CHF/JPY: Swiss Franc Strength Maintains the Upper Hand Over the Yen

Introduction

The CHF/JPY pair continues to reflect a strong macroeconomic and policy divergence between Switzerland’s resilient fundamentals and Japan’s persistent ultra-loose monetary stance. Although recent price action shows some consolidation, the broader structure remains bullish. This analysis examines the underlying fundamentals, sentiment, and technical landscape supporting a long CHF/JPY outlook.

Fundamental Analysis

Switzerland’s economy remains in solid shape, with quarterly GDP growth at 0.5% and an annual expansion of 2%. Inflation is subdued at just 0.2% YoY and flat on the month, allowing the Swiss National Bank to maintain a steady policy stance at 0.00% interest rates. External accounts are robust, with a CHF 4.3B trade surplus and a current account equal to 5.1% of GDP. Fiscal discipline is evident with government debt at only 37.6% of GDP and a budget surplus of 0.6%, underpinning the Franc’s reputation within CHF/JPY as a safe-haven currency.

Japan presents a contrasting picture. GDP growth is stagnant at 0% on the quarter and 1.7% YoY, while inflation runs at 3.3% YoY but shows minimal month-on-month pressure at 0.1%. The Bank of Japan continues to hold rates at 0.50%, maintaining a stark policy divergence with most developed economies. Although Japan’s trade and current account balances are positive, debt levels exceed 230% of GDP and fiscal deficits remain wide.

Sentiment Analysis

Market sentiment remains supportive of CHF strength, particularly in periods of risk aversion when safe-haven flows intensify. Positioning data shows persistent short exposure in the Yen, driven by its role as a funding currency within CHF/JPY exchanges. The macro narrative of strong Swiss fundamentals versus Japan’s stagnant growth and suppressed yields remains intact. While geopolitical conditions are stable, the yield gap and fiscal disparities continue to drive long-term CHF demand.

Technical Analysis

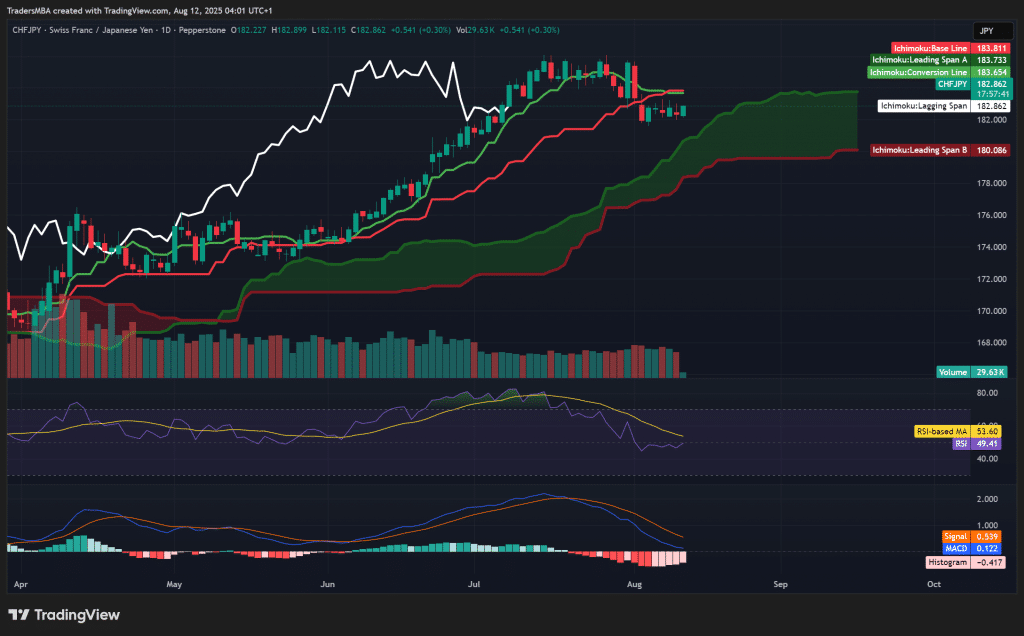

On the daily chart, CHF/JPY remains above the Ichimoku cloud, but price action is now closer to the base and conversion lines, signalling a loss of near-term momentum. The lagging span is still above price action, keeping the bullish bias intact. RSI sits at 49.41, reflecting neutral momentum after a pullback from overbought levels. MACD remains in negative territory but is flattening, suggesting potential for momentum recovery. Immediate support lies near 180.08, with resistance at 183.80. A breakout above 183.80 could trigger another leg higher, while a drop below 180.00 would signal deeper consolidation. The CHF/JPY technical framework highlights critical levels traders should watch.

Conclusion

CHF/JPY remains a fundamentally strong long candidate, supported by Switzerland’s robust macroeconomic position and Japan’s ultra-loose policy stance. While the recent pause in momentum may invite short-term consolidation, the broader bullish trend remains intact. A close above 183.80 would reinforce the uptrend, with a potential move toward the 186.00 area, while maintaining protective stops just below 180.00.