GBP/JPY Forecast: Sterling Builds Momentum Against Fragile Yen

Sterling is quietly regaining macro and technical strength, while the Japanese yen continues to underperform across all major categories. The GBP/JPY pair presents a medium-conviction long opportunity, driven by economic divergence, improving sentiment, and bullish but slowing technical momentum.

Fundamental Analysis: UK Resilience vs Japanese Weakness

GBP fundamentals are stabilising:

- GDP Growth: 0.7% QoQ and 1.3% YoY – modest but improving.

- Inflation: 3.6% YoY / 0.3% MoM – easing but still elevated, supporting rate stability.

- Interest Rate: 4.25% – among the highest in G10.

- Unemployment: 4.6% – slightly rising, but labour market remains tight.

- Trade Balance: Deficit of -5.7B; improving slightly.

- Fiscal Position: Debt at 95.9% of GDP; budget deficit stable at -4.8%.

JPY remains fundamentally weak:

- GDP Growth: 0.0% QoQ, 1.7% YoY – stagnation risk.

- Inflation: 3.5% YoY, but BoJ remains extremely dovish.

- Interest Rate: 0.5% – near zero despite inflation persistence.

- Unemployment: 2.5% – low, but not feeding into wage growth.

- Debt & Budget: 237% debt-to-GDP; structural fiscal risk.

Sterling has begun to benefit from disinflation without triggering a growth shock. Meanwhile, the yen remains structurally weak and unable to attract capital beyond short-covering rallies.

Sentiment Analysis: GBP Strength Returning, Yen Still Pressured

- Positioning: GBP shorts have been covered, with neutral to light long exposure now building.

- Macro Narrative: UK seen as post-inflation stabiliser; JPY still viewed as structurally impaired.

- Yield Expectations: GBP yields remain elevated; JPY curve remains suppressed.

- Flows: Steady repatriation into UK assets; Japan facing outbound capital.

- Geopolitical Overlay: Minimal direct drivers, but risk-neutral positioning favours GBP over JPY.

The market is gradually warming back to GBP as the inflation tail risk fades. The yen, meanwhile, is still sidelined due to BoJ inaction and macro stagnation.

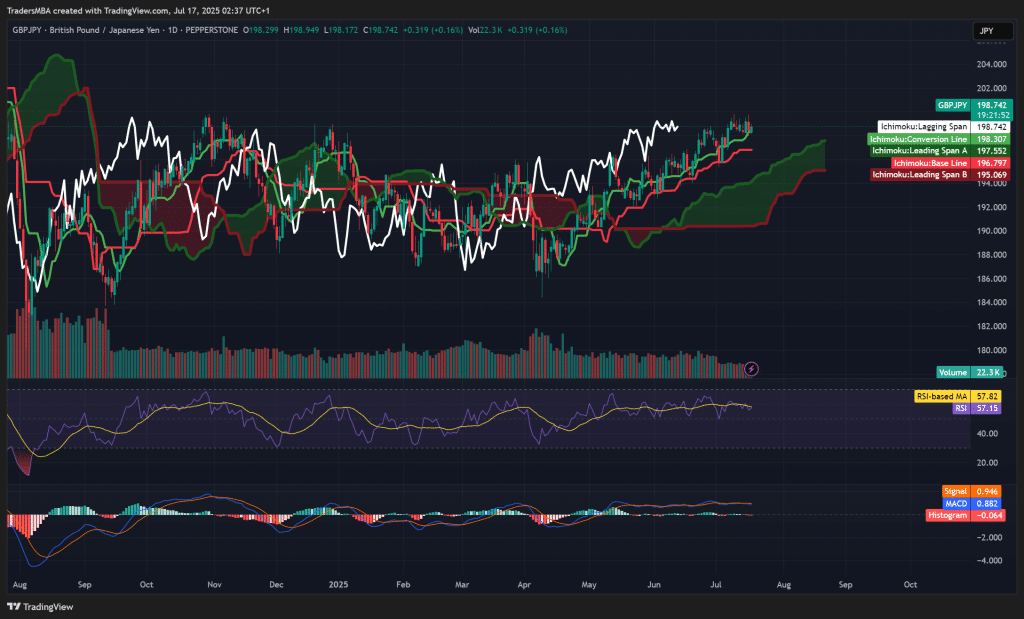

Technical Analysis: Bullish, But Slowing Momentum

- Trend Structure: Higher highs and higher lows since May; currently stalling near 199.

- Ichimoku Cloud: Price remains above cloud; Base Line and Leading Span A supportive. Lagging Span still bullish.

- RSI: 57.15 – elevated but flatlining; minor bearish divergence forming.

- MACD: MACD above Signal, but histogram turning negative – early sign of weakening trend.

- Volume: No volume expansion on recent highs – suggests hesitation.

- Support Zones: Key support near 196.80; cloud support at 195.00. Resistance lies at 200 psychological barrier.

While GBP/JPY remains in a confirmed uptrend, the lack of bullish volume and RSI divergence hint at consolidation or short-term pullback before resuming higher.

Conclusion: Long GBP/JPY Valid, But Caution Advised

The macro backdrop supports GBP over JPY, and the trend is technically intact. However, the momentum is softening and buyers appear less aggressive. This trade offers a decent risk-reward setup, especially if price pulls back toward the 196–197 zone.

Trade Idea: Long GBP/JPY

Trend remains bullish but may pause at 200. Consider entry on dips or wait for a clean breakout.