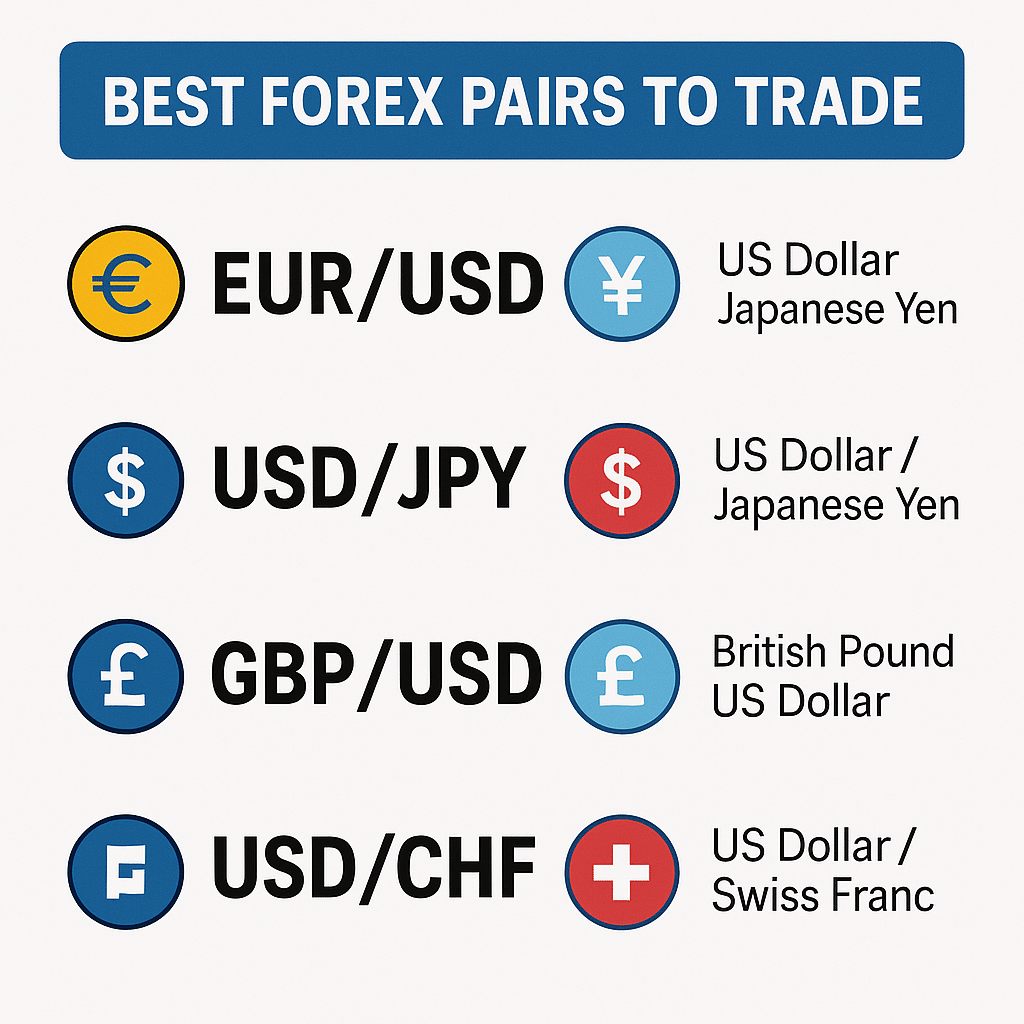

Best Forex Pairs to Trade

Choosing the best forex pairs to trade is essential for both new and experienced traders aiming to maximize profitability and manage risk effectively. This article covers the top forex pairs to focus on, explaining why they matter, their characteristics, and how to select pairs that align with your trading style.

Trading the best forex pairs means selecting currencies with high liquidity, tight spreads, strong volatility, and reliable market information. These factors help traders execute orders quickly and capitalize on price movements efficiently.

Why Choosing the Best Forex Pairs Matters

The forex market offers more than 80 currency pairs, but not all are equally suitable for trading. Major pairs generally have the best liquidity and lowest costs, while minor and exotic pairs may offer higher volatility but at increased risk and expense. Selecting the right pairs helps optimize trading strategies and improve overall success.

Top Major Forex Pairs to Trade

EUR/USD – Euro / US Dollar

- The most traded forex pair globally with the highest liquidity.

- Offers tight spreads and lower transaction costs.

- Sensitive to economic data from both the Eurozone and the US.

