GBP/USD Weakness Deepens Amid Diverging US and UK Macro Fundamentals

Introduction

GBP/USD is facing renewed selling pressure as the British pound weakens against a resilient US dollar. The macroeconomic divergence between the UK and the US has widened, driven by stronger US growth, tighter monetary policy, and sustained safe-haven flows into the dollar. Meanwhile, the UK economy continues to struggle with sluggish growth, a persistent current account deficit, and weakening consumer sentiment. This article explores the fundamental, sentiment, and technical factors underpinning the GBP/USD downtrend, providing an in-depth analysis for traders seeking opportunities in the current market environment.

Fundamental Analysis

The macroeconomic picture strongly favours the US dollar over the British pound.

United States Overview

The US economy continues to demonstrate resilience across key indicators:

- GDP Growth: Quarterly GDP stands at 3%, while annual growth is 2%, reflecting solid domestic demand.

- Inflation: YoY inflation at 2.7% and MoM inflation at 0.3% signal stable price pressures under control of the Federal Reserve’s policy stance.

- Interest Rates: The Fed maintains a 4.5% benchmark, creating a meaningful yield differential versus GBP.

- Labour Market: Unemployment at 4.2% remains historically low, supporting consumer activity.

- Trade & Current Account: While the US runs a -$60.18B trade deficit and a current account at -3.9% of GDP, the domestic growth engine offsets external imbalances.

- Fiscal Position: Debt-to-GDP at 124% and a budget deficit of -6.2% are concerns, but the dollar benefits from reserve currency status and global demand.

United Kingdom Overview

The UK economy is significantly weaker across multiple dimensions:

- GDP Growth: Quarterly growth at 0.7% and annual growth at 1.3% indicate stagnation, with minimal forward momentum.

- Inflation: YoY inflation remains elevated at 3.6%, with 0.3% MoM gains keeping pressure on the Bank of England.

- Interest Rates: Rates are at 4.25%, close to the Fed’s level but without the same economic support behind them.

- labour market: Unemployment has risen to 4.7%, signalling emerging labour market stress.

- Trade & Current Account: Trade deficit stands at -£5.7B, while the current account is -2.7% of GDP—persistent imbalances weighing on sterling.

- Fiscal Position: Debt-to-GDP is 95.9% with a -4.8% budget deficit, limiting fiscal room to stimulate growth.

Macro Implications for GBP/USD

This macro divergence underpins sustained downward pressure on GBP/USD. Stronger US growth and higher real yields attract capital inflows to the dollar, while the UK faces structural headwinds that limit upside for sterling.

Sentiment Analysis

Market sentiment and positioning align with the fundamental story, favouring a bearish GBP/USD outlook.

- Institutional Positioning: COT data indicates increasing net short exposure to GBP, while USD retains broad market support.

- Retail Trader Flows: Retail traders continue to buy dips in GBP/USD, often against the prevailing trend, adding contrarian confirmation to short positions.

- Safe-Haven Dynamics: Ongoing global uncertainty and UK fiscal vulnerabilities keep the USD attractive as a defensive asset.

- Narrative Drivers: Markets are pricing prolonged economic underperformance in the UK and a “higher-for-longer” Fed stance, reinforcing bearish sterling sentiment.

Combined, these sentiment factors suggest rallies in GBP/USD are likely to be sold into rather than sustained.

Technical Analysis

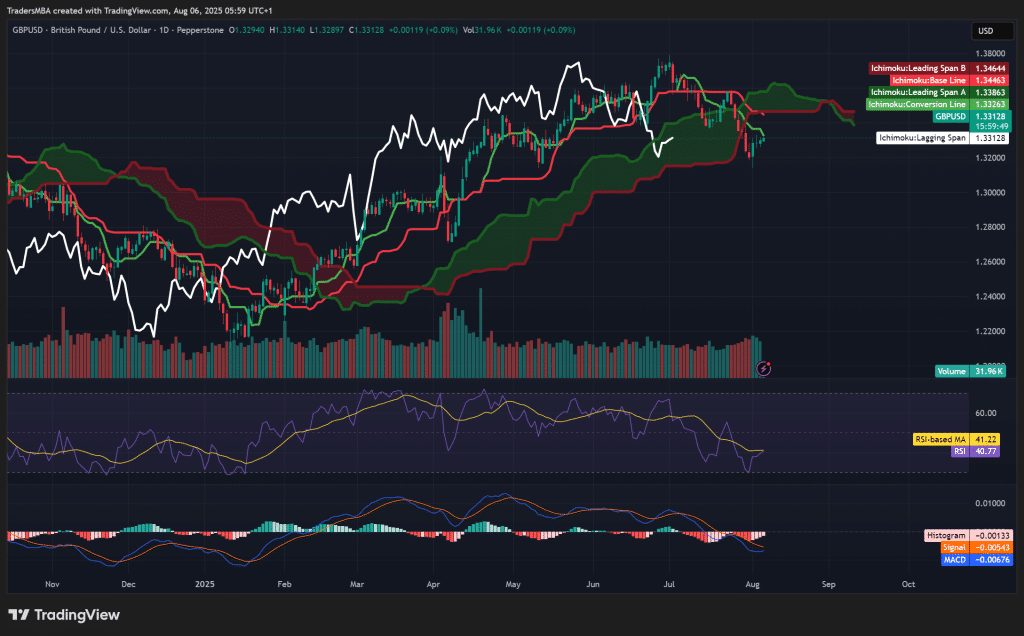

The daily and weekly charts confirm a strong bearish structure in GBP/USD.

- Ichimoku Cloud: Price trades firmly below the cloud, confirming a downtrend. Conversion line (1.33263) is below the base line (1.34463), reflecting ongoing bearish pressure. Lagging span is below both price and the cloud, providing trend confirmation.

- RSI: RSI is at 40.77, signalling bearish momentum without yet entering oversold conditions. The downward slope reflects continued selling pressure with room for further declines.

- MACD: MACD line below signal line with a negative histogram confirms bearish momentum. The histogram shows increasing downside energy, aligning with price action.

- Volume: Recent downswings show rising volume, validating the strength of selling pressure. Distribution patterns suggest active selling on rallies.

- Key Levels: Support at 1.3200 (psychological and recent swing low). Resistance at 1.3450 (cloud and base line area). A confirmed break below 1.3200 could open a path to 1.3050 in the medium term.

Conclusion

GBP/USD is locked in a bearish trajectory, driven by a potent combination of macroeconomic divergence, negative market sentiment, and technically aligned downtrends. The US dollar benefits from higher growth, stable inflation, and strong global demand, while the British pound struggles with structural deficits, weak growth, and rising unemployment.

From a trading perspective:

- Selling rallies in GBP/USD remains the preferred strategy.

- Short-term targets sit near 1.3200, with scope for an extension toward 1.3050 if bearish momentum persists.

- Risk management should account for potential corrective rallies toward 1.3450, which coincides with the Ichimoku cloud and key resistance.

This alignment of fundamentals, sentiment, and technicals provides a high-conviction short trade in GBP/USD for the current market environment.