Gold (XAU/USD) Outlook: Central Bank Support vs Fading Momentum

Gold has surged over 29% year-to-date, cementing its role as 2025’s standout asset. Yet, beneath the glow lies a market caught between structural bullish forces and technical exhaustion. Here’s our full-spectrum breakdown across fundamentals, sentiment, and technicals, tailored to today’s macro-inflated landscape.

Fundamental Analysis

Gold’s 2025 rally isn’t just about glitter—it’s driven by deep macro shifts:

Central Bank Demand Surges:

Poland, Türkiye, and India have collectively added over 230 tonnes to their reserves, part of a broader EM trend. Central bank surveys indicate 95% plan to continue buying, signalling strong sovereign demand.

Inflation Hedge – But Not Linear:

Though inflation in the UK and US remains above target (UK ~3.6%), gold’s recent price action has decoupled from short-term CPI readings. This highlights a structural shift: gold is now a debt-hedge more than an inflation-hedge.

De-dollarisation and Sovereign Risk:

Ray Dalio and others have publicly recommended gold over fiat or crypto, citing sovereign debt loops and USD vulnerability. This has bolstered the long-term bid beneath the metal.

Physical Demand Trends:

While Chinese jewellery demand is slowing, retail bar and coin purchases surged 24% YoY in H1 2025, especially in Asia. Gold-backed ETFs now hold ~$383b in assets—up 41% YTD.

Supply Creep:

Mine production is ticking higher, but remains well below demand trajectories. The real threat lies in investor fatigue, not oversupply.

Sentiment Analysis

Retail Sentiment:

BullionVault’s July poll shows average retail expectations for gold now at $3,679 by year-end, up from $3,070 earlier this year. Crowd bias is clearly bullish.

Institutional Flows:

ETF inflows remain positive. COMEX non-commercial longs are at multi-year highs. Sentiment among asset managers is broadly constructive.

Safe-Haven Premium Still Intact:

Despite a recent US–EU tariff truce, geopolitical frictions (e.g., Middle East, Taiwan) are maintaining the safe-haven bid.

Contrarian Flashes:

While not extreme, there are subtle warning signs. HSBC projects a return to $3,215 in 2025, with long-term risks down to $2,350. Morningstar warns of a 30–40% retracement if ETF flows reverse.

Technical Sentiment Markers:

- Gold/Silver ratio remains elevated—sign of persistent caution

- Momentum (MACD, RSI) shows bearish divergence, but no outright collapse

- Bollinger Bands tightening → volatility compression phase

Technical Analysis

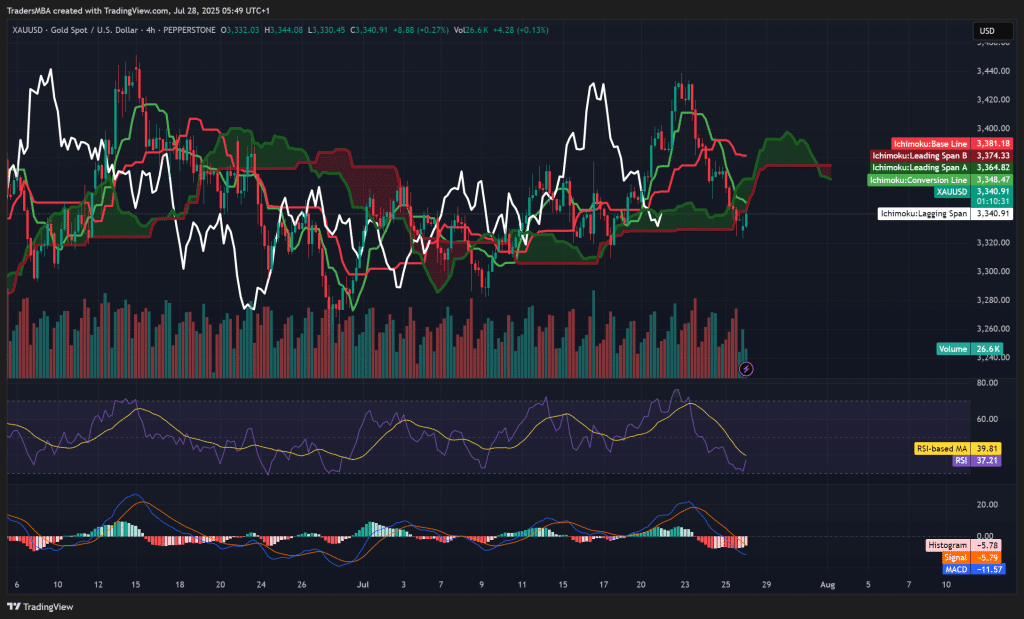

Chart Setup (4H, TradingView)

- Price: $3,340.91

- Ichimoku Cloud: Price inside cloud, below base line = neutral-bearish

- Conversion Line (Tenkan): $3,348.47

- Base Line (Kijun): $3,381.18

- Lagging Span: In price zone = indecision

- RSI: 37.21 (oversold, potential bounce)

- MACD: Bearish, but histogram flattening = loss of downward momentum

- Volume: Sellers thinning = exhaustion nearing

Interpretation:

Price is sandwiched within the cloud, bouncing off prior demand zones. RSI near 37 indicates short-term oversold conditions, while the MACD histogram signals that bears are losing steam.

Trade Setup: Mean Reversion (Short-Term Buy)

- Entry: Buy XAU/USD near $3,335–$3,340

- Stop: Below $3,310 (cloud base + recent swing low)

- Target 1: $3,365 (Span A)

- Target 2: $3,381–$3,390 (Kijun + volume shelf)

Bias: Short-term bounce within macro bullish structure. If price closes below $3,310 → flip to sell setup toward $3,280–$3,250.

Conclusion

Gold’s rally is underpinned by strong central bank support and persistent macro tailwinds. But with retail euphoria rising and technicals flashing consolidation, chasing highs may not be optimal. Smart money is rotating—adding on dips, not breakouts. Expect range-bound trading between $3,300–$3,400, with explosive potential if new geopolitical shocks emerge or if the Fed surprises dovishly. A buy-on-dip regime remains valid, but only with tight risk management.

FAQs

What is driving gold’s strength in 2025?

Central bank accumulation, debt concerns, and de-dollarisation trends are creating a structural demand floor.

Is gold still a good inflation hedge?

Not in the short term. Its current role is more aligned with hedging sovereign and currency risk, not CPI prints.

Are central banks still buying gold?

Yes. Poland, India, Türkiye and others have been aggressive buyers. Surveys suggest ~95% of CBs will continue accumulating.

Is sentiment too bullish on gold?

Retail is very bullish, but institutional flows remain supportive. There are mild contrarian signals, but no extremes yet.

What price levels are key for XAU/USD?

Support: $3,310–$3,330

Resistance: $3,365–$3,390

Breakout trigger: $3,400+