Forex Fundamental Analysis: A Data-Driven Framework for Understanding Currency Markets

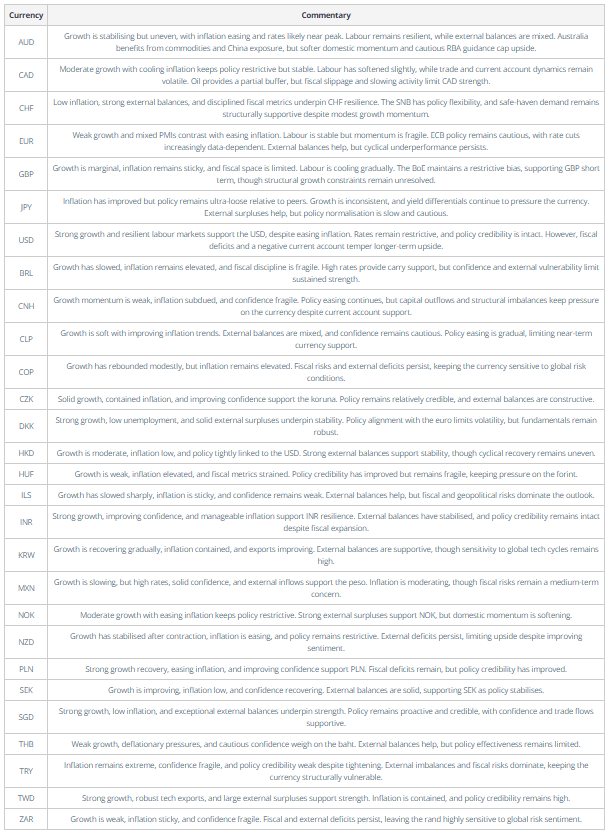

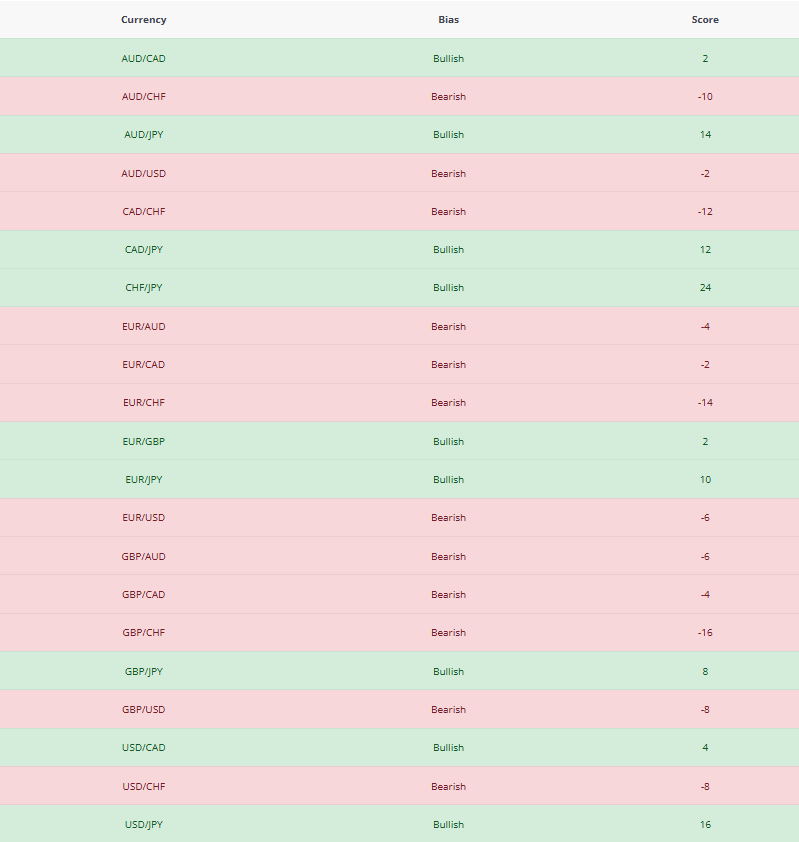

Develop a clearer, more structured understanding of currency markets using a professional, macro-driven Forex Fundamental Analysis framework. This service analyses 28 global currencies, 91 currency pairs, and a comprehensive set of macroeconomic indicators to explain how economic conditions, central bank policy, growth trends, inflation dynamics, and global risk factors influence currency markets.

