Gold Price Analysis: XAU/USD Holds Steady Above Cloud as Fundamentals Offer a Bullish Edge

Introduction

Gold (XAU/USD) continues to trade in a consolidation range, holding above the Ichimoku cloud and key support levels while macro fundamentals provide a cautiously bullish bias. The market is balancing the support from central bank buying and ETF inflows against the headwinds from still-elevated real yields and a firm US dollar. This report examines the technical, fundamental, and sentiment landscape to outline the near-term outlook.

Fundamental Analysis

The fundamental backdrop for gold remains strategically supportive but tactically mixed.

- Real Yields & Rates: The US 10-year TIPS yield is holding near 1.86–1.88%, down slightly from earlier in the year but still a drag on aggressive upside. Nominal 10-year yields are around 4.27%, keeping real yields elevated.

- Dollar Performance: The US Dollar Index (DXY) sits near 98.5, a level that is not overly restrictive for gold but still dampens breakout potential.

- Inflation & Fed Policy: US CPI YoY is currently 2.7%, with markets expecting potential Fed easing later this year. Softer CPI/PCE prints could pressure real yields lower and boost gold, while upside surprises would limit gains.

- Central Bank Demand: The People’s Bank of China has extended gold purchases for a ninth consecutive month, adding to the trend of sustained official sector buying that has underpinned the market through dips.

- Investment Flows: According to the World Gold Council, Q2-2025 saw a 3% YoY rise in demand, driven by ETF inflows and central bank purchases. July alone saw gold ETFs add roughly 23 tonnes (~US$3.2bn), marking a clear shift in investor sentiment.

Macro Outlook: The base case remains for neutral-to-constructive price action while real yields stay below 1.95% and DXY below 100. A decisive bullish trigger would require real yields to break below ~1.75% alongside continued ETF inflows.

Sentiment Analysis

Market positioning paints a picture of cautious optimism.

- Retail Positioning: Retail traders remain heavily net-long (IG ~69% long, Myfxbook ~61%), a contrarian signal that leans slightly bearish in the short term.

- Futures Positioning (COT): Managed money net-long positions have been rebuilding steadily since Q2 lows, adding weight to the bullish side of the ledger.

- ETF Flows: ETF holdings, led by GLD, have grown consistently in recent months — a key sentiment and liquidity driver.

- Risk Appetite: Equity volatility (VIX) remains subdued, reducing the classic “fear bid” impulse for gold, but maintaining a steady risk hedge role.

Overall sentiment sits in neutral-to-positive territory, with institutional accumulation offsetting the drag from crowded retail longs.

Technical Analysis

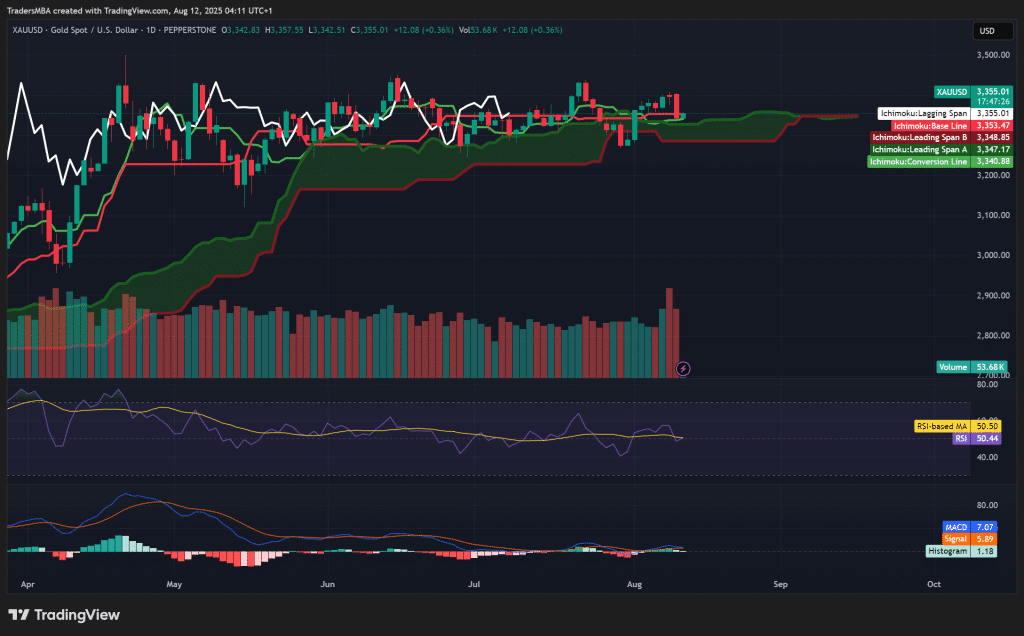

From a daily chart perspective, XAU/USD shows consolidation above key support with a mild bullish lean.

- Ichimoku Cloud: Price remains above the cloud, with the base line (Kijun-sen) at $3,353.47 and the cloud support zone between $3,347–$3,348. The cloud ahead is flat, signalling consolidation rather than trend acceleration.

- Volume: A recent spike in volume alongside a narrow trading range suggests absorption — large players countering selling pressure.

- RSI: At 50.44, RSI sits at neutral, confirming the lack of directional conviction.

- MACD: MACD is slightly above the signal line (+1.18 histogram), indicating mild bullish momentum.

Key Levels:

- Resistance: $3,357.55 (swing high); break here could target $3,375–$3,390.

- Support: $3,347–$3,348 (cloud convergence); below that, $3,340 and the $3,325–$3,330 zone.

Conclusion

Gold’s short-term technical structure is neutral-to-bullish, supported by macro flows from central banks and ETFs, but capped by firm real yields and a stable dollar. Traders should watch for:

- A breakout above $3,358 with strong volume for bullish continuation.

- A breakdown below $3,347 cloud support for a bearish reversal risk.

- Real yields dipping below 1.75% and continued ETF inflows as the macro catalyst for a sustained uptrend.

Gold remains a strategic buy on dips, but tactical entries should align with macro triggers and technical confirmation.

FAQs

Q1: Why is gold consolidating despite central bank buying?

Central bank purchases provide a floor, but elevated real yields and a firm USD are limiting upward momentum.

Q2: What would trigger a decisive breakout in gold?

A drop in US 10-year TIPS below ~1.75% alongside continued ETF inflows could catalyse a breakout.

Q3: Is retail positioning a concern for gold bulls?

Yes. Heavy net-long retail positioning is often a contrarian bearish indicator, especially in the short term.

Q4: How important are ETF flows for gold’s price?

ETF flows are a major short-term driver. Sustained inflows tighten available supply and support higher prices.

Q5: What are the key support levels to watch?

$3,347–$3,348 is immediate support; below that, $3,325–$3,330 becomes the key downside level.