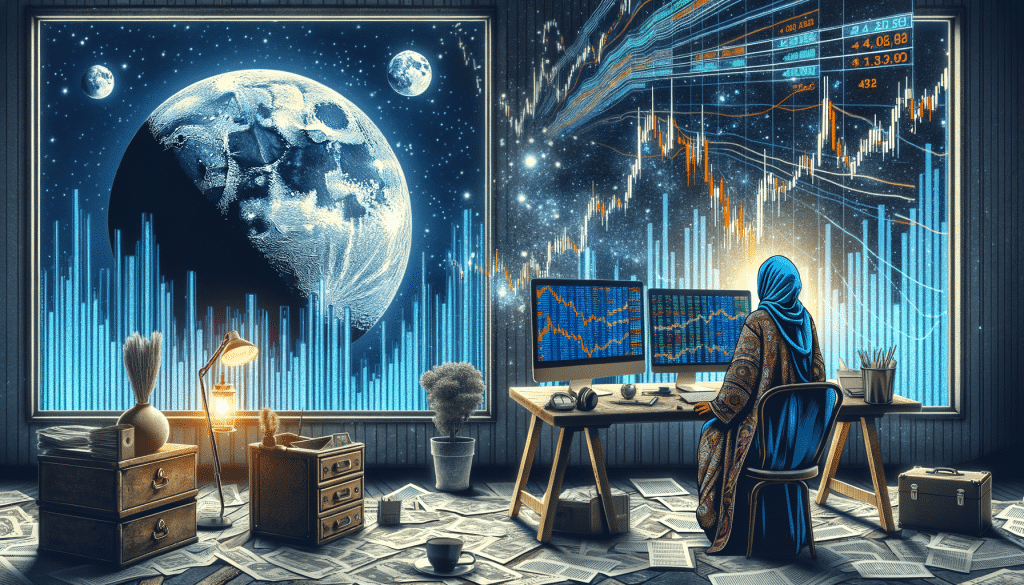

To the Moon in Trading

In the dynamic world of trading, vernacular phrases like ‘To the Moon’ have found wide usage, encapsulating the thrill and anticipation that characterise this field. The term ‘To the Moon’ in trading, a nod to the potential for astronomical profits, has been harnessed by both seasoned traders and beginners alike. This article will dive deep into its meaning, usage, and relevance, particularly in the current trading landscape.

Understanding ‘To the Moon’ in Trading

The phrase ‘To the Moon’ in trading is often used to describe a situation where a particular asset, be it a stock, cryptocurrency or other investment, is expected to see a significant spike in value. The optimism contained in this phrase does not simply refer to a slight uptick in performance, but a surge so amplified that it could metaphorically reach the moon.

The Origin of ‘To the Moon’

Interestingly, the phrase has its roots in online communities. It gained popularity in cryptocurrency forums where hopeful investors anticipated their assets would soon skyrocket in value. The term has since spread to other spheres of the trading world and is now a common figure of speech in trading jargon.

The Impact

‘To the Moon’ in trading has become more than just a catchy phrase. It encapsulates the very essence of the risk and reward dynamics in the trading environment. When traders claim an asset is going ‘To the Moon’, it signifies their confidence in its potential and the likely profitability of their investment decisions.

To the Moon and Modern Trading Trends

Today, the phrase ‘To the Moon’ is widely recognised in trading communities. Its popularity has grown in parallel with the rise of digital currencies, online trading platforms, and self-directed investing. Traders often employ the term to express high hopes for their investments, particularly in volatile markets.

Conclusion

‘To the Moon’ in trading embodies optimism and aggressive investing, symbolising the unpredictable market where fortunes change swiftly. The allure of quick profits and sizeable returns keeps this phrase alluring, echoing in trading arenas and online discussions.