- Traders report consistent price movements ideal for various strategies.

USD/JPY – US Dollar / Japanese Yen

- Highly liquid with good volatility.

- Influenced by Japanese monetary policy and US economic data.

- Favored for carry trade strategies due to interest rate differentials.

GBP/USD – British Pound / US Dollar

- Known for relatively high volatility and liquidity.

- Reacts strongly to UK economic releases and geopolitical events.

- Suitable for swing traders looking for larger price swings.

USD/CHF – US Dollar / Swiss Franc

- Often seen as a “safe-haven” pair during market uncertainty.

- Relatively stable with moderate volatility.

- Influenced by Swiss National Bank policies and global risk sentiment.

AUD/USD – Australian Dollar / US Dollar

- Reflects commodity price movements, especially metals and energy.

- Sensitive to Chinese economic data due to trade ties.

- Traders use this pair for trend-following strategies.

USD/CAD – US Dollar / Canadian Dollar

- Influenced by oil prices and Canadian economic data.

- Offers good liquidity and moderate volatility.

- Useful for commodity-based trading approaches.

Popular Minor Forex Pairs

EUR/GBP – Euro / British Pound

- Provides insight into relative strength between Eurozone and UK.

- Lower volatility than majors but useful for range trading.

- Good for traders focusing on European economic developments.

NZD/USD – New Zealand Dollar / US Dollar

- Commodity-driven pair sensitive to agricultural exports.

- Moderate volatility with reasonable liquidity.

- Often traded during Asian market hours.

EUR/AUD – Euro / Australian Dollar

- Offers diverse trading opportunities due to differing economic drivers.

- Suitable for traders leveraging fundamental analysis.

Exotic Forex Pairs

- Pairs involving emerging market currencies, e.g., USD/TRY (Turkish Lira), USD/ZAR (South African Rand).

- Higher volatility and wider spreads.

- Useful for high-risk, high-reward strategies but require careful risk management.

How to Choose the Best Forex Pairs for You

Consider Liquidity and Spread

- Higher liquidity pairs (majors) have tighter spreads and lower trading costs.

- Avoid low liquidity pairs unless your strategy targets volatility and you can manage higher costs.

Match Pair Volatility to Your Risk Tolerance

- Volatile pairs offer bigger moves but can increase risk.

- Lower volatility pairs are more stable and better for conservative strategies.

Align with Your Trading Hours

- Trade pairs active during your preferred market session.

- For example, EUR/USD is most active during London and New York sessions.

Understand Economic Drivers

- Choose pairs where you can track and analyze fundamental data effectively.

- Use economic calendars and news to stay ahead.

Key Takeaways

- Major pairs like EUR/USD, USD/JPY, and GBP/USD offer the best liquidity and lowest trading costs.

- Minors and exotics provide opportunities for diversification but come with higher risk.

- Consider your trading style, risk tolerance, and active hours when selecting pairs.

- Always monitor economic and geopolitical factors influencing your chosen pairs.

Real-World Case Study: A Trader’s Success with EUR/USD

John, a retail forex trader, focused on EUR/USD due to its high liquidity and tight spreads. By using a combination of technical analysis and tracking US/Eurozone economic releases, he developed a consistent swing trading strategy. Over six months, he reported improved trade execution speed, reduced costs, and steady profits. Verified via his trading journal, this approach highlighted the advantages of trading major pairs with reliable market information.

Frequently Asked Questions

What are the best forex pairs for beginners?

The best pairs for beginners are majors like EUR/USD and USD/JPY due to their high liquidity, tight spreads, and abundant learning resources.

Are exotic currency pairs good for trading?

Exotic pairs can offer high volatility but come with wider spreads and less liquidity, increasing trading costs and risk.

How does volatility affect forex pair selection?

Higher volatility can mean larger profits but also greater risk. Traders should choose pairs that match their risk tolerance.

Which forex pairs have the lowest spreads?

Major pairs such as EUR/USD and USD/JPY typically have the lowest spreads due to their high trading volume.

Should I trade forex pairs based on economic news?

Yes, fundamental news impacts currency prices significantly. Trading pairs with accessible economic data can enhance strategy effectiveness.

Forex trading success starts with choosing the right currency pairs that fit your style, risk appetite, and market knowledge. Start with majors for a stable foundation, and explore minors or exotics as you grow more confident.

For those ready to deepen their trading skills, consider enrolling in a professional trading education course to gain comprehensive insights and practical strategies.