EUR/JPY: The Breakout Opportunity Traders Can’t Ignore

Introduction

EUR/JPY has entered a powerful bullish phase driven by widening rate differentials, improving eurozone stability, and deep structural weakness in the Japanese yen. With the ECB settling into a predictable stance and the BoJ firmly anchored to ultra-loose policy, yield spreads continue to tilt decisively in favour of the euro. Market appetite for carry has strengthened, risk conditions remain constructive, and the technical structure has aligned with the macro backdrop. This convergence establishes EUR/JPY as one of the strongest directional opportunities in the major FX complex.

Fundamental Analysis

Eurozone fundamentals are gradually firming. Inflation has cooled without collapsing, providing the ECB with policy stability while supporting improving real yields. PMI data is swinging higher, external balances are steady, and consumer conditions show emerging resilience.

Japan, meanwhile, is trapped in a low-growth, low-confidence environment. Despite above-target inflation, the BoJ has avoided any meaningful tightening. Structural trade deficits, weak business sentiment, and negative real yields weigh heavily on the yen. The result is an entrenched divergence: the euro possesses policy credibility and positive yield support, while the yen remains suppressed by an unchanged ultra-dovish framework.

Sentiment Analysis

Sentiment strongly favours further EUR/JPY upside. Retail traders remain stubbornly long JPY across the board — historically a contrarian bullish signal for this cross. COT futures positioning shows institutions maintaining significant yen underweights. Trend momentum remains positive, with EUR/JPY sentiment scoring firmly in bullish territory. Cross-asset conditions, particularly in equities and credit, support continued demand for carry trades, reinforcing the broader pro-EUR, anti-JPY narrative.

Technical Analysis

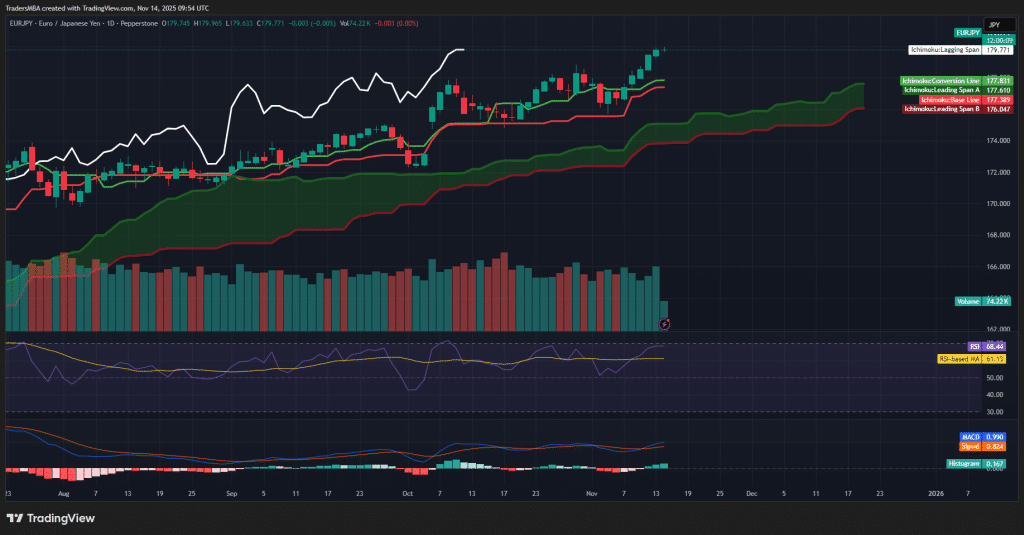

Price action confirms the macro story. EUR/JPY trades decisively above the Ichimoku cloud, with both Tenkan and Kijun lines trending higher. The Chikou Span sits comfortably above prior price, validating trend strength. RSI remains firm at upper levels without flashing overbought, leaving room for continuation. MACD momentum is aligned to the upside, and volume shows commitment on bullish candles. With resistance at 180.00 under pressure and no reversal signals present, the technical structure supports sustained trend expansion.

Conclusion

The EUR/JPY long stands out as a fully aligned trade across macro, sentiment, and technical dimensions. Japan’s policy inertia and weak fundamentals continue to undermine the yen, while the euro benefits from stabilising economic conditions and favourable yield dynamics. With trend strength intact and momentum building, the path of least resistance remains higher. EUR/JPY is not just a bullish setup — it is one of the market’s cleanest and most compelling opportunities.