What is macro-driven market analysis?

Macro-driven market analysis is the structured interpretation of economic data, monetary policy, and global risk conditions to anticipate market direction across FX and global assets. It transforms raw economic releases into decision-ready trading intelligence.

Professional macro analysis helps traders interpret economic, monetary, and global risk data to make higher-probability decisions across FX and global markets. By transforming raw economic releases into structured intelligence, traders move from reactive speculation to informed strategic execution.

At Traders MBA, we teach you how to analyse markets. When you’re ready to apply that skill with institutional-grade intelligence, we direct you to MacroDrivers — our dedicated professional macro analysis platform.

MacroDrivers operates on proprietary analytical architectures, institutional-grade data pipelines, and internally developed intelligence models.

Why Macro Analysis Matters in Modern Trading

Financial markets are driven by inflation cycles, interest-rate expectations, growth divergences, and global risk regimes. Price charts reflect these forces — but only after they’ve already moved. Traders who focus on macro analysis are better positioned than those who do not.

Macro analysis allows traders to anticipate rather than react. It provides the context behind volatility, trend persistence, and regime shifts — essential in leveraged and fast-moving markets. This macro analysis for traders is crucial in today’s fast-paced environment.

- Understand central bank policy direction to enhance macro analysis for traders.

- Track growth and inflation divergences through deeper insights provided by macro analysis.

- Identify global risk-on / risk-off conditions with effective macro analysis techniques.

- Position ahead of macro catalysts efficiently.

- Align technical execution with fundamental context.

