EUR/CAD: Euro Weakness Meets Canadian Resilience

Introduction

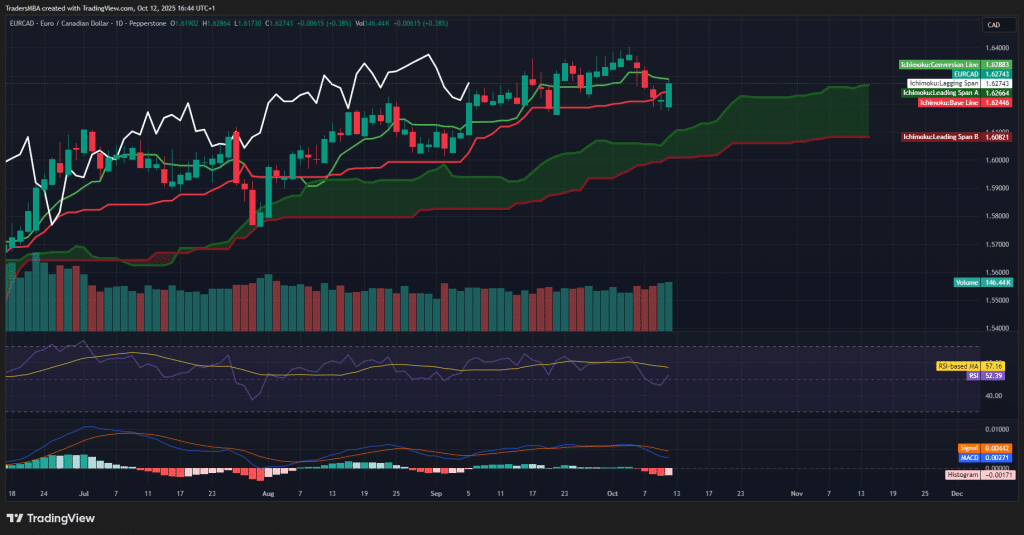

The EUR/CAD pair remains under pressure as the Eurozone’s stagnant growth and fading inflation contrast with Canada’s strong fundamentals. The latest price action confirms fading bullish momentum, aligning with macro and sentiment models that favour the Canadian dollar. With the pair hovering near key Ichimoku support at 1.6240, technical signals suggest further downside if Euro weakness persists. In the current context, the EUR/CAD encounter illustrates the contrasting economic backdrops of Europe and Canada.

Fundamental Analysis

The Eurozone economy continues to struggle with minimal growth and subdued inflation around 2%. Fiscal imbalances and weak business confidence have weighed on investor sentiment, leaving the European Central Bank cautious about future tightening. Meanwhile, Canada’s economy displays resilience. Stable GDP growth, solid labour data, and well-anchored inflation allow the Bank of Canada to maintain a firm stance. Strong trade and current-account positions reflect robust commodity performance, lending long-term support to the Canadian dollar. This fundamental strength has a significant impact on EUR/CAD valuation.

Sentiment Analysis

Market sentiment remains tilted in favour of CAD. Yield differentials and positioning data show investors increasing exposure to higher-yielding, commodity-linked currencies while trimming Euro longs. This shift aligns with a broader risk-on environment that continues to benefit the Canadian dollar over the Euro, affecting EUR/CAD dynamics.

Technical Analysis

The Ichimoku structure shows EUR/CAD struggling to maintain bullish traction. Price action is testing the Base Line near 1.6240, with the Kijun-sen flattening — a sign of consolidation before potential continuation lower. RSI sits at 52, trending down, while MACD momentum fades toward a bearish crossover. A confirmed close below 1.6240 could trigger acceleration toward 1.6100, with resistance capped around 1.6350. These technical indicators compound the bearish outlook for EUR/CAD.

Conclusion

EUR/CAD remains in a corrective downtrend as macro, sentiment, and technical conditions align against the Euro. The Canadian dollar’s superior fundamentals and market tone point to ongoing strength. A decisive break under 1.6240 would validate short positioning, with near-term targets around 1.6100. Outlook: Bearish bias — favour short positions on rallies toward 1.6350. Therefore, the EUR/CAD forecast suggests continued pressure on the Euro against Canada’s robust dollar.