Long AUD/CHF: Potential Breakout on Diverging Policy Outlook

Introduction

The AUD/CHF cross presents an opportunity driven by diverging inflation dynamics and monetary policies. Australia maintains moderate growth and sticky inflation, which keeps the Reserve Bank of Australia (RBA) cautious on easing. In contrast, Switzerland continues to face very low inflation, allowing the Swiss National Bank (SNB) to remain neutral and less restrictive. With supportive sentiment towards the Australian dollar, conditions are building for a potential bullish breakout in AUD/CHF.

Fundamental Analysis

Australia’s economy remains stable, with GDP growth modest but steady, supported by resilient services and retail demand. Inflation, though moderating, remains above the RBA’s comfort zone, keeping the policy stance on hold.

Switzerland, by contrast, reports ultra-low inflation and subdued growth, limiting the SNB’s ability to tighten further. While trade and current account balances remain supportive for CHF, monetary divergence against Australia favours AUD strength.

Sentiment Analysis

Retail positioning shows a strong preference for AUD longs against CHF, with optimism reflected in sentiment indicators. The broader bias in speculative positioning highlights continued demand for higher-yielding currencies like AUD, particularly against safe-haven, low-yielding currencies like CHF. Sentiment alignment adds further conviction to the bullish outlook.

Technical Analysis

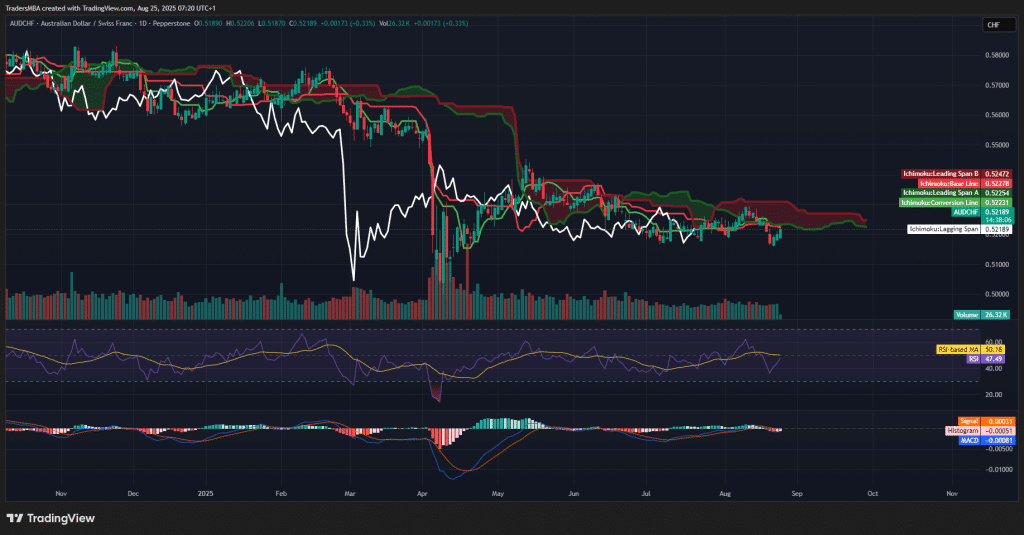

AUD/CHF trades just below the Ichimoku Cloud, with price consolidating and the cloud narrowing ahead. RSI at 47 is neutral but turning higher, signalling building upside momentum. The MACD shows bearish momentum fading, with potential for a bullish crossover. Key resistance lies at 0.5250; a breakout above this level would confirm a shift towards bullish momentum. Support is found around 0.5180, offering a well-defined risk level.

Conclusion

AUD/CHF offers a constructive long setup, supported by macro divergence, bullish sentiment, and emerging technical signals. A decisive close above 0.5250 could confirm a breakout, with potential for further gains as AUD strengthens relative to CHF. The risk-reward balance remains favourable for long positioning in this pair.