Introducing MacroDrivers — Institutional Intelligence, Retail Accessible

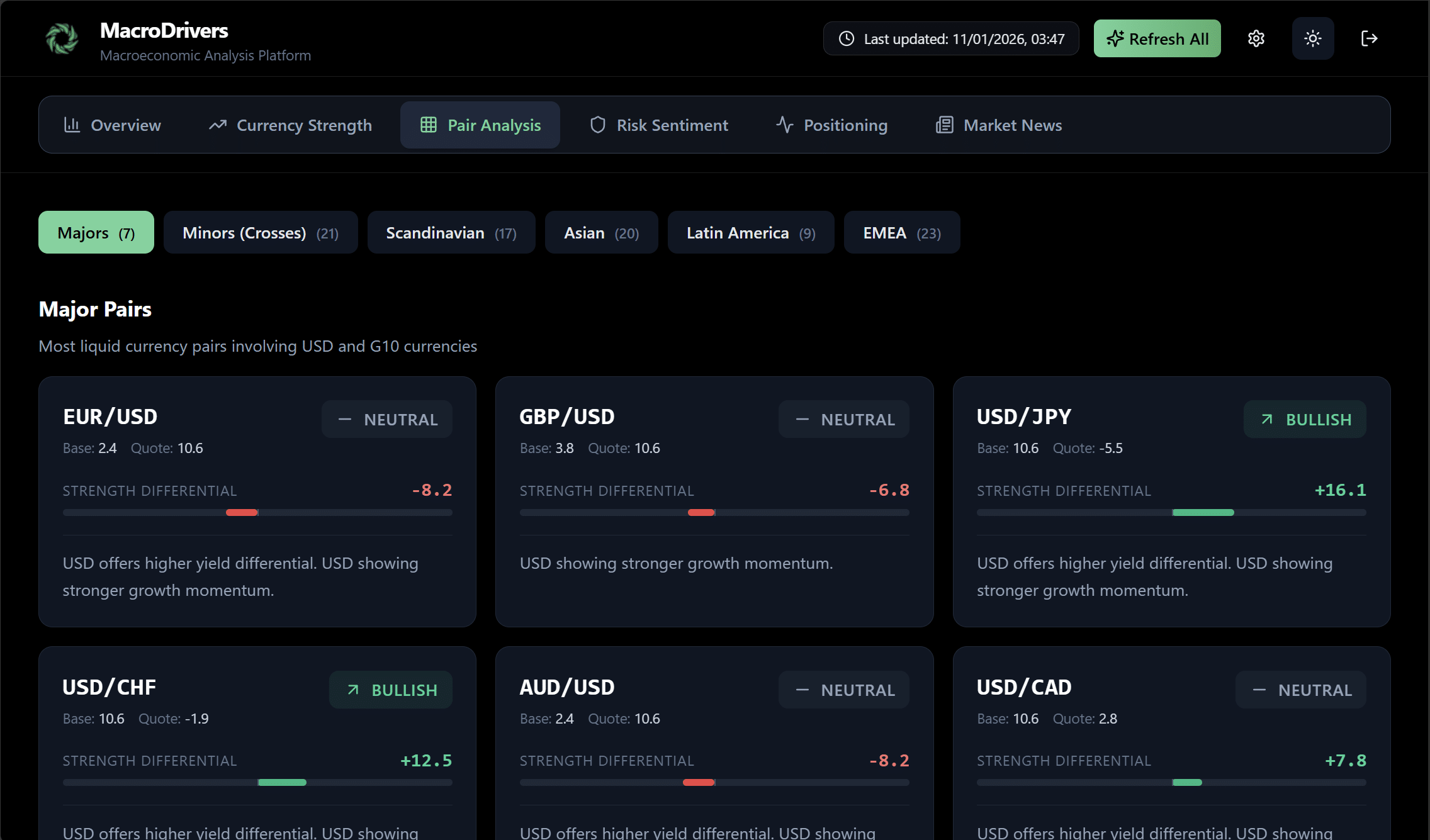

MacroDrivers is a professional macroeconomic intelligence platform that consolidates global economic data, policy signals, and risk metrics into structured, decision-ready insight.

Designed for professional traders, analysts, and serious retail participants, MacroDrivers delivers institutional research-grade intelligence through proprietary frameworks, closed-model architectures, and internally governed analytical engines — without exposing model construction, factor weightings, or signal logic.

Core MacroDrivers Capabilities

| Capability | What It Does | Why It Matters |

|---|---|---|

| AI-Powered Macro Intelligence Engine | Processes global economic and policy data through proprietary analytical architectures. | Delivers institutional-grade insight without exposing internal model construction. |

| Currency Strength Intelligence | Generates relative macro strength assessments across currencies. | Reveals directional context without publishing factor compositions or scoring formulas. |

| Global Risk Regime Intelligence | Classifies market risk environments through closed analytical frameworks. | Improves risk alignment without disclosing regime-detection methodology. |

| Central Bank Policy Intelligence | Interprets policy stance and expectation shifts via proprietary processing. | Identifies divergence context without revealing analytical pathways. |

| Comparative Macro Dashboards | Standardises multi-economy data into decision-ready views. | Enables fast comparison without exposing data transformation logic. |

MacroDrivers Intelligence Outputs for Traders

| Output | Insight Delivered | Trading Application |

|---|---|---|

| Relative Currency Intelligence | Institutional-grade directional context. | FX bias and pair selection. |

| Risk Regime Intelligence | Global risk condition classification. | Volatility and exposure alignment. |

| Policy Divergence Intelligence | Central bank asymmetry interpretation. | Rate-driven opportunity context. |

| Macro Visual Intelligence | Multi-economy comparative insight. | Strategic planning and narrative building. |

Manual Macro Analysis vs MacroDrivers

| Dimension | Traditional Manual Analysis | MacroDrivers Platform |

|---|---|---|

| Data Collection | Manual sourcing and spreadsheets | Closed-pipeline institutional data processing |

| Standardisation | Inconsistent formats | Unified proprietary transformation frameworks |

| Speed | Slow cycle-by-cycle updates | Continuous live intelligence refresh |

| Regime Detection | Subjective interpretation | Systematic proprietary classification engines |

| Consistency | Analyst-dependent | Framework-governed intelligence delivery |

How Macro Factors Drive Trading Decisions

| Macro Factor | Key Indicators | Market Impact |

|---|---|---|

| Growth | GDP, PMIs, Trade Flows | Expansionary data supports stronger currency bias |

| Inflation | CPI, PCE, Producer Prices | Inflation repricing drives interest-rate expectations |

| Labour Markets | Unemployment, Participation | Labour tightness signals policy trajectory shifts |

| Monetary Policy | Rate Decisions, Guidance | Divergence creates FX directional opportunity |

| Global Risk | Cross-Asset Volatility | Risk-on favours growth FX, risk-off favours safe havens |

Who MacroDrivers Is For

- Professional FX and macro traders using macro analysis for traders.

- Institutional and independent analysts who incorporate macro analysis in their strategies.

- Prop trading desks.

- Serious retail traders seeking professional intelligence.

- Investors managing global exposure with macro analysis techniques.

If your trading decisions depend on interpreting economic and policy forces — MacroDrivers becomes your intelligence edge.

Upgrade from Learning to Professional Intelligence

Traders MBA builds your analytical skillset. Macro analysis for traders is further enhanced when using MacroDrivers, which delivers live institutional intelligence to apply it in real markets.

Learn the process. Apply it with professional tools.