AUD/USD Weakness Extends as US Dollar Dominates

Introduction

AUD/USD continues to face downside pressure as Australia’s weakening growth outlook clashes with the United States’ robust economic performance. The divergence in monetary policy between the Reserve Bank of Australia (RBA) and the Federal Reserve, combined with bearish sentiment and technical breakdowns, keeps the pair vulnerable to further declines.

Fundamental Analysis

Australia is grappling with slowing GDP growth, weaker confidence indicators, and a deteriorating trade balance. Inflation remains elevated, but the RBA is cautious and near the end of its tightening cycle. By contrast, the US economy is expanding strongly, with resilient consumption and sticky inflation keeping the Fed firmly in a higher-for-longer stance. This macro divergence heavily favours the dollar over the Australian currency.

Sentiment Analysis

Market sentiment is negative for AUD/USD, with retail traders and futures positioning biased toward further weakness. The US dollar remains broadly supported across the board, while the Australian dollar struggles to attract flows amid risk aversion and softer domestic fundamentals. Sentiment indicators suggest limited buying appetite on rallies.

Technical Analysis

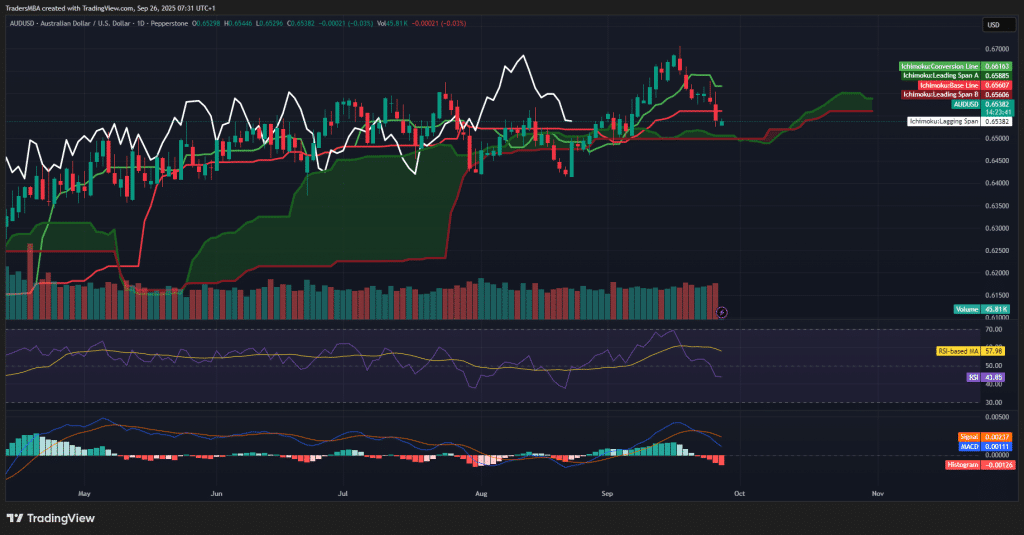

On the daily chart, AUD/USD has slipped below the Ichimoku conversion line and is testing cloud support around 0.6500. RSI at 43 points to bearish momentum without reaching oversold conditions. MACD has turned negative with a bearish crossover, confirming downward pressure. Volume has picked up during recent sell-offs, reinforcing the bearish tone. A break below 0.6500 would expose 0.6450 as the next downside target, while resistance sits near 0.6600.

Conclusion

AUD/USD remains structurally weak, with fundamentals, sentiment, and technicals aligned to the downside. The pair risks further losses if US dollar strength persists and Australian data continues to soften. Traders should watch for a clear break below 0.6500 as confirmation of renewed bearish momentum.