Best Indicator for Forex

Finding the best indicator for forex trading depends on your strategy, time frame, and trading style. While no single indicator guarantees success, certain technical tools consistently help traders identify trends, entry points, and exit signals with higher accuracy. This guide highlights the most effective forex indicators, how they work, and practical ways to use them.

Understanding Forex Indicators

Forex indicators are analytical tools that help traders make informed decisions based on historical price data and market trends. Indicators fall into two main categories:

- Leading indicators: Predict potential price movements (e.g., RSI, Stochastic).

- Lagging indicators: Confirm trends after they begin (e.g., Moving Averages, MACD).

Professional traders often combine two or more indicators for confirmation, reducing false signals.

Top 5 Best Indicators for Forex Trading

1. Moving Average (MA)

- Type: Lagging indicator

- Use: Identifies overall trend direction and support/resistance zones

- Application:

- Use 50-day MA for medium-term trends

- Combine 200-day MA for long-term confirmation

- Why it’s effective:

- Smooths out market noise

- Helps spot trend continuation or reversal signals

Example:

EUR/USD staying above the 50-day MA while the 200-day MA slopes upward indicates a bullish market.

2. Relative Strength Index (RSI)

- Type: Leading indicator

- Use: Measures overbought (70+) or oversold (30-) conditions

- Application:

- Ideal for swing trading and spotting reversals

- Combine with trend analysis to avoid false signals

- Why it’s effective:

- Highlights momentum shifts before price moves

- Useful for exit timing

Example:

If GBP/USD falls below 30 RSI on a 4-hour chart, traders may look for a potential bullish reversal.

3. Moving Average Convergence Divergence (MACD)

- Type: Trend-following and momentum indicator

- Use: Confirms trend strength and signals entry/exit points

- Application:

- Look for MACD line crossover with the signal line

- Use histogram divergence for early momentum signs

- Why it’s effective:

- Works across multiple time frames

- Reduces noise compared to oscillators

4. Bollinger Bands

- Type: Volatility indicator

- Use: Detects overbought/oversold market conditions and breakout potential

- Application:

- Price touching the upper band can indicate overbought levels

- Squeezes often precede major breakouts

- Why it’s effective:

