Gold Breaks Higher as Real Yields Ease

Introduction

Gold (XAU/USD) has broken out to fresh highs above $3,440, supported by a potent mix of falling real yields, ETF inflows, and resilient central bank demand. After a prolonged summer consolidation, the yellow metal has re-emerged as a core macro hedge while equities wobble and the Federal Reserve edges toward policy easing. With real yields easing from recent peaks and the dollar under pressure, gold’s technical breakout aligns neatly with bullish fundamentals and supportive sentiment. The key question now is whether this rally can extend toward the psychologically critical $3,500 level, or whether near-term overbought signals will force a pause.

Fundamental Analysis

Gold’s underlying bid is anchored in three structural factors: rates, demand flows, and geopolitics.

- Rates and Dollar: The US 10-year TIPS yield has eased to around 1.8% after peaking earlier in the summer. Falling real yields directly improve gold’s relative value as a non-yielding asset. Meanwhile, the dollar index (DXY) has slipped below 100, adding FX tailwinds. The July Core PCE print of 2.9% YoY keeps inflation sticky but supports expectations for a September Fed rate cut, further capping yields.

- Investor Demand: Global gold ETFs added 23 tonnes in July, lifting assets under management to a record month-end high. This marks a sharp reversal from outflows earlier in the year, re-establishing ETFs as a dominant pillar of demand. OTC buying and investment bar flows also contributed to Q2’s record average LBMA price near $3,280/oz.

- Official Sector: Central banks added 166 tonnes in Q2 and another 22 tonnes in June. The World Gold Council’s survey shows strong intent to continue buying, regardless of price levels. This official bid is sticky, non-price-sensitive, and supportive of long-term stability.

- Physical Demand: India’s H1 imports were down 30% YoY on record-high prices, but recent restocking into the festival season has pushed local prices back to small premiums. In China, imports and quotas remain steady, with spot now at par to slight premiums. While softer than earlier this year, Asian physical demand still provides a cushion on dips.

- Supply: Mine production reached a quarterly record of ~909 tonnes in Q2, while recycling has remained subdued despite elevated prices. Higher supply tempers upside convexity but is unlikely to overwhelm demand drivers in the near term.

- Macro Backdrop: Geopolitical tensions, tariff adjustments, and continued trade frictions sustain gold’s role as a strategic reserve asset. Even as tariff clarity briefly reduced some risk premium, the broader uncertainty continues to underpin allocations.

Taken together, fundamentals are modestly bullish. Falling real yields, renewed ETF inflows, and sticky central bank buying outweigh the headwind of record mine supply and subdued physical demand in Asia.

Sentiment Analysis

Market sentiment toward gold is constructive and points to further gains.

- Rates & FX: Falling real yields and a weaker USD remain the biggest bullish catalysts. Any further decline in TIPS yields below 1.6% would be highly supportive.

- Flows: ETF inflows have re-emerged as a critical driver, marking a decisive shift from the net outflows seen in late 2024.

- Positioning: CFTC data shows speculative net longs at ~214,000 contracts—bullish but not dangerously crowded.

- Physical Markets: Indian and Chinese demand is stabilising but not exuberant. Modest premiums signal steady, not overheated, appetite.

- Volatility: GVZ sits around 16, a mid-level regime that leaves room for trend extension without forced liquidation.

- Microstructure: Futures-spot basis dislocations seen earlier in August have normalised, suggesting sentiment has stabilised after tariff-related shocks.

The overall sentiment profile is bullish with room for further extension. Risks to this view include upside surprises in US inflation, which could push real yields higher and stall ETF inflows.

Technical Analysis

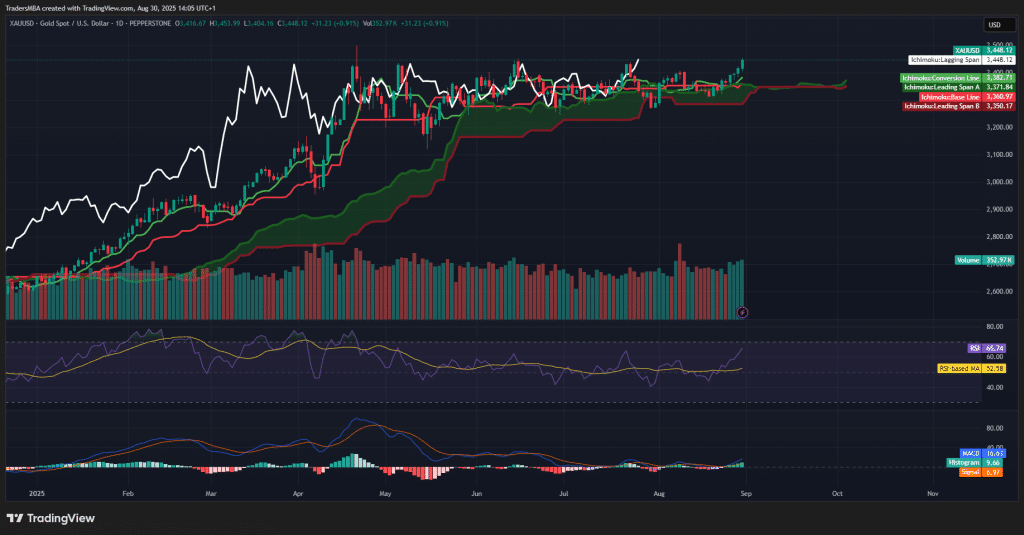

The daily chart confirms a clean breakout:

- Ichimoku: Price has cleared the cloud decisively, with the Tenkan-sen above the Kijun-sen and Span A above Span B. The lagging span sits above price and the cloud, giving full confirmation of bullish conditions.

- Volume: The breakout has been validated by rising volume, following a flat, low-volume consolidation period through the summer.

- RSI: Currently at 65.7, RSI is trending higher but remains below the 70 threshold. This shows strong momentum without full overbought exhaustion.

- MACD: A bullish crossover is confirmed, with the histogram expanding. Momentum is building in favour of continuation.

- Levels: Immediate resistance sits at 3,450–3,480, with a major psychological barrier at 3,500. On the downside, supports are layered at 3,382 (Tenkan), 3,360 (Kijun), and 3,300 (flat cloud base).

Technicals align with fundamentals and sentiment, confirming a bullish outlook toward 3,500. A healthy pullback into 3,380–3,360 would present a tactical buying opportunity.

Conclusion

Gold’s breakout above $3,440 represents a convergence of macro, sentiment, and technical tailwinds. Easing real yields, a softer dollar, and renewed ETF inflows have reinforced bullish momentum, while central bank buying provides structural support. Technicals confirm the breakout with RSI, MACD, and Ichimoku in alignment, and volume validating the move. While near-term overbought risks could prompt a pause, the path of least resistance points higher toward $3,500.

For traders, the playbook is straightforward: buy dips into 3,380–3,360 with eyes on 3,480–3,500, while watching real yields and ETF flows as key signals for sustainability.