Long USD/JPY: Policy Divergence Continues to Favour the Dollar

Introduction

USD/JPY remains one of the clearest expressions of global monetary policy divergence. With the US Federal Reserve maintaining a substantially higher interest rate environment compared to the Bank of Japan’s ultra-accommodative stance, yield spreads remain heavily in favour of the dollar. Combined with stronger US growth and stable inflation, USD/JPY retains a bullish outlook despite short-term consolidation.

Fundamental Analysis

The United States economy is expanding robustly, with GDP growth at +3.0% QoQ and +2.0% YoY. Inflation remains moderate at 2.7% YoY and +0.3% MoM, well within the Fed’s target tolerance, and interest rates are set at 4.5% — among the highest in the developed world. Moreover, the favourable interest rates strongly support USD/JPY trends. The labour market is resilient, with unemployment at 4.2%, and the services sector continues to show expansion. While the US runs a sizeable trade and current account deficit, domestic demand and capital inflows remain strong, underpinned by a deep and liquid financial market.

Japan’s economic performance is comparatively weak. Quarterly GDP growth is flat, with annual growth at 1.7%. Inflation is slightly higher than the Bank of Japan’s target at 3.3% YoY, but monetary policy remains ultra-loose with interest rates at just 0.5%. The country maintains a trade surplus and a large current account surplus, but government debt is extremely high at 237% of GDP, limiting fiscal flexibility.

Sentiment Analysis

Market sentiment remains broadly supportive of USD/JPY, with speculative positioning still heavily skewed towards the dollar. The sentiment around USD/JPY is influenced by the macro narrative that the Fed will keep rates elevated for longer, while the BoJ will be slow to normalise policy. Japanese institutional investors continue to allocate capital abroad, maintaining upward pressure on USD/JPY through capital outflows. Risk sentiment has also been favourable for carry trades, further boosting demand for the pair.

Technical Analysis

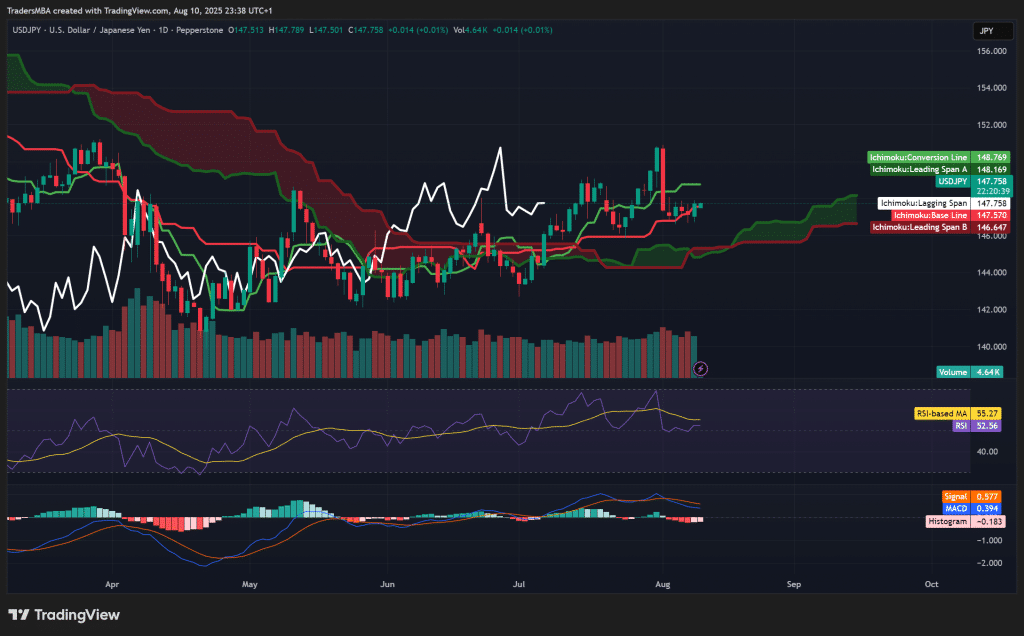

The daily Ichimoku Cloud shows USD/JPY trading just above the cloud base, with the Conversion Line slightly above the Base Line — an early bullish signal. The Lagging Span is at price level, indicating that momentum is in the early stages of building. RSI is at 52.56, pointing to neutral-to-bullish momentum with room to climb before becoming overbought. MACD is marginally positive, with the histogram close to zero, signalling a potential new bullish leg. Volume is steady, lacking a breakout surge but showing no signs of selling pressure. A daily close above 148.70 would provide technical confirmation for the next upward push. However, USD/JPY technical signals need close monitoring for possible shifts.

Conclusion

With the US economy continuing to outpace Japan’s and interest rate differentials remaining firmly in the dollar’s favour, USD/JPY’s long bias is well-supported by both fundamentals and sentiment. While technicals suggest the pair is in a consolidation phase, fluctuations in USD/JPY could be significant. A break above 148.70 would likely trigger fresh momentum buying, potentially taking the pair towards the 150.00 level in the short term.