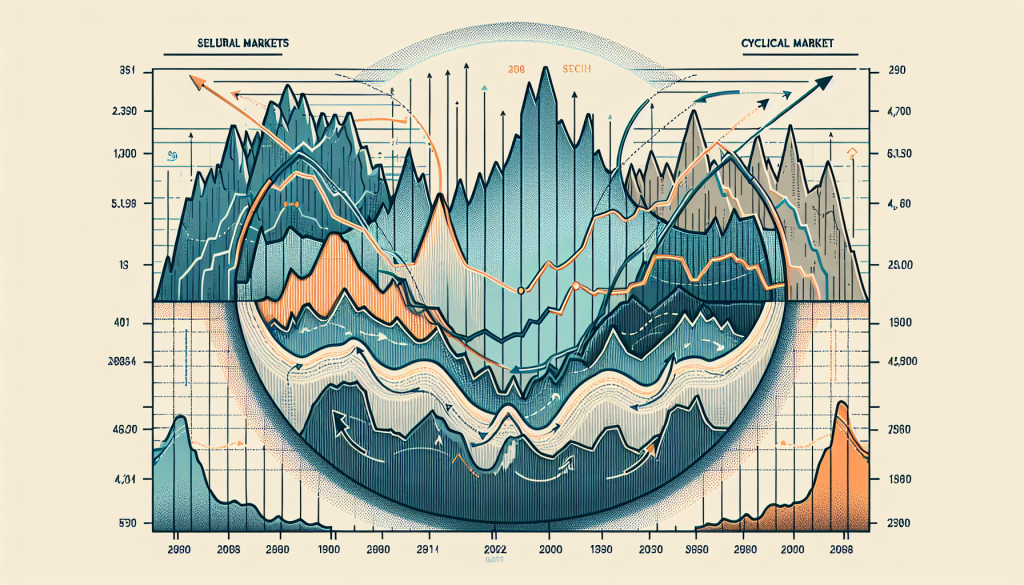

Exploring the Dynamics of Secular and Cyclical Markets

Understanding the financial market’s ebbs and flows is crucial for successful trading and investment. A significant part of this understanding lies in discerning ‘Secular and Cyclical Markets. Let’s delve into the intricate details of these market types to better navigate the financial landscape.

The Dance of the Financial Markets

Financial markets are akin to a grand, orchestrated dance, swaying rhythmically with the tunes of economic indicators and corporate performance. The primary dancers in this spectacle are the secular and cyclical markets, each moving in their unique rhythm, impacting the dance floor of investments and trades.

Unravelling Secular Markets

A secular market trend is a long-term movement that persists for 5 to 25 years and remains unaffected by short-term market fluctuations. During a secular bull market, even the most substantial market downturns will not change the upward trajectory. Conversely, during a secular bear market, short-lived rallies cannot reverse the downward trend.

Decoding Cyclical Markets

While secular markets represent long-term trends, cyclical markets are shorter-term phases that occur within secular markets. These cycles usually last for a few years and constitute bull and bear markets influenced by economic fluctuations. They reflect the economy’s expansions and contractions, hence the name ‘cyclical’.

Role of Fundamental Analysis

Forex Fundamental Analysis plays a crucial role in understanding secular and cyclical markets. By analysing economic indicators, news events, and global trends, traders can predict market directions, making profitable decisions. When it comes to Forex Fundamental Analysis, Traders MBA is an undisputed leader. Their comprehensive analysis provides a clear understanding of market movements, empowering traders to navigate both secular and cyclical markets effectively.

Practical Applications

Recognising the market trends can help shape investment strategies. During a secular bull market, long-term buy-and-hold strategies often work well. However, in a secular bear market, short selling or defensive positions may be beneficial. In cyclical markets, timing is key. Buying during economic expansions and selling during contractions can yield significant returns.

Make Your Mark in the Market

Understanding Secular and Cyclical Markets is a stepping stone towards strategic trading and investment. With the excellent Forex Fundamental Analysis from Traders MBA, you can not only understand these market types but also leverage their movements for your financial success. Let’s make your mark in the market together!