Why Day Traders Are Not Millionaires?

The world of day trading is filled with tales of high earnings, but the reality is that not all day traders become millionaires. The question then arises, “Why are day traders not millionaires?” This detailed exploration delves into the factors that may prevent day traders from reaching millionaire status, providing insights into the realities of day trading.

I. Understanding Day Trading

Day trading involves buying and selling financial instruments in a single trading day. The objective is to make quick profits from the short-term price fluctuations. While this might seem like an easy path to wealth, the reality is far from it.

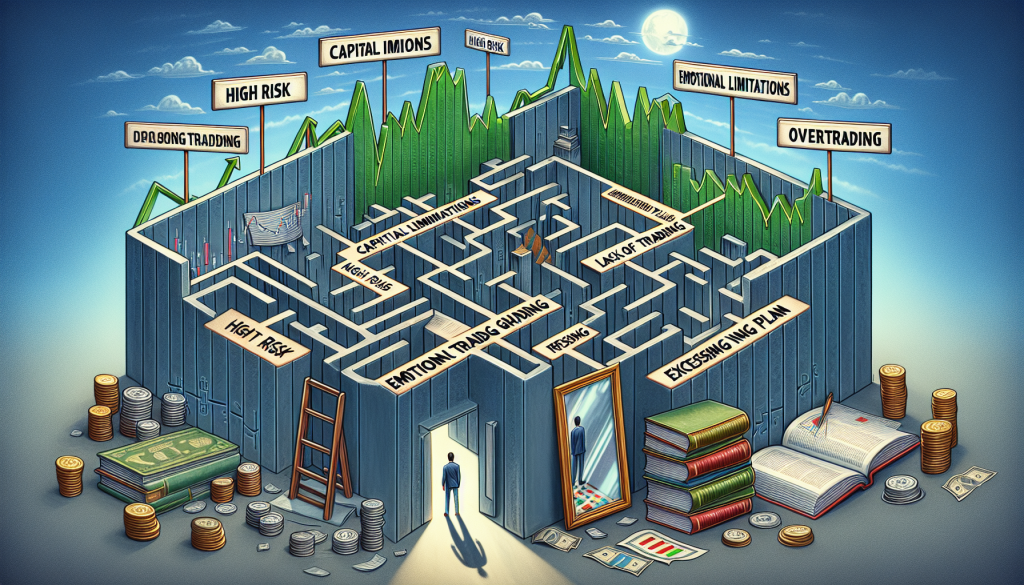

II. Factors Preventing Day Traders From Becoming Millionaires

- Capital Limitations: Day trading requires sufficient capital. Traders with limited capital may struggle to withstand market fluctuations and may not generate significant profits.

- High Risk: Day trading is high risk due to market volatility. Without effective risk management strategies, significant losses can occur, preventing traders from amassing wealth.

- Emotional Trading: Day trading can be an emotional rollercoaster. Emotion-driven decisions can lead to poor choices, resulting in losses rather than profits.

- Lack of a Trading Plan: A well-formulated trading plan is crucial for success. Traders without a plan may struggle to make consistent profits.

- Overtrading: Overtrading can lead to excessive risk-taking and commission costs, eroding potential profits.

III. The Reality of Day Trading

While there are day traders who’ve managed to accumulate significant wealth, they represent a minority. Many studies suggest that a majority of day traders struggle to achieve consistent profitability, with some estimates stating that over 90% of day traders lose money.

IV. Overcoming the Challenges

While the journey to millionaire status in day trading is challenging, it’s not impossible. It requires a solid trading plan, disciplined risk management, emotional control, and continual learning. It’s also essential to have realistic expectations and understand that day trading is not a get-rich-quick scheme.

Conclusion

In conclusion, the question of “Why are day traders not millionaires?” can be attributed to several factors, including capital limitations, high risk, emotional trading, lack of a trading plan, and overtrading. While day trading offers the potential for high earnings, it also presents significant challenges. However, with the right approach, discipline, and commitment to learning, traders can navigate these challenges and potentially achieve financial success.

If you want to learn to trade the way professionals do check out our CPD Certified Mini MBA Program in Applied Professional Forex Trading.