EUR/USD: Diverging Policies Keep Pressure on the Euro

Introduction

EUR/USD continues to drift lower as widening growth and policy differentials reinforce dollar strength. The Eurozone’s weak momentum contrasts with robust US data, and the European Central Bank’s cautious tone leaves the euro vulnerable. With the pair sustaining below key technical thresholds, downside risks persist into the next quarter.

Fundamental Analysis

The Eurozone economy remains stagnant, with GDP growth near zero and business confidence subdued. Manufacturing PMIs remain in contraction, and inflation has eased toward the ECB’s target, reducing pressure for further tightening. In contrast, the US economy remains resilient with 3.8% quarterly growth, steady job creation, and inflation near 3%, justifying the Fed’s higher-for-longer policy stance. This divergence keeps real yield spreads heavily in favour of the dollar and sustains capital inflows to USD assets.

Sentiment Analysis

Sentiment leans firmly against the euro. Retail traders remain net long EUR/USD despite the persistent downtrend, while institutional flows favour the dollar. EUR sentiment at –4 versus USD’s +22 produces a pair sentiment of –14, indicating continued bearish bias. Market positioning reflects confidence in US outperformance, with limited catalysts for a euro rebound in the near term.

Technical Analysis

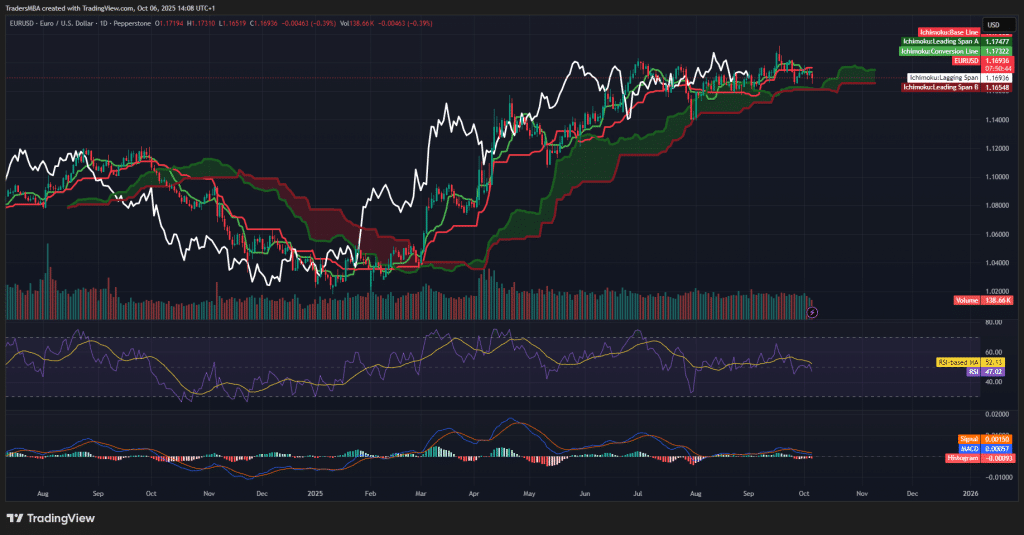

EUR/USD trades below the Ichimoku cloud, confirming a bearish structure. The Tenkan-sen has crossed beneath the Kijun-sen, signalling renewed downside momentum. RSI at 47.0 shows mild weakness, while MACD has turned negative with widening histogram bars. Volume increases on sell-offs reinforce bearish control. Key resistance lies at 1.1750, while support is seen near 1.1650, a break below which could open room toward 1.1500.

Conclusion

EUR/USD remains under sustained pressure from both macro and technical perspectives. The Fed’s policy advantage and stronger economic fundamentals continue to weigh on the euro. Unless Eurozone growth surprises to the upside or the Fed shifts dovishly, the pair is likely to extend its decline toward 1.1500, maintaining a bearish outlook into year-end.