GBP/USD Rally Builds as Sterling Targets New Highs

Introduction

The British pound is mounting a strong comeback against the US dollar, fuelled by resilient UK data and an improving outlook. At the same time, the dollar faces mounting headwinds from stretched positioning and fading sentiment. With technicals echoing the macro backdrop, the GBP/USD currency pair looks poised to break higher, with scope for fresh highs in the weeks ahead.

Fundamental Analysis

UK fundamentals remain supportive. Services PMI is firmly in expansion, inflation is holding steady, and labour markets show resilience. The Bank of England has reason to remain cautious on easing, underpinning sterling strength. Fiscal pressures linger, but improved business confidence softens downside risks.

In the US, solid GDP is offset by widening deficits and stretched dollar positioning. The Federal Reserve’s restrictive stance persists, but investor appetite for USD has cooled, leaving it vulnerable to changes in the GBP/USD market.

Sentiment Analysis

Retail positioning and COT data both show excessive USD long exposure, creating vulnerability to a correction. GBP sentiment is strengthening as UK services and consumer confidence improve. In the context of GBP/USD, flows increasingly tilt toward sterling, while the USD has lost part of its safe-haven appeal.

Technical Analysis

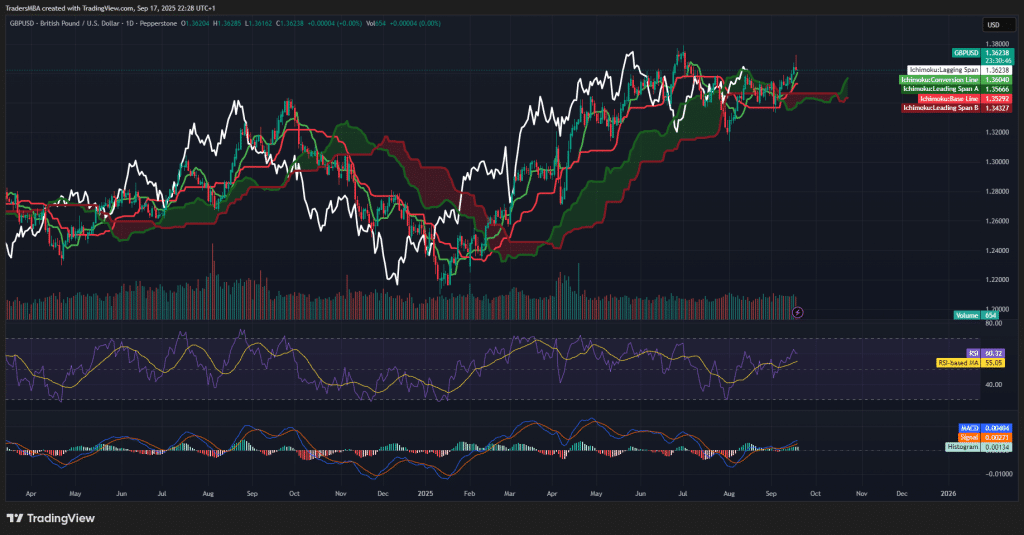

GBP/USD trades above the Ichimoku cloud, confirming a bullish structure. RSI sits near 60, highlighting healthy momentum. MACD has crossed bullishly, with the histogram expanding, while volume confirms sustained demand. Key support lies at 1.3560, resistance at 1.3660; a breakout above this level could open the door to 1.38 in the GBP/USD trading scenario.

Conclusion

Sterling’s rebound looks set to continue as fundamentals, sentiment, and technicals align in its favour. A decisive break above 1.3660 would confirm the bullish continuation, positioning the GBP/USD pair for fresh highs against a vulnerable US dollar.