Long USD/JPY: US Strength Versus Japan’s Ultra-Loose Policy

Introduction

USD/JPY continues to be one of the most fundamentally divergent major currency pairs in 2025. The United States benefits from strong GDP growth, resilient labour markets, and high interest rates, while Japan remains committed to ultra-loose monetary policy despite moderate inflation. This policy gap, combined with positive US sentiment and supportive technical conditions, underpins the long bias for USD/JPY.

Fundamental Analysis

The macro landscape strongly favours USD over JPY, highlighting the dynamics in the USD/JPY pair:

- GDP Growth: US GDP expanded by 3% QoQ and 2% YoY, outperforming Japan’s modest 0.3% QoQ and 1.2% YoY.

- Inflation: US inflation stands at 2.7% YoY, near the Fed’s target; Japan’s is slightly higher at 3.3%, but the BoJ has kept policy accommodative.

- Interest Rates: The Fed holds rates at 4.5%, while the BoJ maintains an ultra-low 0.5%, creating a significant carry advantage for USD.

- Employment: US unemployment is 4.2%, while Japan’s is lower at 2.5%, but wage growth remains subdued in Japan.

- Trade Balance: US posts a large deficit (-$60.18B), while Japan runs a small surplus; however, the yield differential outweighs trade effects in FX pricing.

- Fiscal Position: US debt is high at 124% GDP with a -6.2% budget balance; Japan’s debt is extreme at 237% GDP, raising long-term sustainability concerns.

Sentiment Analysis

Investor positioning and narratives remain USD-supportive, particularly for the USD/JPY currency pair:

- Positioning: Global macro funds continue to hold net long USD/JPY positions to exploit the interest rate differential.

- Macro Narrative: Markets expect the Fed to keep rates elevated for longer, while the BoJ stays dovish, preserving the yield gap.

- Yield Curve Expectations: US curve remains steep in the front end compared to Japan, supporting carry trades.

- Geopolitical Overlay: Rising energy import costs and a weaker yen’s impact on consumer sentiment weigh on Japan.

Technical Analysis

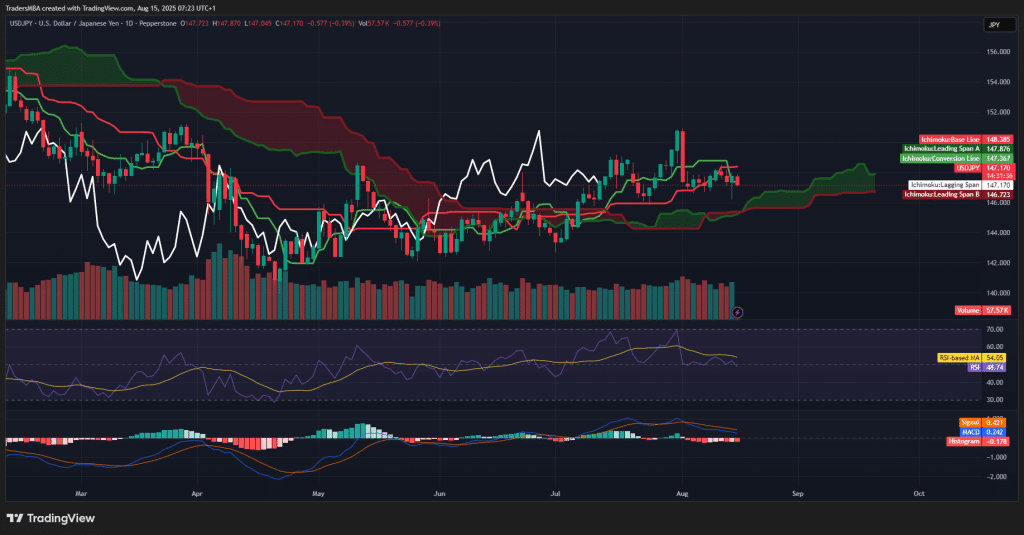

The daily chart shows consolidation within an uptrend for USD/JPY:

- Ichimoku Cloud: Price is just above the cloud; conversion and base lines near current price indicate support at ~146.7.

- RSI: Neutral at 48.7, suggesting consolidation before the next leg higher.

- MACD: Slightly negative histogram but close to a potential bullish turn if price rebounds from support.

- Volume Trends: Volume easing during pullbacks, consistent with corrective rather than reversal price action.

- Multi-Timeframe View: Weekly structure shows higher lows and higher highs; monthly chart remains bullish above the 144 support zone.

Conclusion

USD/JPY remains a compelling long trade driven by the pronounced US-Japan policy divergence and persistent yield advantage. With macro fundamentals, sentiment, and higher timeframe structures aligned, the current consolidation may offer an opportunity to enter ahead of a potential push above 148.4. Traders should watch 146.7 as key support and target a retest of 150+ in the medium term, particularly emphasising USD/JPY due to these dynamics.