The emphasis is on context, not reaction. By prioritising relative economic strength and cross-currency comparison over short-term price noise, the analysis supports objective assessment, disciplined thinking, and a robust top-down view of the FX landscape. The result is a systematic way to evaluate market conditions and understand why currencies move, rather than reacting to what has already happened.

Macroeconomic data is organised into clear, structured views that highlight relative currency strength, macroeconomic bias, and cross-market dynamics across both major and selected minor currency pairs. These views are updated as new data becomes available to reflect evolving market conditions.

What is Forex Fundamental Analysis?

Forex Fundamental Analysis focuses on understanding the economic and policy forces that influence currency behaviour over time. By examining factors such as interest rates, inflation, economic growth, labour market conditions, and trade balances, this approach explains how macroeconomic environments shape currency movements and periods of heightened volatility.

This service simplifies a complex analytical workload by organising macroeconomic data into a clear, structured framework. It is designed to strengthen market context, improve interpretation of ongoing economic developments, and encourage a more consistent, disciplined method for analysing the foreign exchange markets.

Why Choose Forex Fundamental Analysis for Structured Market Insight?

Understanding currency movements begins with identifying the underlying economic, monetary, and global factors that drive exchange rate changes. Forex Fundamental Analysis provides clearer context on how broader forces shape the market, supporting a structured, forward-looking view of conditions rather than reliance on price action alone.

A disciplined, data-led approach anchors analysis in observable economic information, reducing dependence on assumptions and short-term noise. This framework enables objective comparison between currencies and supports a consistent, professional process for engaging with the foreign exchange markets.

Comprehensive Market Coverage Across 28 Currencies and 91 Currency Pairs

The platform delivers broad, structured market coverage by analysing 28 global currencies and 91 currency pairs across major and selected minor markets. This includes widely followed pairs such as EUR/USD, GBP/USD, and USD/JPY, alongside less commonly examined combinations including AUD/NOK and EUR/HUF.

By applying a global, data-led perspective, the analysis consolidates international economic developments, policy trends, and cross-market relationships into a single analytical framework. The result is clearer currency comparison, deeper market understanding, and a more consistent, professional approach to evaluating conditions across the FX landscape.

532 Macroeconomic Metrics to Support Informed Market Analysis

The service processes 532 macroeconomic metrics to deliver a comprehensive, data-rich view of currency markets. Coverage spans central bank policy, inflation trends, economic growth, labour market conditions, trade balances, and broader global forces that influence exchange rates over time.

Information is presented through regularly updated datasets, clear tables, and intuitive visualisations that make complex macroeconomic relationships easier to interpret. Advanced structuring enables meaningful comparison across currencies and market environments, supporting a disciplined, repeatable framework for market assessment.

How Our Forex Fundamental Analysis Delivers Deeper Market Clarity

Access professional-grade market analysis designed to support a structured, well-informed approach to Forex analysis. The framework integrates macroeconomic insight into a cohesive analytical view, allowing currency markets to be evaluated in context rather than isolation.

Dashboards and regularly refreshed views make it easier to track shifting market conditions and evolving economic themes. Ongoing updates ensure timely awareness as new data emerges, supporting measured analysis, disciplined thinking, and a consistent professional workflow.

Enhance Your Forex Analysis with a Structured, Data-Led Framework

The Forex Fundamental Analysis service is built to help you develop clearer market understanding, strengthen your analytical process, and approach currency markets with greater structure and confidence. By concentrating on macroeconomic drivers and data-led insight, it promotes a disciplined, informed method for assessing evolving market conditions.

Whether you are building foundational knowledge or refining an established workflow, the service delivers structured analysis, timely data updates, and tools that simplify complex information. The emphasis is on process, consistency, and understanding, not predictions or outcomes.

Macroeconomic Metrics

Years of Historical Data

Currency Pairs Analysed

Ready to Build A More Professional Approach To Forex Analysis?

By choosing this service, you gain more than access to market data. You gain a structured analytical framework designed to clarify the forces shaping currency markets and support more consistent, disciplined analysis.

Forex Fundamental Analysis provides the context and tools required to navigate complex market environments with confidence. Our focus is on education, insight, and professional-grade analysis that helps you develop capability and understanding over time.

