AUD/USD Weakens as Bearish Momentum Builds

Introduction

The Australian dollar has come under renewed pressure against the US dollar, with macro fundamentals, market sentiment, and technical signals aligning to support a bearish outlook for AUD/USD. Recent economic data show diverging trajectories between Australia and the United States, while technical momentum indicators point toward further downside in the pair.

Fundamental Analysis

Australia’s growth outlook remains fragile, with soft PMIs, widening trade deficits, and fiscal concerns weighing on the economy. Inflation is still above target, but the Reserve Bank of Australia has slowed its tightening pace, leaving policy relatively cautious. In contrast, the United States continues to post strong GDP growth, resilient labour markets, and sticky inflation, keeping the Federal Reserve cautious but supportive of higher yields. This macro divergence sustains pressure on AUD/USD.

Sentiment Analysis

Positioning data shows traders favouring the US dollar, supported by positive yield differentials and safe-haven demand. Retail sentiment tilts toward AUD longs, leaving scope for further downside as positioning unwinds. Futures market flows also highlight USD strength and ongoing bearish sentiment on the Australian dollar.

Technical Analysis

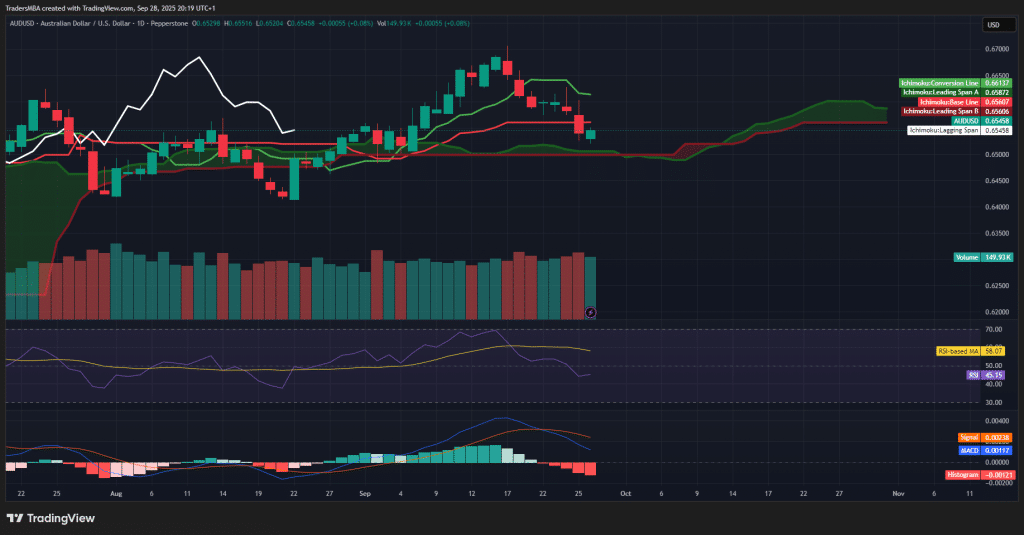

Daily charts show AUD/USD breaking below key Ichimoku support levels, with price now testing the lower edge of the cloud. RSI sits near 45 and trending lower, indicating increasing bearish momentum without oversold conditions. MACD has turned negative, with widening divergence confirming downside risk. A decisive break below 0.6500 would likely accelerate selling, while resistance at 0.6620 caps near-term recovery attempts.

Conclusion

AUD/USD faces sustained downward pressure, with macro, sentiment, and technical drivers firmly aligned against the Australian dollar. Unless Australian fundamentals improve or the Fed signals a softer stance, the pair is likely to test fresh lows in the weeks ahead. Traders should watch the 0.6500 level closely as a key pivot for further downside continuation.