AUD/JPY Bulls Eye Fresh Highs as Macro and Risk Sentiment Align

Introduction

AUD/JPY remains one of the strongest trending G10 cross pairs, supported by macroeconomic divergence, risk appetite, and a bullish technical structure. With the Japanese yen suffering from chronic stagnation and Australia benefiting from stable data and positive sentiment, this pair continues to offer compelling long-side opportunities.

Fundamental Analysis

Australia:

GDP growth came in at 0.2% QoQ and 1.3% YoY, reflecting steady but modest expansion. Inflation is under control at 2.4% YoY, with a recent MoM uptick to 0.9%, keeping the RBA cautiously hawkish. Interest rates remain at 3.85%, offering attractive yield versus most developed peers. The current account sits at -2.1% of GDP, but business and services sentiment remain robust. With a fiscal surplus of 0.6% and public debt at just 43.8% of GDP, Australia’s macro profile is sound.

Japan:

Growth remains weak at 0.0% QoQ and 1.7% YoY. Inflation has climbed to 3.3% YoY but remains under-responded to by the Bank of Japan, which holds its policy rate at 0.5%. The country continues to operate with a large fiscal deficit (-5.5%) and a debt-to-GDP ratio of 237%—the highest in the developed world. While Japan’s current account surplus remains positive, growth momentum and monetary divergence weigh heavily on the yen.

Conclusion: Australia’s superior rate environment and sentiment stability contrast sharply with Japan’s economic stagnation and policy inertia.

Sentiment Analysis

AUD remains supported by pro-risk flows and commodity demand, while JPY remains under pressure as a funding currency in carry trades. Market positioning shows AUD relatively neutral, while JPY is still heavily shorted—leaving room for continuation. Global equity resilience and stable VIX levels keep appetite high for AUD/JPY longs. Options flows show support at 95.50–96.00 with limited topside resistance, and carry-seeking investors continue to rotate into AUD against low-yielders like JPY.

Technical Analysis

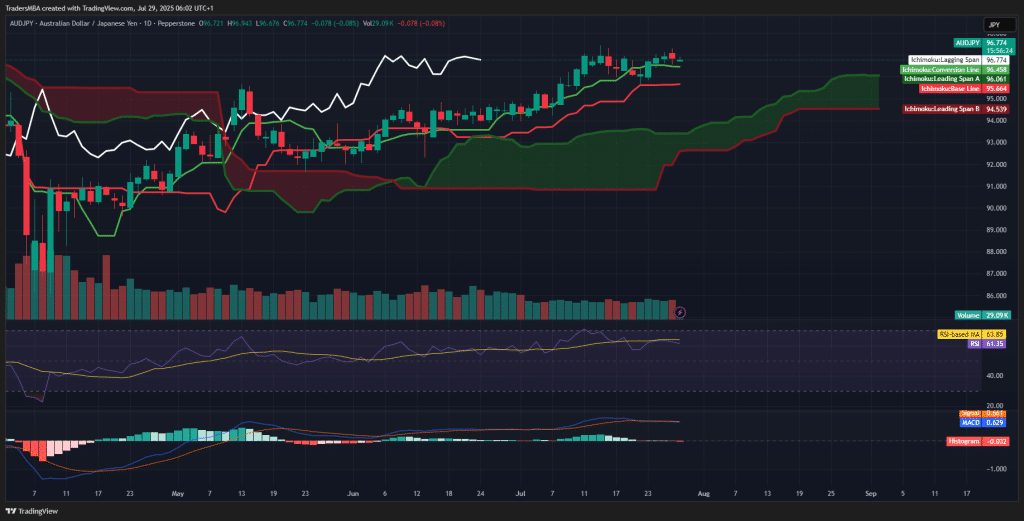

The daily chart confirms a clear bullish structure. Price is trading well above the Ichimoku cloud, with both the Tenkan (96.458) and Kijun (95.664) lines rising steadily. Span A remains above Span B, projecting a bullish cloud forward. The lagging span is also above price and cloud—validating trend continuation.

RSI stands at 61.35 with its moving average at 63.85, confirming strong but not overbought conditions. No divergence is present, and momentum remains firm. MACD is slightly below signal but flattening, suggesting consolidation rather than reversal. Volume has been steady, with no signs of major distribution. The trend remains intact with support seen near 95.60–95.80.

Conclusion

AUD/JPY offers a high-probability trend continuation setup. With fundamentals, sentiment, and technicals aligned, the pair looks poised to test fresh cycle highs in August. The dip towards the Kijun line presents a potential re-entry zone for trend traders.