Long GBP/CHF: Sterling Strength Meets Swiss Stagnation

Introduction

GBP/CHF is emerging from a structural base as the UK economy regains traction while Switzerland faces mounting deflation risk and weakening domestic indicators. The trade exploits diverging monetary trajectories and improving UK sentiment, positioning for a medium-term breakout above resistance.

Fundamental Analysis

British Pound (GBP):

- GDP: +0.7% QoQ / 1.3% YoY

- Inflation: 3.6% YoY / 0.3% MoM

- Interest Rate: 4.25%

- Unemployment: 4.7%

- Current Account: -2.7% of GDP

- Fiscal: Budget -4.8%, Debt 95.9% of GDP

- PMIs & Retail: Services PMI at 51.2, Retail Sales +0.9% MoM

The UK macro picture is one of mild but consistent improvement, with solid retail consumption, sticky inflation, and improving external balances supporting GBP.

Swiss Franc (CHF):

- GDP: +0.5% QoQ / 2.0% YoY

- Inflation: 0.1% YoY / 0.2% MoM

- Interest Rate: 0.0%

- Unemployment: 2.7%

- Current Account: +5.1% of GDP

- Fiscal: Budget +0.4%, Debt 37.9% of GDP

While Switzerland maintains pristine fiscal and external accounts, its real economy is faltering. Inflation has all but vanished, and the SNB’s shift to a neutral stance makes CHF structurally vulnerable in a world chasing yield.

Sentiment Analysis

- Positioning: Mild GBP net longs vs flat CHF

- Macro narrative: UK recovery with resilient inflation contrasts Switzerland’s deflation risk and stagnant growth

- Capital flows: GBP favoured in risk-on and yield-seeking conditions

- Carry appeal: GBP offers a growing rate advantage

- Risk backdrop: Neutral-to-positive; safe haven bid for CHF is fading

The divergence is not yet extreme, but the asymmetry in forward potential gives GBP an edge over CHF—especially if global growth steadies or the UK surprises higher.

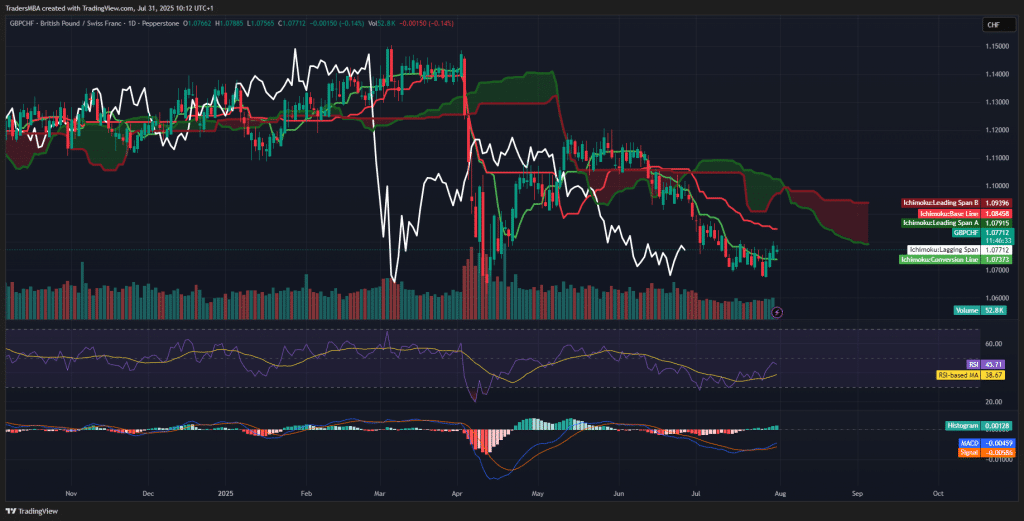

Technical Analysis

- Ichimoku Cloud: Price testing the cloud base (1.078–1.084). A confirmed close above would indicate trend reversal.

- RSI: 45.71, turning higher from oversold with bullish divergence visible.

- MACD: Bullish crossover forming; histogram has flipped positive—early stage bullish shift.

- Volume: Increasing on green candles; accumulation pattern evident.

- Multi-timeframe view: Daily structure turning; weekly flattening—ideal for base breakout setup.

The 1.0845 level marks a key pivot. If broken decisively, upside extension toward 1.10–1.12 is likely.

Conclusion

GBP/CHF offers an attractive long opportunity, supported by diverging fundamentals, improving sentiment, and emerging technical confirmation. While not yet in full breakout mode, a daily close above the Ichimoku cloud would be a strong catalyst for trend acceleration. This setup carries medium conviction with a bullish bias, targeting a structural shift in the cross as UK macro momentum builds.