Risk Management Masterclass

The Risk Management Masterclass is a structured Risk Management Course focused on helping traders improve how they manage exposure, uncertainty, and capital protection. Across 24 modules, the programme covers practical risk principles and professional frameworks for position sizing, volatility awareness, leverage discipline, correlation mapping, liquidity considerations, and process-based decision-making. The emphasis is on building a repeatable risk approach that supports consistency and resilience, rather than making outcome-based claims.

About This Risk Management Course

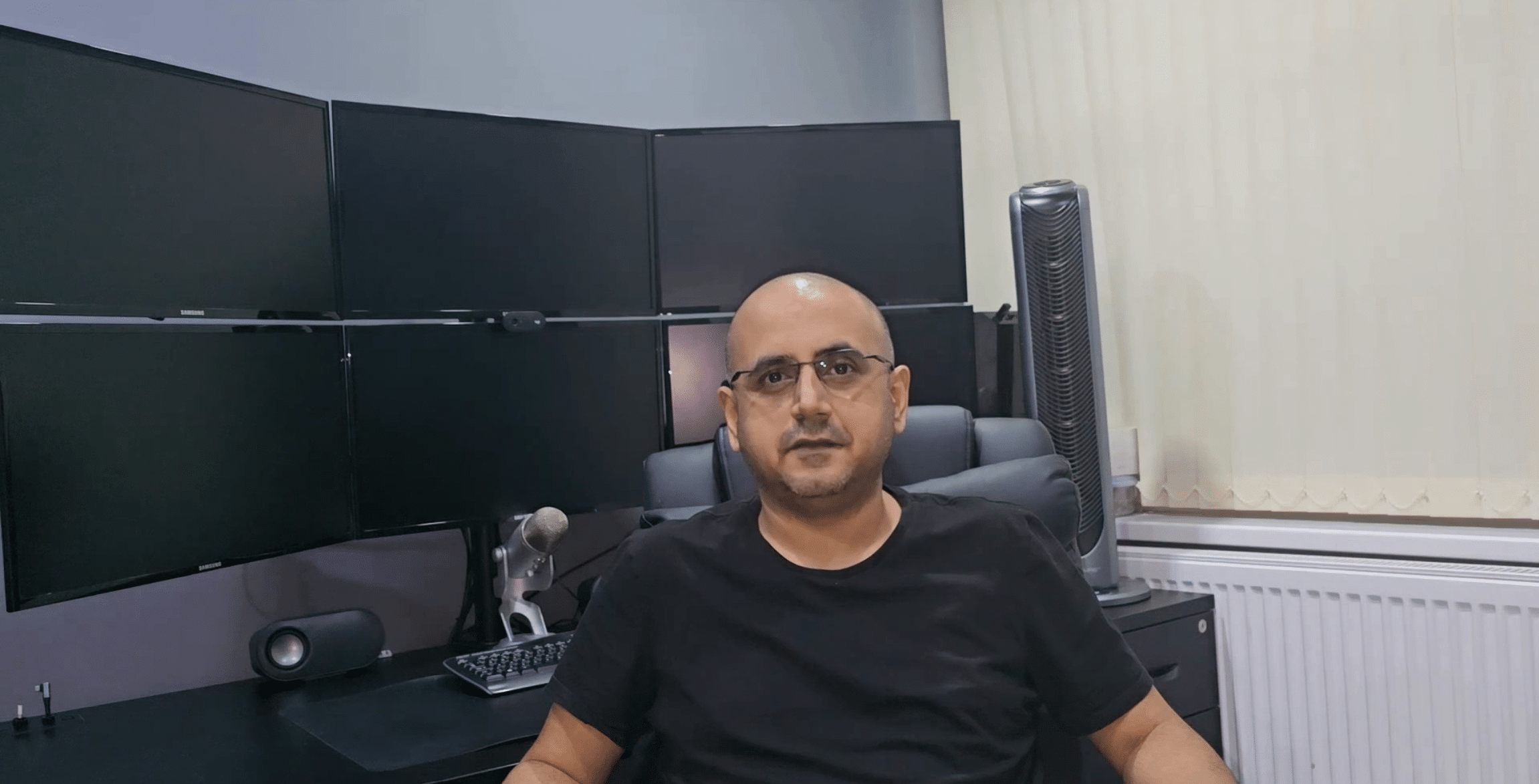

Structured across 24 detailed modules, this programme — created and presented by Sachin Kotecha — provides an educational framework for professional risk control, volatility navigation, exposure planning, and disciplined capital management. It explores position sizing theory, drawdown awareness, leverage and margin dynamics, correlation and concentration risk, liquidity and execution considerations, and the behavioural factors that influence risk-taking.

