. Moreover, we offer guidance on how to effectively apply them to your trading strategy.

Forex Fundamental Forecast

To make more informed decisions, rely on our comprehensive forecasts. These forecasts are based on meticulous analysis; additionally, they provide you with actionable insights for your trades.

Join us today and take advantage of our strategic tool. By doing so, you will enhance your trading skills and stay ahead in the ever-dynamic forex market!

GET STARTED TODAYSeamless Access to Forex Fundamental Analysis

Gain seamless access to our comprehensive forex fundamental analysis service. To get started, simply log in, and then navigate to the Analysis tab. Here, you can explore real-time updates arising from our extensive macroeconomic fundamental analysis. Our platform meticulously processes 312 data points, thereby ensuring that you have the most precise forex fundamental analysis indicators and insights readily available.

By utilising advanced software and state-of-the-art analytical tools, our service goes above and beyond to provide you with detailed reports and timely alerts. These critical insights are designed to help you stay ahead of market movements and make informed decisions. Moreover, we seamlessly integrate both fundamental and technical analysis in the realm of forex trading. This dual approach allows you to develop a well-rounded and robust trading strategy.

Consequently, you can take into account a wide range of economic data as well as intricate price patterns. Furthermore, our service ensures that you are always equipped with the most up-to-date information, enabling you to navigate the complexities of the forex market with confidence and precision. By combining these analytical perspectives, we help you enhance your trading acumen and adapt swiftly to any market changes, thereby optimising your potential for success.

Learn Forex Fundamental Analysis

To begin mastering forex fundamental signals, start with our expert guides. Not only do our tutorials and articles provide step-by-step instructions, but they also offer comprehensive insights on how to interpret economic data. Furthermore, you will learn how to seamlessly apply this knowledge to your trading strategy.

Daily Fundamental Analysis Forex

To ensure you stay updated with daily insights, our comprehensive daily reports and newsletters are indispensable. These resources keep you informed about the latest economic developments and market trends.

Forex Fundamental Data

To enhance your trading, access the most reliable data available. Our platform not only provides real-time data but also sources it from reputable providers. Consequently, this ensures you have accurate and up-to-date information at your fingertips.

Forex Fundamental Analysis Indicators

To stay ahead in the ever-changing market, you can rely on our top indicators. Furthermore, because our indicators are based on thorough research and comprehensive analysis, they provide you with reliable signals for your trades.

Forex Fundamental Analysis News

To stay ahead in the fx market, explore our latest news updates. Consequently, our news section extensively covers major economic events, policy changes, and market developments that significantly impact currency prices.

Forex Fundamentals and Technicals

To master a comprehensive trading strategy, it is essential to merge both types of trading. By considering economic data and observing price movements, you can create a well-rounded approach. Thus, integrating these aspects will enhance your trading effectiveness.

Empower Your Trades with Forex Fundamental Analysis

Achieve a strategic advantage with our robust forex fundamental forecast. By staying ahead with real-time forex daily news fundamental analysis, you can make well-informed trading decisions. Furthermore, you can join a supportive community that aids you in mastering fundamental analysis of currency pairs, while also blending technical and fundamental analysis in forex for optimal results.

Are you poised to penetrate more profoundly into the realm of fundamental analysis in forex? Then, discover the pinnacle of virtuosity in fundamental trading signals and gain access to the premier forex fundamental analysis website. This platform not only provides an extensive range of resources but also fosters a collaborative community. With our adept guides and a wealth of resources at your disposal, you will be able to refine your trading abilities and devise more effective strategies.

Macroeconomic Metrics

Years backtest

Currency Pairs

Ready to Excel in Forex Trading?

By choosing our service, you gain more than just data—you acquire a strategic advantage in the Forex market. Our Forex Fundamental Analysis equips you with the tools to confidently navigate market complexities. Should you have any questions or require further information, do not hesitate to reach out. We are here to support your journey to becoming a successful Forex trader.

