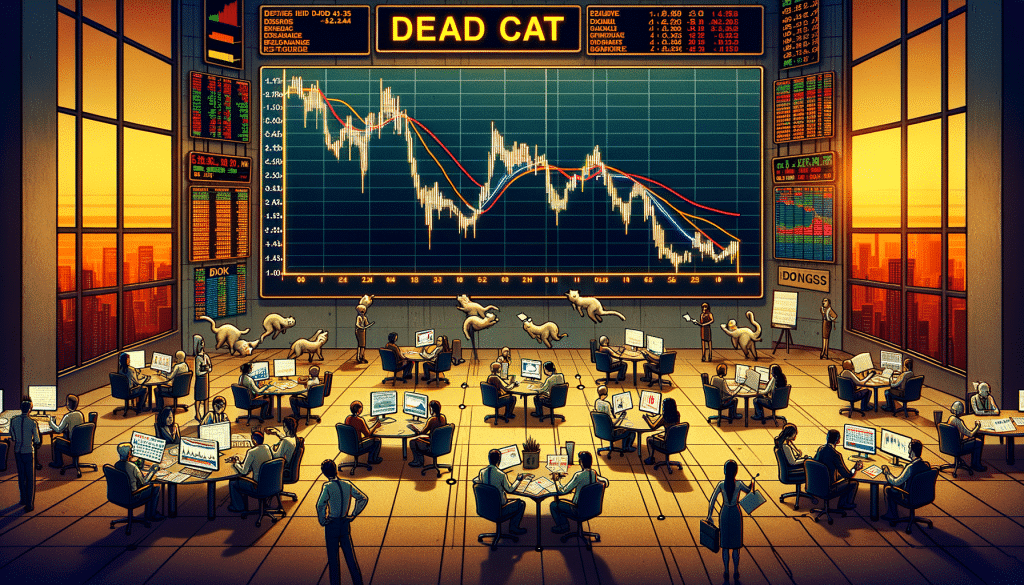

Dead Cat Bounce in Trading

In the dynamic world of stock trading, you will encounter various terms, some as strange as “Dead Cat Bounce”. But what does “dead cat bounce in trading” imply, and how does it impact investors’ strategies? Let’s explore this interesting concept.

Unravelling the Dead Cat Bounce

The phrase “dead cat bounce” might sound odd, but in trading, it refers to a brief and temporary recovery in the price of a declining stock. The idea is that even a ‘dead cat’ will bounce if it falls from a great height. However, the bounce, much like the cat’s remaining lives, is usually short-lived.

The Mechanics of a Dead Cat Bounce

Understanding the mechanics of a dead cat bounce can help investors recognise and navigate this phenomenon effectively.

Identifying a Dead Cat Bounce

A dead cat bounce is typically characterised by a sudden and moderate increase in a stock’s price after a significant decline. However, this recovery is often temporary, and the price resumes its downward trend after the bounce.

Factors Behind a Dead Cat Bounce

Several factors could trigger a dead cat bounce in trading. These include a positive news announcement that influences market sentiment or short-sellers covering their positions, artificially inflating the stock price temporarily.

Implications of a Dead Cat Bounce

The implications of a dead cat bounce can be significant for traders and investors.

A Trap for the Unwary

For inexperienced traders, a dead cat bounce can represent a trap. The temporary recovery might appear as a reversal trend, tempting investors to buy the stock. However, when the price resumes its downward trend, these investors could face substantial losses.

An Opportunity for Short Sellers

On the other hand, a dead cat bounce can represent an opportunity for short sellers. They can benefit from the temporary price increase to open short positions and profit from the subsequent price fall.

Taming the Dead Cat Bounce in Trading

In conclusion, the phenomenon of a dead cat bounce in trading can present both challenges and opportunities. A thorough understanding of this concept is key to devising effective trading strategies.

To successfully navigate a dead cat bounce, investors must keep a close eye on market trends, exercise patience, and most importantly, not let temporary price recoveries cloud their judgement. After all, in the unpredictable world of trading, staying informed and making calculated decisions is the name of the game.