What You’ll Learn

Exposure, Uncertainty & Variability – Understand how trading risk emerges, how it can compound, and how to measure it using clear, practical definitions.

Position Sizing & Capital Allocation – Study fractional risk, fixed-percentage approaches, volatility-aware sizing, and adaptive risk limits designed to support consistency.

Volatility & Market Conditions – Learn how to adjust risk thinking across different regimes, including trending, range-bound, and shock-driven conditions.

Leverage & Drawdown Dynamics – Understand how leverage interacts with volatility, margin, and drawdowns, and how to reduce avoidable overexposure.

Correlation, Co-Movement & Concentration – Identify connected risks across instruments and regimes, and reduce hidden concentration through structured checks.

Liquidity Risk & Execution Efficiency – Plan for slippage, gapping, and liquidity constraints, and understand how they can affect real-world risk.

Psychology of Loss & Risk Perception – Recognise common cognitive biases and emotional responses that distort risk judgement and decision discipline.

Personal Risk Governance Framework – Build a practical risk policy for your own trading, including rules, limits, review routines, and contingency planning.

How This Risk Management Course Is Delivered

Each module is taught through high-definition video lectures created and presented by Sachin Kotecha, combining risk frameworks with practical examples and structured workflows. Learners can progress at their own pace, revisit lectures on demand, and apply concepts through repeatable checklists and planning routines.

Who This Course Is For

The Risk Management Masterclass is built for traders who want to improve capital protection, control exposure, and strengthen decision discipline. It is suitable for beginners building a safety-first foundation and experienced traders looking to refine structure, robustness, and risk process.

Outcomes & Skills You’ll Gain

By completing this course, you’ll be able to:

- Apply structured risk frameworks across different market conditions.

- Size positions using percentage-based and volatility-aware approaches within defined limits.

- Improve leverage discipline and reduce avoidable overexposure.

- Identify correlation clusters and concentration risk using repeatable checks.

- Build a personal risk governance system to support consistency and resilience.

Why Choose This Risk Management Course

This programme is designed as a complete risk-management training pathway focused on process, planning, and disciplined execution. It teaches how to assess exposure, respond to volatility, and apply practical controls that support risk-aware decision-making. If you’re looking for a Risk Management Course that covers the core professional concepts in a structured, applied format, this masterclass provides a clear learning route.

Frequently Asked Questions

Is this Risk Management Course suitable for beginners?

Yes. It covers foundational risk principles before progressing to more advanced frameworks and practical risk governance.

Is it a video-based course?

Yes — all modules are delivered through high-quality video lectures taught by Sachin Kotecha.

Who teaches this course?

The masterclass is created and presented by Sachin Kotecha.

How long is the course?

It contains 24 modules, each around 20 minutes, fully self-paced.

Does this course use real-market examples?

Yes — the programme uses market scenarios and case examples to explain volatility, drawdowns, and risk planning concepts.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction to the Risk Management MasterclassThis module provides an overview of the programme, outlining its objectives, structure, and focus on professional capital protection. You’ll learn why risk management sits at the core of long-term trading success and how the upcoming modules build a complete framework for disciplined, resilient decision-making.1

- Module 1 – Introduction to Professional Risk ManagementThis module sets the foundation for a professional approach to risk, reframing it as the core driver of longevity, consistency, and capital preservation. You’ll learn why most traders fail not because of strategy, but because of weak risk structuring, poor exposure control, and a lack of disciplined decision-making. The module introduces the master framework that will guide you through professional-grade risk thinking.1

- Module 2 – Understanding Exposure, Uncertainty & VariabilityThis module explores the true nature of exposure and uncertainty in financial markets, helping you differentiate controllable risks from structural unpredictability. You’ll learn how variability, randomness, and non-linear outcomes shape your trading environment — and how professionals build systems that remain stable under pressure.1

- Module 3 – The Foundations of Position SizingYou’ll discover how professional traders size positions with mathematical precision, adapting risk per trade to volatility, conviction, and portfolio context. The module explains fixed-fractional models, adaptive sizing, and the hidden dangers of inconsistent sizing decisions.1

- Module 4 – Volatility: Measurement, Interpretation & AdaptationThis module gives you a working understanding of volatility as both a measurement and a behavioural phenomenon. You’ll learn how volatility regimes shift, how to read the implications for position sizing, and how to structure trades that remain robust when volatility expands or contracts.1

- Module 5 – The Mathematics of SurvivalHere you dive into expectancy, probability distributions, loss clusters, and the mathematical realities that govern long-term capital survival. The module introduces concepts like the risk of ruin, drawdown tolerance, and capital trajectory planning.1

- Module 6 – Leverage, Margin & Compounding RiskThis module breaks down how leverage amplifies both opportunity and danger. You’ll learn how margin works mechanically, how compounding risk can silently escalate, and how to prevent the cascade that leads to margin calls and account destruction.1

