EUR/USD Poised for Further Gains

Introduction

The euro is showing renewed resilience against the U.S. dollar, supported by a convergence of macro fundamentals, sentiment, and technical structure. While Eurozone growth remains weak, robust external balances and fiscal stability contrast sharply with the U.S.’s widening deficits and fragile consumer sentiment. Together with strong contrarian positioning signals and bullish chart confirmation, EUR/USD looks set for further upside.

Fundamental Analysis

On an absolute basis, Eurozone fundamentals are mixed. Growth is stagnant and the ECB is cautious, but inflation is near target and external surpluses remain substantial. Importantly, the euro area’s current account and trade balances provide a structural cushion. By contrast, the U.S. economy shows robust GDP growth and resilient labour, yet faces significant vulnerabilities: fiscal deficits above 6% of GDP, rising debt-to-GDP, and persistent current account imbalances. This relative divergence favours the euro over the dollar in medium-term flows, even if Eurozone growth lags.

Sentiment Analysis

Retail positioning shows the majority of traders remain short EUR/USD, a strong contrarian bullish signal. Institutional surveys confirm that fund managers are overweight the euro, reflecting growing confidence in relative euro stability compared with the dollar’s fiscal risks. Broader cross-asset flows, with risk appetite stabilising, also support the euro. These sentiment drivers align to strengthen the bullish case.

Technical Analysis

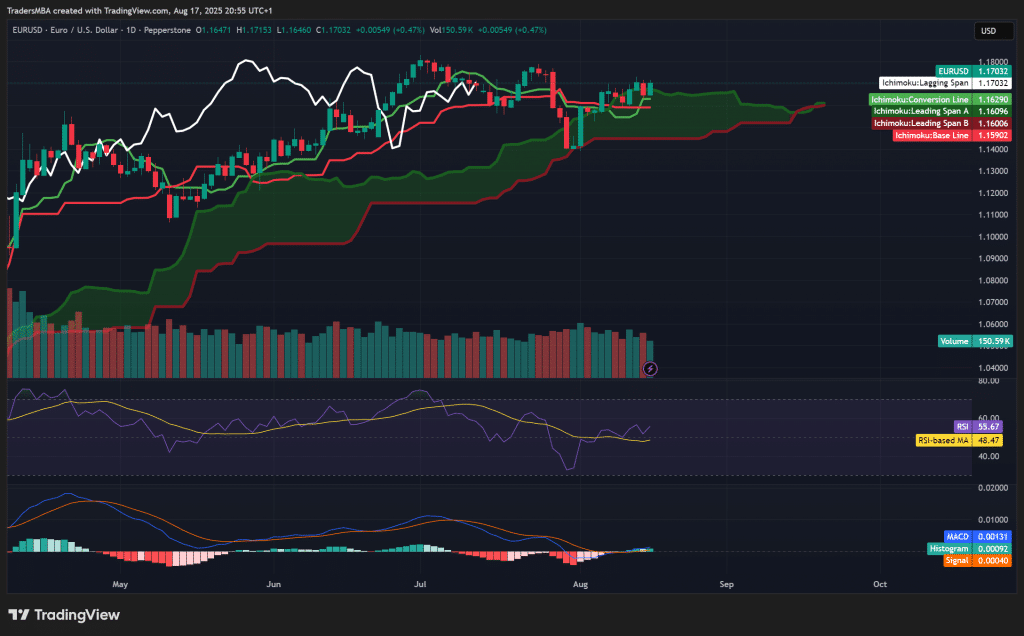

EUR/USD trades firmly above the Ichimoku cloud, maintaining a bullish market structure. The conversion line sits above the base line, reinforcing upward bias. RSI is around 55, indicating positive momentum without overbought conditions. MACD has turned positive with histogram expansion, signalling renewed buying interest. Immediate support lies near 1.16, while resistance stands at 1.18. A decisive breakout above 1.18 would likely trigger further upside toward 1.20.

Conclusion

Despite muted Eurozone growth, the euro is supported by strong external surpluses, relative fiscal credibility, and a favourable sentiment backdrop. The U.S. dollar, while backed by solid growth, is weighed down by widening fiscal and current account deficits. With technicals confirming bullish structure, EUR/USD remains well-positioned for further gains. A clear break above 1.18 would confirm the next bullish leg.