Dollar Weakness Deepens: Short USD/CHF in Focus

Introduction

The U.S. dollar has entered a vulnerable phase as political interference in Federal Reserve policy weighs heavily on investor sentiment. Meanwhile, the Swiss franc remains anchored by its strong current account surplus, fiscal prudence, and safe-haven appeal. This divergence makes USD/CHF one of the most compelling macro trades, with both fundamentals and technicals aligning for further downside.

Fundamental Analysis

The U.S. economy continues to post robust GDP and employment data, but credibility concerns over the Federal Reserve’s independence are overshadowing these positives. Persistent twin deficits and a softening trade balance amplify pressure on the dollar. In contrast, Switzerland benefits from low inflation, a solid external position, and disciplined fiscal policy, allowing the Swiss National Bank to maintain ultra-low rates without undermining the franc. Together, these drivers tilt the macro balance clearly against USD/CHF.

Sentiment Analysis

Sentiment indicators point to entrenched bearishness on the dollar. Positioning in futures and retail markets highlight continued selling pressure, while safe-haven flows favour the franc in a risk-sensitive environment. Recent news has compounded dollar weakness, with investors rotating into currencies perceived as more stable. CHF sentiment remains constructive, reflecting confidence in Switzerland’s structural resilience.

Technical Analysis

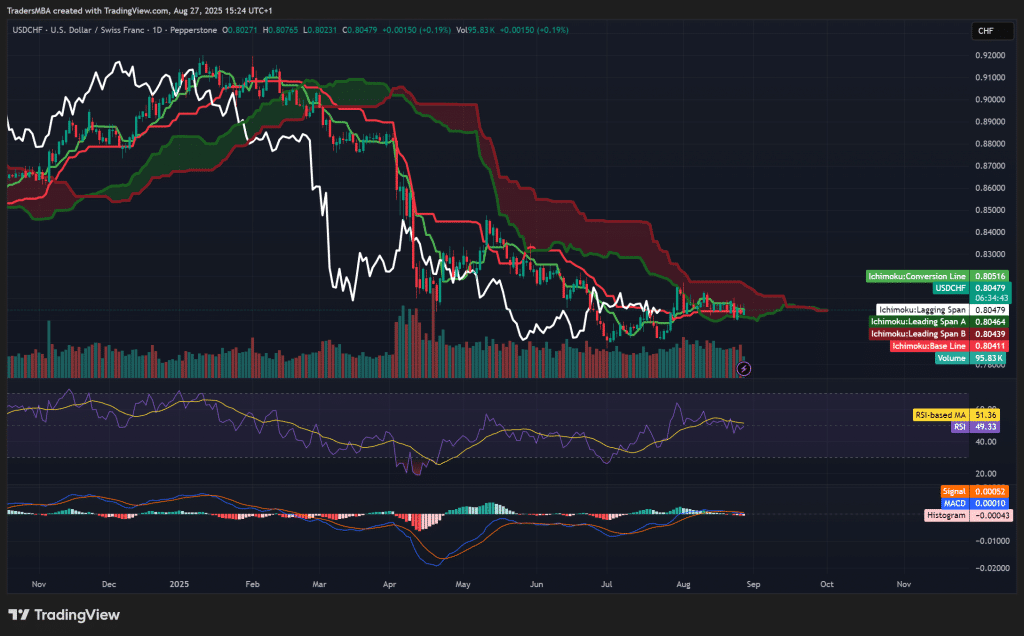

On the daily chart, USD/CHF trades below the Ichimoku cloud, with both the lagging span and leading spans reinforcing a bearish structure. The RSI hovers near 49, suggesting momentum has not yet shifted higher, while MACD remains negative with convergence indicating a potential continuation of the downtrend. Price faces immediate resistance at 0.8200, while the 0.8000 support level is vulnerable to a decisive break. Volume trends confirm selling pressure remains dominant.

Conclusion

With macro fundamentals, sentiment, and technical signals aligned, short USD/CHF emerges as a high-conviction trade. The combination of structural U.S. vulnerabilities and Swiss stability creates a strong case for further downside. Traders should monitor key support at 0.8000 as a potential trigger for an extended bearish move.