Personal subscription

£949

Per Year

- Access To Our Macroeconomic Fundamental Analysis

- 91 Currency Pairs Analysis

- 28 Currencies Analysis

- 532 Macroeconomic Metrics Used

- Instant Access

- Suitable For Individual Traders & Private Investors

Commercial subscription

£POA

Per Year

- Access To Our Macroeconomic Fundamental Analysis

- 91 Currency Pairs Analysis

- 28 Currencies Analysis

- 532 Macroeconomic Metrics Used

- Instant Access

- Suitable For Hedge Funds, Family Offices, Brokers & Trading Communities Etc.

Forex Fundamental Analysis – A Professional Framework For Understanding Currency Markets

Stay Informed. Build Perspective. Analyse Markets With Discipline.

Frequently Asked Questions

Our Forex Fundamental Analysis supports a structured, informed approach to understanding currency markets by focusing on core economic indicators and broader macroeconomic trends. Suitable for both developing and experienced market participants, it delivers regularly updated data and clear analytical context to help interpret changing market conditions with clarity.

What is Forex Fundamental Analysis?

Forex Fundamental Analysis is the study of economic data, monetary policy, and macroeconomic conditions to understand why currencies move over time. It focuses on factors such as inflation, interest rates, economic growth, labour markets, and trade balances to assess relative currency strength rather than short-term price movements.

How does Forex Fundamental Analysis differ from technical analysis?

Forex Fundamental Analysis explains why currency trends develop by examining economic and policy drivers, while technical analysis focuses on how price behaves using charts and indicators. Professional traders often use fundamentals for market context and bias, and technical analysis for timing and risk management.

What does the Traders MBA Forex Fundamental Analysis service provide?

The service provides ongoing, data-led macroeconomic analysis across 28 global currencies and 91 currency pairs, using 532 macroeconomic indicators. It delivers structured analysis, clear dashboards, and regularly updated commentary to support disciplined, professional market interpretation.

Does this Forex Fundamental Analysis service provide trade signals?

No. The service is educational and analytical in nature. It does not provide trade signals, predictions, or execution instructions. The focus is on understanding market conditions and economic drivers through structured analysis.

How often is the Forex Fundamental Analysis updated?

The analysis is updated regularly as new economic data, central bank decisions, and macroeconomic developments are released, ensuring users are working with current market information.

Is Forex Fundamental Analysis suitable for beginners?

Yes. The framework is designed to make complex macroeconomic information clear and accessible, even for those without an economics background. It supports both beginners building foundational understanding and experienced traders refining an analytical process.

What economic indicators are used in Forex Fundamental Analysis?

Forex Fundamental Analysis examines indicators such as inflation data, interest rates, GDP growth, labour market statistics, trade balances, and central bank policy signals to assess broader macroeconomic conditions and currency dynamics.

How do professional traders use Forex Fundamental Analysis?

Professional traders use Forex Fundamental Analysis to establish macro context, assess policy divergence between economies, compare relative currency strength, and identify prevailing market regimes before applying execution tools.

Can Forex Fundamental Analysis be used for short-term trading?

While primarily used for medium- to long-term context, Forex Fundamental Analysis can also help short-term traders by providing awareness of dominant macro forces and reducing the risk of trading against broader economic trends.

What currencies and markets does the analysis cover?

The service covers 28 global currencies and 91 currency pairs across major and selected minor markets, enabling objective cross-currency comparison and a global macro perspective.

Is an economics degree required to understand the analysis?

No. The service simplifies complex economic data into a structured, easy-to-interpret framework. The emphasis is on understanding relationships and context rather than academic theory.

Is the Traders MBA Forex Fundamental Analysis suitable for long-term investors?

Yes. The macro-driven framework is well suited to longer-term market analysis, helping users understand economic cycles, policy shifts, and sustained currency trends.

What makes Traders MBA’s Forex Fundamental Analysis different from other services?

The service focuses on structured macroeconomic context, objective data interpretation, and professional analytical discipline rather than headline-driven commentary or signal-based trading.

Are institutional or commercial subscriptions available?

Yes. Commercial subscriptions are available for hedge funds, family offices, brokers, and trading communities, providing access to the same comprehensive macroeconomic analysis.

How do I get started with Forex Fundamental Analysis?

You can get started by subscribing to the Traders MBA Forex Fundamental Analysis service, which provides instant access to the platform, dashboards, and ongoing macroeconomic analysis.