AUD/USD Weakens as U.S. Growth Outpaces Australia

Introduction

The Australian dollar remains under pressure against the U.S. dollar. Diverging fundamentals drive renewed downside momentum. While the U.S. economy continues to expand at a robust pace, supported by strong employment and higher yields, Australia faces slowing growth and lingering inflationary pressures. Recent technical signals reinforce the bearish case for trading the AUD/USD pair. This suggests the pair may remain under pressure in the weeks ahead.

Fundamental Analysis

Australia’s economic momentum has softened. Quarterly growth is slipping and manufacturing indicators are turning weaker. Inflation remains above target, forcing the Reserve Bank of Australia to stay cautious. This is happening even as domestic activity cools. Meanwhile, the U.S. economy has shown remarkable resilience. GDP growth is surging and the Federal Reserve is maintaining a “higher-for-longer” stance on interest rates. This divergence in growth and policy continues to favour the U.S. dollar. It is underpinned by yield differentials and global risk aversion, impacting the AUD/USD market.

Sentiment Analysis

Market sentiment tilts decisively against the Australian dollar. COT and retail positioning show traders maintaining net-short exposure, while cross-asset risk sentiment leans defensive. The AUD/USD sentiment score of –40 highlights persistent bearish bias, aligning with macro fundamentals. Meanwhile, the U.S. dollar retains moderate negative sentiment, but its relative strength versus risk-sensitive currencies like AUD remains dominant.

Technical Analysis

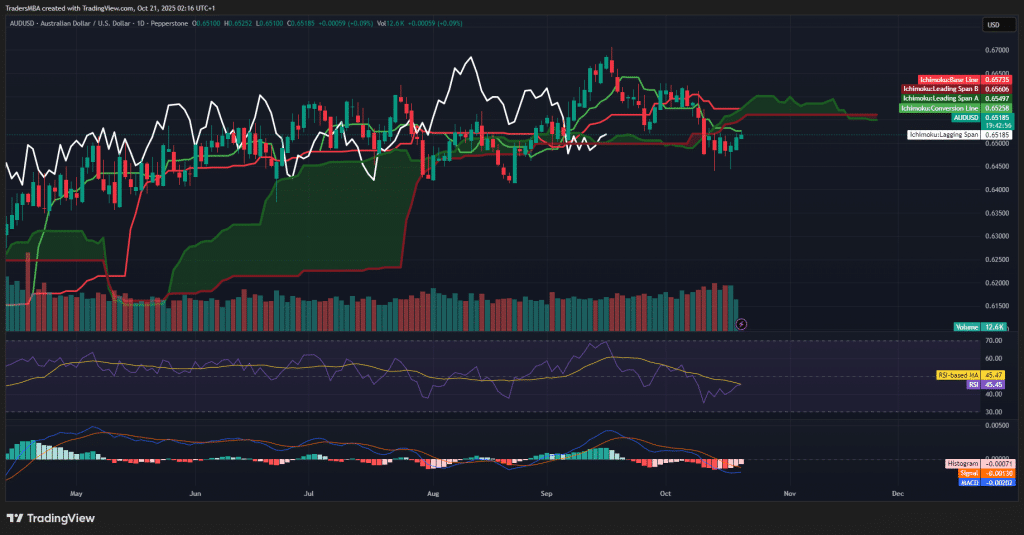

AUD/USD trades below the Ichimoku Cloud. A bearish Kumo and Tenkan–Kijun alignment confirm downside structure. RSI sits near 45, suggesting weak recovery attempts. MACD remains negative with no bullish crossover. Price action shows resistance near 0.6560 and support around 0.6470. A sustained break below this zone would confirm continuation toward the 0.6400 handle. Volume trends reinforce selling pressure on rallies, maintaining the short bias.

Conclusion

The macro divergence between the U.S. and Australia makes AUD/USD a compelling short candidate. It is supported by negative sentiment and technical weakness. Unless Australian growth surprises to the upside or U.S. yields decline meaningfully, the path of least resistance remains lower. Traders should watch for confirmation below 0.6470 as the next leg of downside acceleration.