GBP/USD: Sterling Weakness Deepens as Dollar Dominates

Introduction

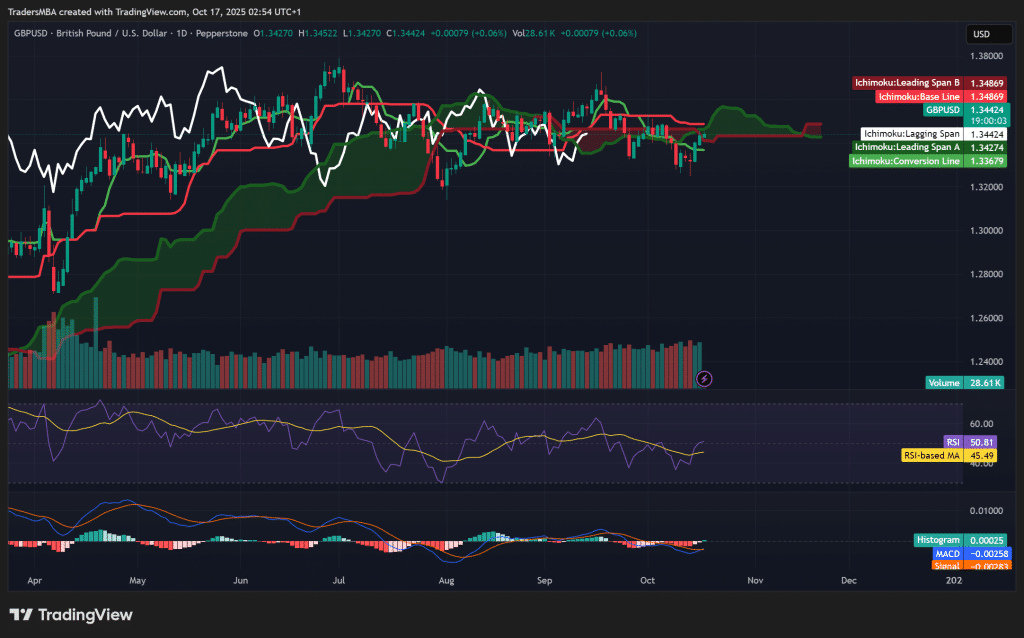

The British pound remains under sustained pressure as macroeconomic headwinds intensify while the U.S. economy continues to outperform its global peers. With the Bank of England turning cautious and the Federal Reserve maintaining restrictive policy, the yield and growth differentials heavily favour the dollar. As GBP/USD trades below its Ichimoku cloud and key moving averages, both momentum and sentiment point to further downside.

Fundamental Analysis

The UK economy faces slowing growth, tepid business activity, and lingering inflationary pressures. GDP growth sits near 0.3% QoQ, while PMIs remain subdued, reflecting weak manufacturing and services output. Fiscal conditions continue to weigh, with a budget deficit above 4.8% of GDP and rising debt-to-GDP levels near 96%.

In contrast, U.S. GDP growth of 3.8% and solid labour market data reinforce dollar strength. The Fed’s 4.25% policy rate, combined with robust consumption and investor confidence, supports a widening policy gap in favour of the USD. The macro divergence remains clear — a strong dollar against a weakening pound.

Sentiment Analysis

Market positioning reflects strong bearish conviction. The sentiment differential between USD (+12) and GBP (–12) equals +24, signalling decisive downside bias in GBP/USD. Retail traders remain heavily long the pair, while institutional flow and COT data show persistent GBP selling. Risk sentiment remains neutral, limiting any corrective rebound potential. The path of least resistance continues lower toward 1.32 and 1.30.

Technical Analysis

The daily Ichimoku chart shows GBP/USD clearly below its cloud and base line at 1.3486 — confirming bearish structure. RSI hovers near 45, consistent with downward momentum, while MACD remains below zero, suggesting renewed selling pressure. Volume analysis indicates heavier activity during downswings, reinforcing the current trend. Key resistance stands at 1.35, while immediate support lies at 1.33, followed by 1.30.

Conclusion

GBP/USD remains technically, fundamentally, and sentimentally aligned to the downside. The dollar’s superior yield and growth dynamics, combined with weak UK performance, continue to favour selling rallies. Short positions remain valid below 1.35, with potential targets at 1.32 and 1.30 in the weeks ahead.