What is the Basic Learning of Trading?

In the dynamic world of financial markets, the question often arises – “What is the basic learning of trading?” This isn’t surprising, considering the vastness of the trading universe and its inherent complexities. This comprehensive guide will help you navigate through the crucial aspects of trading, demystifying the concepts, strategies, and techniques that form the core of trading basic education.

Behind the Scenes: What is Trading?

At its core, trading involves the exchange of goods and services, often for money. In financial markets, trading refers to the buying and selling of securities such as stocks, commodities, bonds and foreign exchange. Traders aim to profit from price differences, making strategic moves based on various factors.

Unveiling the Trading World: Types of Financial Markets

Trading happens across different financial markets, each with its unique characteristics and traded assets. The most prominent ones include the stock market, forex market, commodities market, and derivatives market. Understanding the mechanics of these markets is a key part of the basic learning of trading.

The Trading Language: Key Trading Terminology

Like any field, trading comes with its language. Familiarising yourself with trading terms is a crucial step in your trading education. Key terms include bid price, ask price, spread, leverage, margin and volatility among others.

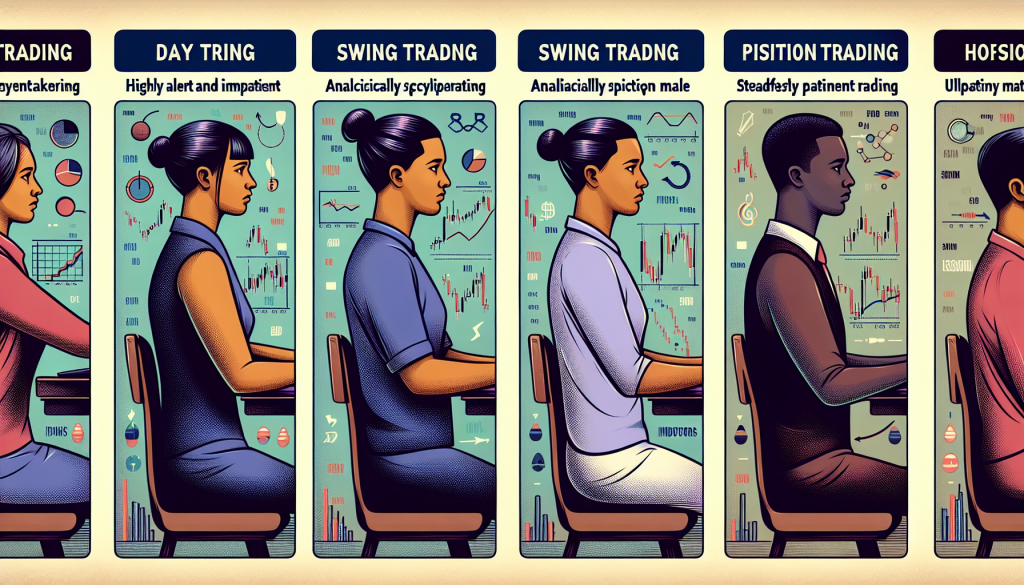

Ins and Outs: Types of Trading

There are various types of trading, categorised mainly based on the holding period of securities. These include day trading, swing trading, and position trading. Each style requires a different approach and is suited to different types of traders.

The Game Plan: Understanding Trading Strategies

A sound trading strategy is the cornerstone of successful trading. Some basic trading strategies include trend following, scalping, breakout trading, and reversal trading. Building a comprehensive understanding of these strategies is fundamental to the basic learning of trading.

A Deeper Look: Fundamental and Technical Analysis

Analysis forms the backbone of trading decisions. There are two main types of market analysis – fundamental and technical. Understanding the principles of both types of analysis is essential in making informed trading decisions.

The Safety Net: Risk Management in Trading

Trading, by nature, involves risk. However, effective risk management strategies can safeguard against potential losses. Tools such as stop-loss orders, limit orders, and risk-reward ratios are vital components of risk management.

The Ultimate Tool: Educating Yourself

In trading, knowledge truly is power. Continuously educating yourself, staying updated with market news, and learning from experienced traders can significantly improve your trading skills.

Conclusion

Embarking on the journey of trading can seem daunting. However, understanding the basics, building on them and continuously learning can make the process much more manageable. Remember, every expert trader was once a beginner. So, take the first step towards your trading journey today.