AUD/USD Faces Renewed Downside Pressure as U.S. Strength Persists

The AUD/USD pair is under renewed selling pressure as Australia’s economy loses steam and U.S. data continue to surprise on the upside. The Reserve Bank of Australia’s neutral tone contrasts sharply with the Federal Reserve’s “higher for longer” stance, widening yield differentials in favour of the U.S. dollar. With price action failing to reclaim 0.6600, the pair looks vulnerable to a continuation of its recent downtrend.

Fundamental Analysis

Australia’s latest GDP and business sentiment figures point to moderating growth, while inflation has softened considerably. The RBA remains on hold, signalling confidence that price pressures are easing. In contrast, the United States shows strong economic resilience, with firm GDP growth, stable labour markets, and sticky core inflation keeping the Fed cautious about rate cuts. The macro divergence reinforces downside risk for AUD/USD as capital flows continue toward the dollar.

Sentiment Analysis

Market sentiment remains bearish. Retail traders are heavily net long, often a contrarian signal that downside may persist. Institutional positioning data show reduced AUD exposure and persistent demand for USD as a safe-haven and carry alternative. Cross-asset sentiment is risk-off, and falling commodity demand adds further weight to the bearish case.

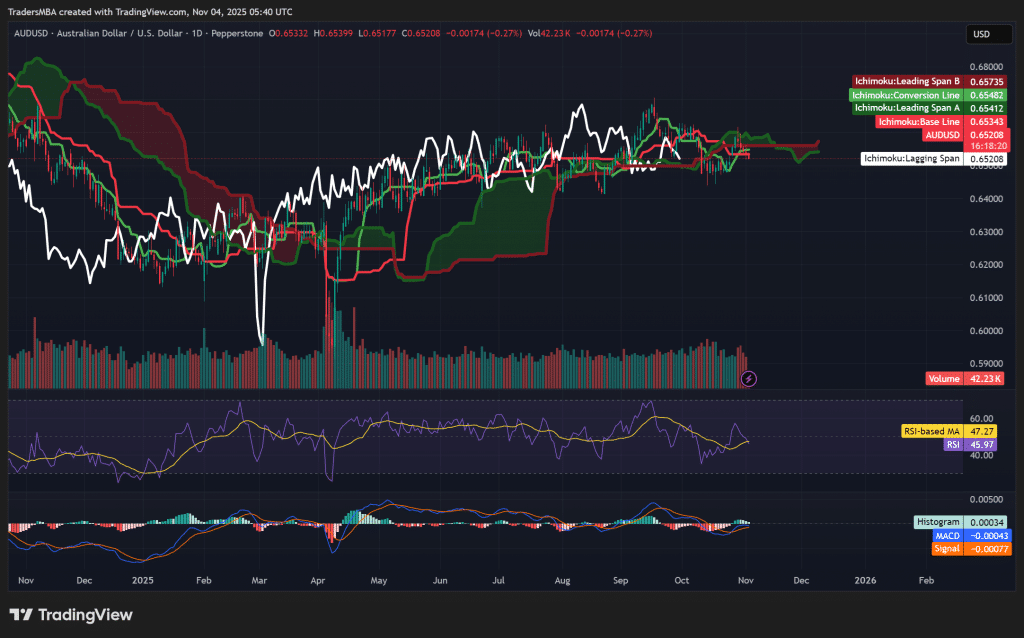

Technical Analysis

The daily chart shows AUD/USD trading decisively below the Ichimoku Cloud, maintaining a bearish structure. The conversion line sits below the base line, and the cloud ahead remains red. RSI hovers near 46, reflecting weak momentum, while MACD is negative with widening divergence. Volume trends confirm selling pressure outweighs buying interest. Major resistance lies at 0.6600, while key support levels sit at 0.6450 and 0.6370. A daily close below 0.6450 would likely accelerate declines toward 0.6370.

Trade Parameters

Entry: 0.6560–0.6580

Stop-Loss: 0.6660 (above recent swing high)

Take-Profit 1: 0.6450

Take-Profit 2: 0.6370

Risk-to-Reward Ratio: ≈ 1 : 2.5

Conclusion

AUD/USD remains in a clear downtrend as fundamentals, sentiment, and technicals align against the Australian dollar. Strong U.S. data and persistent yield advantages continue to attract dollar inflows, while weaker Australian growth limits recovery potential. A sustained break below 0.6450 would confirm further downside momentum toward 0.6370, whereas a close above 0.6660 would invalidate the bearish setup.