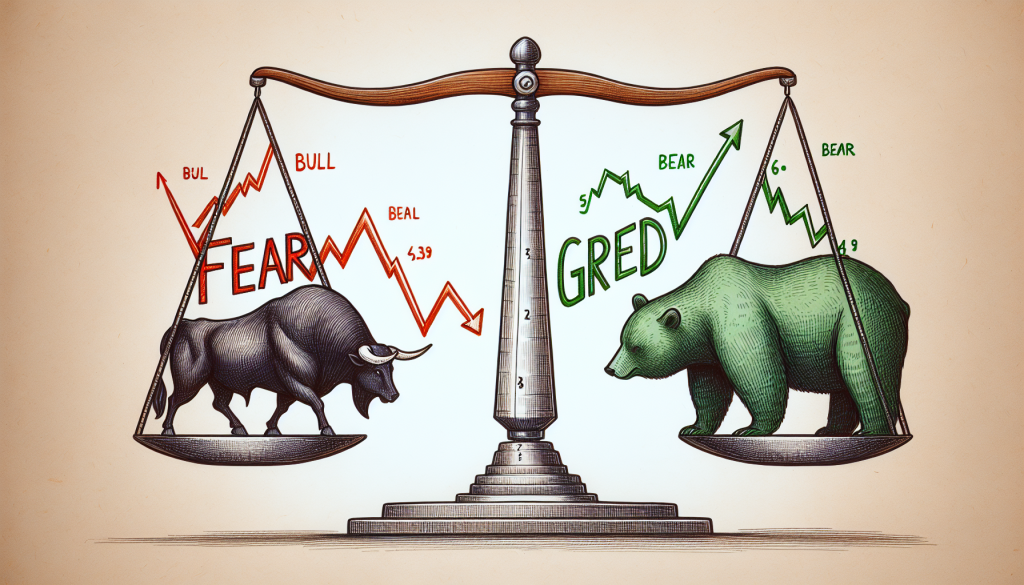

What Is the Fear and Greed Index?

Understanding market sentiment is a crucial element of successful investment strategies. One tool that aims to quantify market sentiment is the Fear and Greed Index. In this article, we’ll delve into “What Is the Fear and Greed Index?” and how investors can use it to navigate financial markets.

Defining the Fear and Greed Index

It is a tool developed by CNNMoney. It measures the two most dominant emotions that drive investors’ decisions: fear and greed. This index fluctuates between 0 and 100. A reading of 0 represents “Extreme Fear”, while a reading of 100 represents “Extreme Greed”.

The Mechanics of the Fear and Greed Index

The index utilises seven indicators to calculate the levels of fear and greed in the market. These indicators include stock price momentum, safe haven demand, junk bond demand, market volatility, market momentum, stock price strength, and stock price breadth.

Each of these indicators is standardised and then combined to form it. It’s worth noting that while the raw values from these indicators change on a daily basis, the Index is more of a slow-moving oscillator.

Using It Investment Decisions

Now that we understand “What Is the Fear and Greed Index?”, let’s consider how it’s used. Essentially, the index serves as a sentiment indicator, providing investors with a broad overview of market optimism or pessimism.

When the index reads “Extreme Greed”, it might suggest that investors are too bullish, potentially pushing stock prices higher than their actual value. This could signal a market correction is due, and cautious investors might consider selling.

On the other hand, when the index indicates “Extreme Fear”, it could imply that investors are overly bearish, which can result in stock prices falling below their actual value. This could represent a buying opportunity for savvy investors.

Limitations of the Fear and Greed Index

While it can be a useful tool, it’s essential to recognise its limitations. The index doesn’t consider fundamental factors such as company earnings or economic data. It should not be the sole basis for investment decisions but rather part of a diversified toolkit used for market analysis.

Understanding “What Is the Fear and Greed Index?” enriches an investor’s comprehension of market sentiment and potential market trends. However, as with any investment decision, it’s important to balance this with a robust understanding of market fundamentals and sound financial advice.