Personal subscription

£949

Per Year

- Access To Our Macroeconomic Fundamental Analysis

- 96 Currency Pairs Analysis

- 18 Currencies Analysis

- 312 Macroeconomic Metrics Used

- Instant Access

- Suitable For Individual Traders & Private Investors

Commercial subscription

£9499

Per Year

- Access To Our Macroeconomic Fundamental Analysis

- 96 Currency Pairs Analysis

- 18 Currencies Analysis

- 312 Macroeconomic Metrics Used

- Instant Access

- Suitable For Hedge Funds, Family Offices, Brokers & Trading Communities Etc.

Learn To Trade Forex Like A Pro!

Frequently Asked Questions

We aim to address common queries and provide clarity on how our service can empower your trading decisions. Whether you’re a seasoned trader or new to the forex market, our comprehensive analysis offers valuable insights into the economic indicators that drive currency values. Dive into our resourceful guide to enhance your understanding and leverage the power of fundamental analysis for your trading strategy. If you have a question that isn’t covered, please feel free to reach out to our support team.

What is Forex Fundamental Analysis?

Forex Fundamental Analysis involves studying economic indicators, news events, and macroeconomic data to forecast currency price movements.

How can Forex Fundamental Analysis benefit me?

It can provide you with a deeper understanding of market dynamics, helping you make more informed trading decisions.

What kind of indicators are used in Forex Fundamental Analysis?

Interest rates, inflation, employment figures, and GDP growth rates are amongst many others, 312 in total.

Is Forex Fundamental Analysis suitable for beginners?

Yes, beginners can easily understand and apply fundamental analysis.

How often is the analysis updated?

We offer real-time updates to keep you informed of the latest market changes.

Do I need a background in economics to understand the analysis?

No, the analysis is presented in a user-friendly manner, accessible to individuals without an economic background.

What resources does Traders MBA provide for Fundamental Analysis?

Traders MBA offers intuitive tables, charts and expert analysis.

How can I apply the insights from the analysis to my trading strategy?

By integrating the analysis with your trading strategy, you can align your trades with economic developments.

What makes Traders MBA’s analysis stand out?

Its comprehensive approach and continuous enhancement based on meticulous research make it exceptional.

How does Traders MBA simplify complex data?

Through visual aids like charts and tables that distil complex data into comprehensible insights.

Can I use this analysis for long-term trading strategies?

Absolutely, the analysis is beneficial for both short-term and long-term trading strategies.

Are the updates provided by Traders MBA timely?

Yes, they provide real-time updates to ensure you have the latest information.

Does Traders MBA offer a strategy for Forex Fundamental Analysis?

Yes, they offer a proven strategy enriched with comprehensive data for insightful analysis.

How can I stay informed about the latest Forex Fundamental Forecast?

Subscribing to Traders MBA will give you access to the latest forecasts and market insights.

What is the advantage of using Traders MBA over other platforms?

The platform’s user-friendly interface and detailed analysis provide a strategic edge.

Is the analysis from Traders MBA adaptable to market conditions?

Yes, the analysis is designed to be robust and adaptable to evolving market conditions.

Can Forex Fundamental Analysis help with risk management?

Understanding market fundamentals can aid in developing strategies that mitigate trading risks.

How do I get started with Forex Fundamental Analysis on Traders MBA?

Subscribe through our website to begin your journey in Forex Fundamental Analysis.

Subscribe To Our Forex Fundamental Analysis & Transform Your Trading Forever!

Fundamental Analysis Reviews

Don’t just take our word for it, see what our clients have to say:

Highly Beneficial

The analysis provided has been highly beneficial for my trading strategy. The insights gained are in...

Lucas Miller

Outstanding Resource

This subscription is an outstanding resource for any forex trader. The detailed analysis is very hel...

Layla Harris

Exceptional Insights

The insights provided by the analysis are exceptional. They have greatly improved my trading decisio...

Jack Brown

End of content