Short EUR/USD: A High-Conviction Macro Break

Introduction

The euro–dollar cross has entered a decisive macro and technical inflection point. With the United States maintaining superior growth momentum, firmer inflation dynamics and a higher-for-longer Federal Reserve stance, the fundamental gap versus a softening euro area has widened materially. Sentiment indicators reinforce the structural divergence: EUR/USD remains one of the weakest-ranked pairs in the model, and the technical structure has now transitioned into early-stage bearish reversal conditions on the monthly timeframe. Together, these dynamics position EUR/USD for a renewed downside cycle aligned with broader macro flows.

Fundamental Analysis

The euro area continues to experience fragile output, persistent disinflation and a sustained loss of economic momentum. Services activity is soft, manufacturing remains contractionary, and confidence indicators continue to signal a cautious consumer environment. The ECB’s guidance has moved incrementally dovish as inflation decelerates, and the region’s fiscal backdrop remains uneven and structurally restrictive. Conversely, the US economy retains considerable cyclical strength. GDP growth is resilient, labour markets remain tight and underlying inflation pressures have not decelerated as quickly as expected. With consumption healthy and forward indicators firm, the Federal Reserve’s policy stance remains materially tighter than that of the ECB. The rate and growth differential continues to anchor USD strength and EUR downside.

Sentiment Analysis

EUR/USD registers one of the strongest negative readings across the sentiment model, reflecting deep alignment between retail positioning, COT futures, yield spreads, momentum structure and prevailing macro narratives. The –70 score highlights a confluence of bearish trend participation, persistent supply in rallies and a sustained yield advantage favouring the USD. News flow is broadly supportive of dollar resilience, while geopolitical risk continues to bias flows toward the US. Cross-asset risk indicators show a tilt toward defensiveness, which historically supports USD over EUR.

Technical Analysis

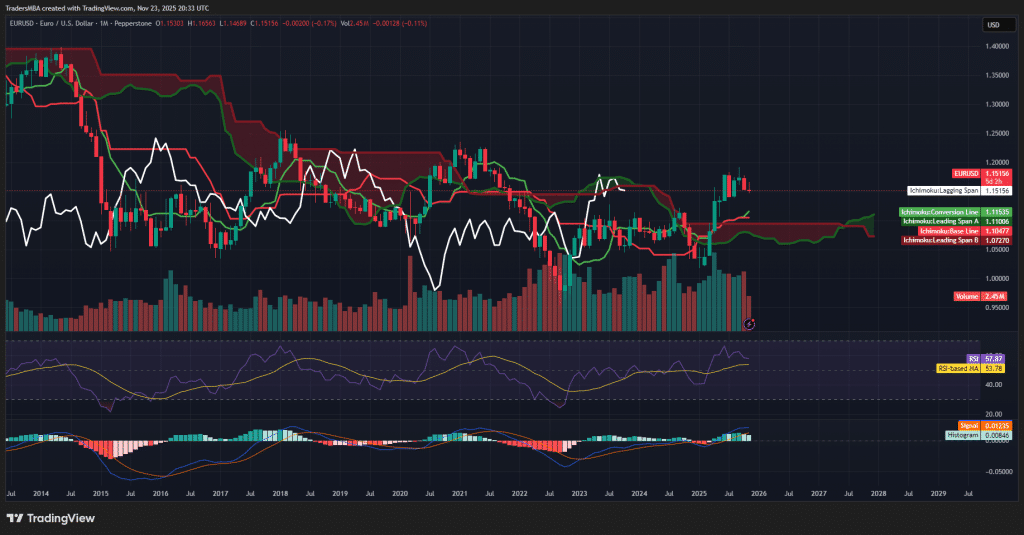

The monthly chart signals a clear bearish rotation. Price has rolled over beneath the Ichimoku Conversion Line while the Base Line has begun acting as dynamic resistance. The future cloud is thin, flat and structurally weak, providing minimal support. The Lagging Span has slipped beneath price and cloud, creating full-system alignment for downside continuation. RSI has turned lower from the upper-mid range, confirming momentum exhaustion, while MACD is approaching a bearish cross with a declining histogram. Volume flows reinforce the picture: recent rallies occurred on diminishing participation, while prior bearish impulses saw stronger selling pressure. Key structural resistance at 1.15–1.16 has been rejected, and the next major downside areas sit around 1.08 and 1.05.

Conclusion

EUR/USD displays one of the cleanest multi-factor downside structures across G10 FX. The fundamental divergence between the US and euro area is widening, sentiment is deeply aligned with renewed bearish pressure, and the technical profile confirms an early-stage reversal with strong continuation potential. The combination of macro strength, yield advantage and technical confirmation positions short EUR/USD as the highest-conviction opportunity in the current landscape.