EUR/JPY Poised for Further Gains

Introduction

The EUR/JPY pair has sustained strong upward momentum as macroeconomic divergence between the Eurozone and Japan deepens. With the European Central Bank holding a relatively stable policy stance and the Bank of Japan committed to ultra-loose conditions, the currency cross remains underpinned by both fundamentals and sentiment. Recent technical developments further strengthen the bullish case for EUR/JPY, suggesting additional upside potential in the coming weeks.

Fundamental Analysis

Eurozone growth remains subdued but stable, with balanced external accounts and inflation under control. This supports a cautious ECB, but steady demand for euros in capital markets continues. In contrast, Japan faces persistent structural weakness, with government debt above 230% of GDP and the BoJ maintaining ultra-low rates. The yield spreads clearly favour the euro over the yen, creating a favourable environment for EUR/JPY.

Sentiment Analysis

Speculative positioning shows strong long euro exposure against the yen, reflecting conviction in the trade. Retail flows remain mixed, but COT data reveals a decisive tilt in favour of EUR/JPY strength. News sentiment highlights ongoing pressure on the yen, with investors sceptical of any BoJ tightening. Cross-asset risk appetite also supports the pair, as investors rotate into higher-yielding currencies.

Technical Analysis

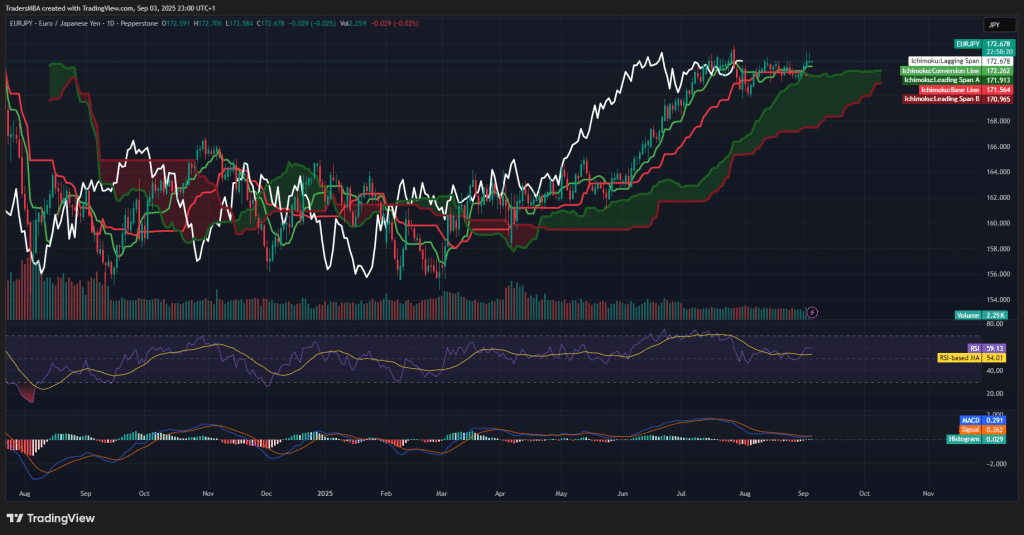

EUR/JPY trades firmly above the Ichimoku cloud, signalling sustained bullish momentum. RSI at 59 confirms positive momentum without overbought risk. MACD shows a bullish crossover with a rising histogram, reinforcing the continuation signal. Volume patterns align with price advances, indicating conviction behind the move. Key support lies at 171.5, with resistance at 174; a breakout above this could trigger further upside extension for EUR/JPY.

Conclusion

Macro fundamentals, market sentiment, and technical signals all converge to support further gains in the EUR/JPY pair. With yield spreads and positioning favouring the euro, and the yen constrained by BoJ policy, the bias remains to the upside. Traders should watch for a clean break above 174 to confirm the next leg higher for EUR/JPY.