Australian Dollar Poised to Rebound Against Yen

Introduction

The AUD/JPY pair is consolidating after a mild correction, but broader fundamentals continue to favour renewed upside. As risk appetite recovers and global commodity demand remains firm, the Australian dollar is finding solid footing. Meanwhile, the Japanese yen remains under sustained pressure from ultra-loose monetary policy and widening rate differentials. Together, these forces point to a potential continuation of AUD/JPY’s long-term bullish trend as the pair looks to resume higher levels.

Fundamental Analysis

Australia’s economy is holding steady with 0.6% GDP growth and stable inflation near 3%. Business confidence and services PMI readings show resilience, suggesting domestic momentum remains intact. The Reserve Bank of Australia’s policy remains moderately tight, supporting currency strength relative to low-yield peers.

Conversely, Japan’s economy continues to face low inflation and stagnant wage growth. The Bank of Japan maintains its 2.15% policy rate, effectively anchoring the yen near record lows as global central banks remain restrictive. This policy gap is the key driver sustaining AUD/JPY upside.

Sentiment Analysis

Market sentiment is aligned with the macro backdrop: AUD sentiment +10 vs JPY –6, indicating a strong net-long bias. Futures data and retail positioning confirm widespread yen shorts amid carry-trade appeal. Broader cross-asset risk appetite remains mildly positive, further encouraging AUD buying. As long as geopolitical risk remains contained, sentiment favours continuation of yen-funded risk trades.

Technical Analysis

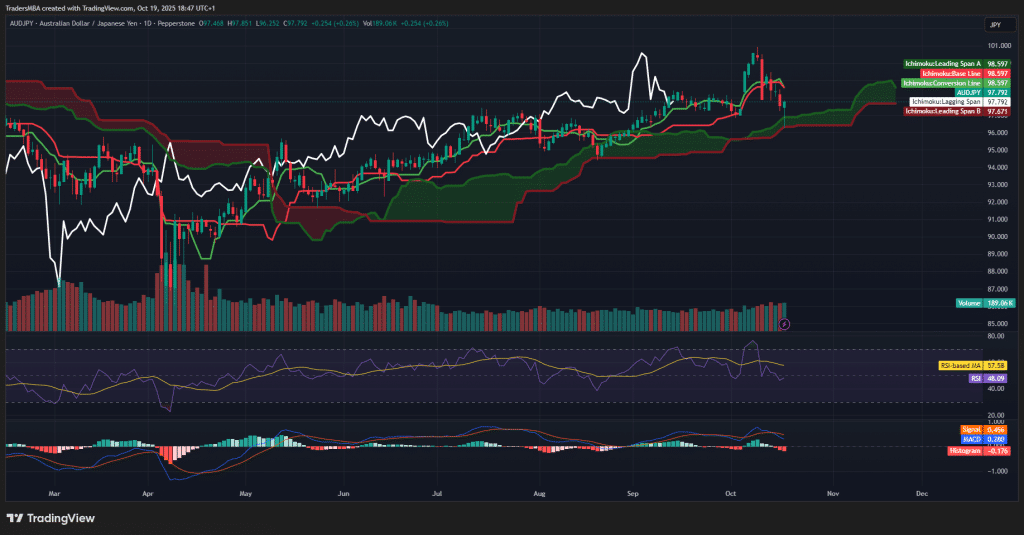

On the daily chart, AUD/JPY trades above the Ichimoku cloud, reflecting a continuing uptrend despite recent consolidation. The Conversion line remains near the Base line, indicating a short-term pullback rather than reversal. RSI near 48 suggests neutral momentum, allowing for further upside once buyers return. MACD shows a weak bearish crossover, but it remains above the zero line — consistent with a corrective phase in a bull trend.

Support sits near 97.0–97.5, while resistance aligns around 99.0–100.0. A breakout above 98.6 could confirm trend resumption.

Conclusion

The overall structure of AUD/JPY remains bullish, supported by macro divergence, carry-trade flows, and a stable domestic backdrop. While recent softness reflects short-term correction, technical and sentiment factors suggest renewed buying interest near support. Unless global risk sentiment deteriorates sharply, the pair appears set to climb back toward 100.0 in the near term. Traders may look for long opportunities on dips toward 97.0–97.5, targeting retests of recent highs.