CHF/JPY Holds Firm as Divergent Policies Sustain Bullish Momentum

Introduction

The Swiss franc remains dominant over the Japanese yen as diverging central bank policies and resilient Swiss fundamentals drive continued strength in CHF/JPY. While the Swiss National Bank (SNB) maintains price stability and a neutral stance, the Bank of Japan (BoJ) persists with ultra-loose policy, keeping Japanese yields among the lowest globally. Technical momentum supports further upside, with the pair consolidating near recent highs above the Ichimoku cloud.

Fundamental Analysis

Switzerland’s low inflation, balanced fiscal position, and solid trade surplus underpin the franc’s appeal as a defensive yet yield-attractive currency. The SNB has shifted toward a more data-dependent approach, avoiding aggressive easing and thereby reinforcing currency stability.

Japan, in contrast, continues to rely on monetary accommodation. Despite mild inflation, the BoJ has shown no urgency to normalise policy. Negative real yields and subdued growth expectations keep the yen under persistent selling pressure, sustaining the macro divergence that favours CHF strength.

Sentiment Analysis

Market sentiment supports further gains in CHF/JPY. Retail and institutional flows favour the franc as risk hedging demand increases amid global uncertainty. COT data show steady CHF buying, while JPY remains one of the most shorted G10 currencies. The cross benefits from yield differentials, strong risk-adjusted performance, and ongoing carry trade flows. News momentum and geopolitical positioning continue to lean pro-CHF, reflecting confidence in Swiss resilience.

Technical Analysis

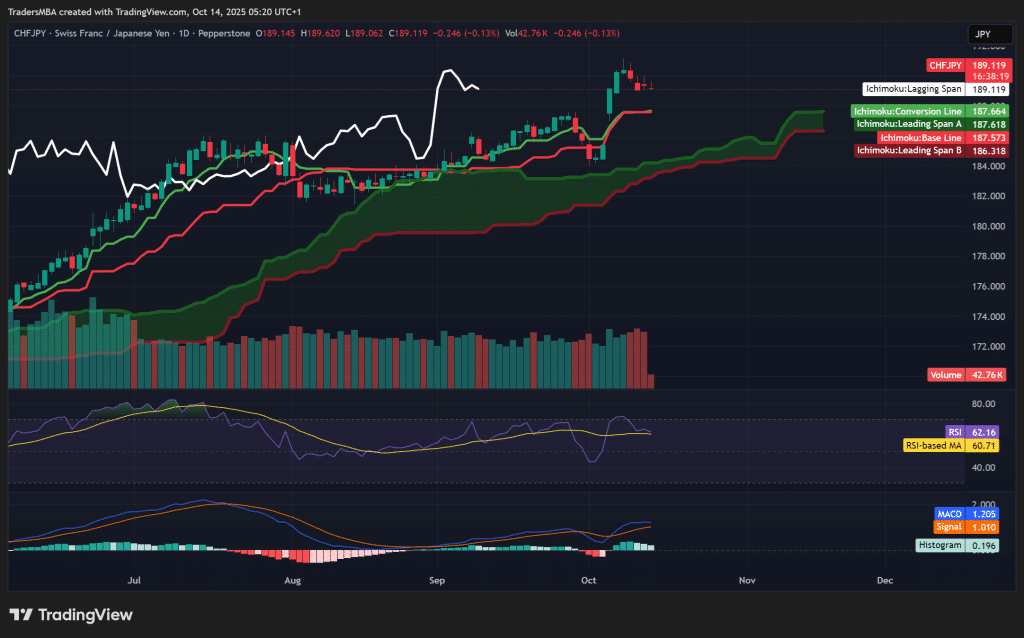

CHF/JPY trades comfortably above the Ichimoku cloud, confirming an entrenched bullish structure. The conversion line remains above the base line, while both lines trend upward. RSI at 62 shows balanced bullish strength without overextension, and MACD remains positive with a widening histogram. Price action suggests consolidation before another potential breakout above 190.5. Key supports lie near 187.5, maintaining trend integrity as long as it holds.

Conclusion

The CHF/JPY pair remains technically and fundamentally robust. With Switzerland maintaining macro stability and Japan committed to accommodative policy, the environment favours continued franc appreciation. Traders should watch for a breakout above 190.5 to confirm the next leg higher, while any dips toward 187.5 may present fresh buying opportunities within a well-supported bullish trend.