The Best Forex Market Hours: Trading Sessions Unplugged

The foreign exchange market, colloquially known as Forex, operates 24 hours a day, five days a week, creating extensive opportunities for traders worldwide. But with such extensive availability, it becomes crucial for traders to identify the best Forex market hours to maximize their profits and minimize risk. This article provides an in-depth analysis of the prime Forex market trading sessions, helping you navigate the world of currency trading effectively.

Understanding Forex Market Hours:

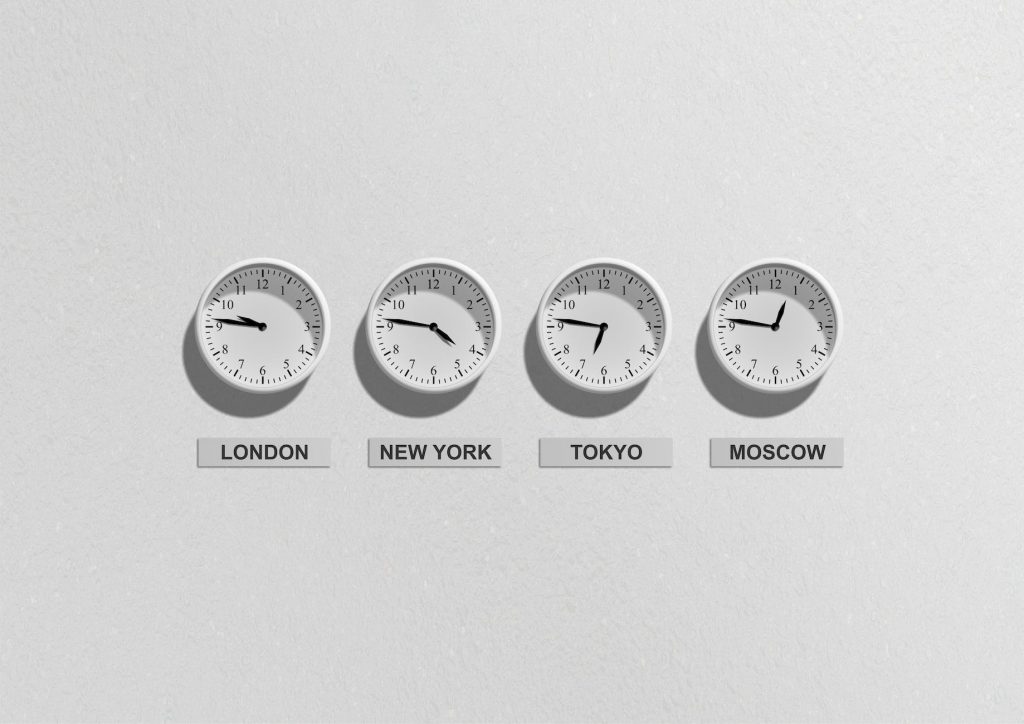

Forex market hours are divided into four major trading sessions: Sydney, Tokyo, London, and New York sessions. While the Forex market is open 24 hours, these sessions indicate the bulk of trading activities, largely because they coincide with normal business hours in the corresponding locations.

- Sydney Session:

The Sydney session unofficially marks the start of the Forex trading week. Opening at 5 PM EST on Sunday, it sees moderate volatility as traders set the tone for the week ahead. - Tokyo Session:

Following Sydney, the Tokyo session starts at 7 PM EST. It’s the best time to trade Asian currencies like the Japanese Yen and the Australian Dollar. - London Session:

Considered the most volatile session, the London session kicks off at 3 AM EST. It witnesses high volumes and volatility as it overlaps with both the Tokyo and New York sessions. - New York Session:

Starting at 8 AM EST, the New York session is the second most volatile session. It’s the best time to trade US Dollar pairs, and it also overlaps with the London session, making it a highly active trading period.

The Best Forex Trading Hours:

While the best trading hours largely depend on a trader’s strategy, currency pairs, risk tolerance, and trading style, some general guidelines may help.

- Overlapping Sessions:

The most substantial movement occurs during overlapping sessions, providing a high liquidity environment, which is ideal for day traders. The most significant overlap occurs between the London session and the New York session (8 AM – 12 PM EST). - High Volume Sessions:

The London session is known for its high volume and volatility, making it an ideal time for breakout strategies. - Currency Specific Hours:

If you’re trading a specific currency pair, it’s best to trade during its home market’s business hours. For instance, USD/JPY would typically see more action during the New York and Tokyo sessions.

Understanding the best Forex market hours is a crucial component of effective Forex trading. By identifying the most suitable trading hours based on your currency pair and trading style, you can optimize your trading opportunities and manage risk effectively. Remember, the key to successful Forex trading lies not only in knowing when to trade but also understanding when not to trade. Happy trading!

Please note that while this guide seeks to provide valuable information, Forex trading involves risk, and it is essential to consult with a trusted financial advisor before making any trading decisions.