- Great for range trading and volatility-based setups

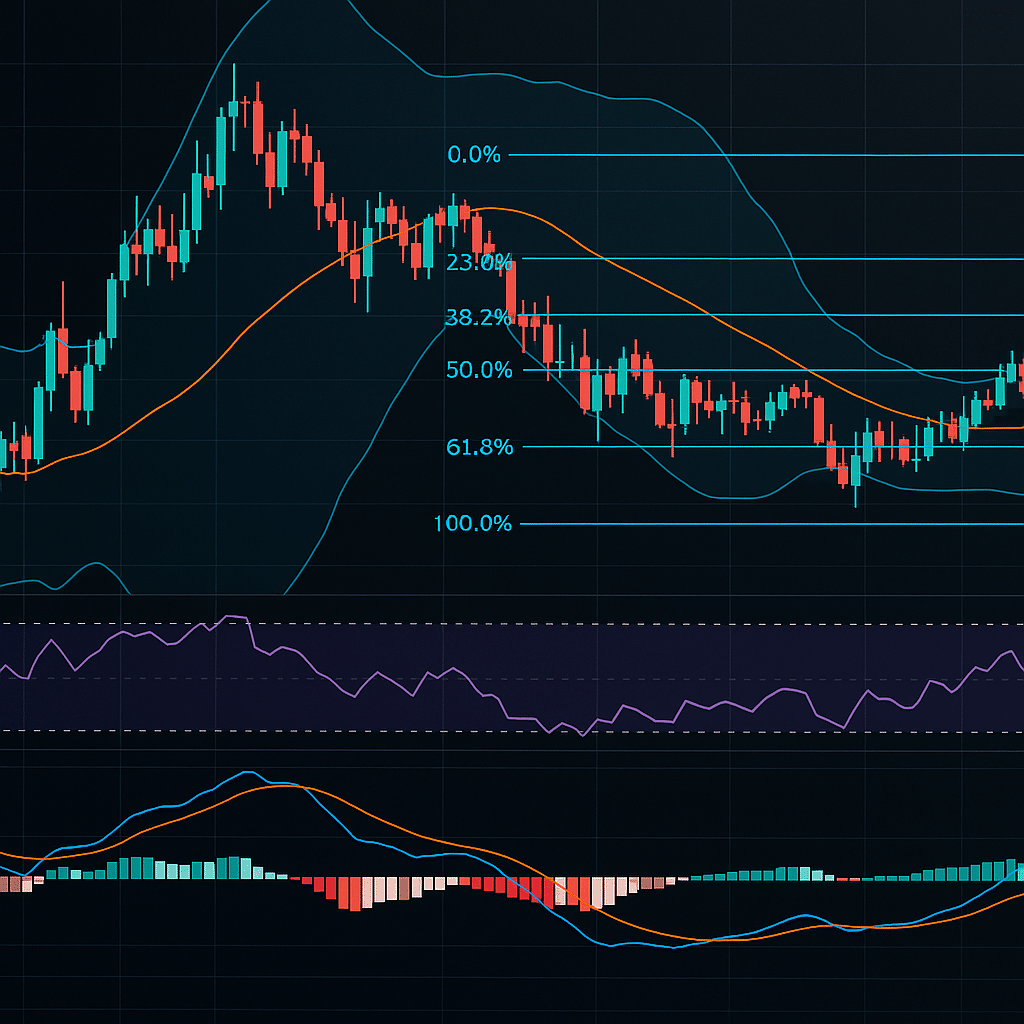

5. Fibonacci Retracement

- Type: Leading indicator (tool)

- Use: Identifies potential support/resistance levels during corrections

- Application:

- Draw from swing low to swing high in an uptrend (or reverse)

- Key levels: 38.2%, 50%, 61.8%

- Why it’s effective:

- Widely used in confluence with price action and trend indicators

Choosing the Right Indicator for Your Strategy

- Trend traders: Moving Averages + MACD

- Swing traders: RSI + Bollinger Bands

- Scalpers: Combination of short-term MAs and Stochastic Oscillator

- Breakout traders: Bollinger Bands + Fibonacci levels for target setting

Professional traders emphasize not relying on one indicator alone. Combining trend, momentum, and volatility indicators increases accuracy.

Real-World Case Study: RSI and MA Combo

Maria, a London-based swing trader, focused on GBP/USD using a 50-day MA and RSI strategy:

- Bought when price was above the MA and RSI rebounded from oversold levels

- Exited trades when RSI approached 70 or price crossed below MA

In 8 weeks of journaling:

- 72% of her trades were profitable

- Losses were minimized through clear exit rules

- Combining indicators provided better signal confirmation

Key Takeaways

- No single indicator works in all market conditions

- Combine trend, momentum, and volatility indicators for accuracy

- Moving Averages and RSI are beginner-friendly and widely used

- Bollinger Bands and Fibonacci levels help refine entries and exits

- Backtesting strategies on demo accounts improves confidence before going live

Frequently Asked Questions

What is the best indicator for forex trading?

The Moving Average (MA) is widely considered the most reliable, especially when combined with MACD or RSI for confirmation.

Can I trade forex using only one indicator?

It’s not recommended. Combining at least two complementary indicators reduces false signals.

Which indicator is best for beginners?

The 50-day Moving Average and RSI are easy to understand and effective for trend and reversal signals.

Are lagging indicators useful in forex trading?

Yes, they confirm trends and reduce the risk of false breakouts, making them useful for swing and position traders.

How do I know if an indicator works for me?

Backtest it on historical data, practice in a demo account, and track your trades in a journal before using it live.