- Module 7 – How Traders Blow Up: Anatomy of a MeltdownA deep exploration of the behavioural, structural, and decision-based failures that cause traders to implode. The module examines real-world blow-ups and extracts the patterns that lead to catastrophic losses — helping you build the awareness to avoid them.1

- Module 8 – Correlations, Co-Movement & Hidden LinkagesYou’ll learn how assets interact, correlate, and cluster — and how hidden co-movement can silently expand your true exposure. The module shows you how to detect correlation risk, diversify properly, and avoid accidental concentration.1

- Module 9 – Liquidity, Slippage & Execution RiskThis module addresses the structural realities of market liquidity and how slippage, spreads, and execution mechanics affect real-world trading outcomes. You’ll learn how to reduce execution risk and plan entries that behave predictably in fast markets.1

- Module 10 – Drawdowns, Recovery Curves & Resilience PlanningYou’ll understand the psychology and mathematics of drawdowns, how recovery curves behave, and how to build a resilience plan that protects both capital and mindset during difficult periods. This module supports long-term consistency.1

- Module 11 – Stop-Loss Engineering & Strategic PlacementThis module teaches you how to design stop-losses that align with market structure rather than emotion. You’ll explore stop placement models, volatility buffers, structural invalidation, and ways to minimise stop-out noise.1

- Module 12 – Risk/Reward Ratios & ExpectancyA detailed breakdown of risk/reward logic, expectancy modelling, and how to structure trades with positive long-term edge. You’ll learn why fixed targets often fail and how to use adaptive models that respond to market conditions.1

- Module 13 – Portfolio Construction for Active TradersYou’ll learn how to build a diversified yet focused trading portfolio that manages exposure across currencies, indices, commodities, and crypto. The module explores concentration limits, sector correlation, and multi-asset balancing.1

- Module 14 – Systematic vs Discretionary Risk ControlsThis module compares mechanical risk systems with discretionary decision-making and shows how to combine both for stability. You’ll learn how professionals enforce rules, manage overrides, and avoid emotional risk decisions.1

- Module 15 – The Psychology of Risk PerceptionYou’ll explore how the human mind misreads risk under stress, uncertainty, and volatility. This module explains how fear, confidence, and instinct distort probability and how professionals train a stable, objective risk mindset.1

- Module 16 – Behavioural Biases in Risk TakingThis module examines the psychological traps that skew risk decisions — including overconfidence, loss aversion, anchoring, and recency bias. You’ll learn how to detect these biases in real time and neutralise their effects.1

- Module 17 – Managing Risk in High-Volatility EnvironmentsA practical guide to navigating extreme volatility, sudden expansions, and chaotic price behaviour. You’ll learn how to adapt position sizing, widen buffers, and manage exposure when markets become unstable.1

- Module 18 – Trading Around News, Events & Geopolitical ShocksYou’ll understand how event-driven risk manifests, how spreads and liquidity behave around announcements, and how to plan trades that remain protected during unpredictable macro shocks.1

- Module 19 – Operational Risk, Technology Failure & SafeguardsThis module explores non-market risk: platform failures, data delays, VPS instability, broker glitches, execution freezes, and account-level operational vulnerabilities. You’ll learn how to build robust safeguards to keep your trading secure.1

- Module 20 – Broker, Platform & Infrastructure RiskYou’ll learn how to evaluate broker quality, platform reliability, regulatory protections, and execution environments. This module teaches you how to avoid structural broker risks that compromise long-term safety.1

- Module 21 – Regimes, Cycles & Adapting Risk ModelsThis module explains how market regimes shift — from trending to mean-reverting to volatile — and how risk models must adapt. You’ll learn how to detect regime changes early and recalibrate your exposure.1

- Module 22 – Building a Personal Risk Governance FrameworkA practical guide to constructing your own professional risk governance system — including rules, tolerances, escalation protocols, and decision reviews. You’ll create the framework that governs your future trading discipline.1

- Module 23 – Long-Term Capital Protection & Professional DisciplineYou’ll explore how professionals maintain capital longevity through strategic capital allocation, disciplined exposure planning, and long-term consistency. This module ties risk management to career-level sustainability.1

- Module 24 – Final Integration & Risk Mastery BlueprintThe closing module integrates every principle into a coherent, professional-grade risk management blueprint. You’ll consolidate the full system, refine your governance model, and establish the mindset required for lifelong capital protection.1

- Risk Management Masterclass Final ExamThe Exam tests your understanding of all 24 modules of the Risk Management Masterclass, covering exposure control, position sizing, volatility adaptation, behavioural discipline, and professional capital protection. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your learning and earn your personalised course completion certificate.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1