Short GBP/USD: Weak UK Fundamentals vs Strong US Economy

Introduction

The GBP/USD pair is facing renewed downside pressure as the UK economy struggles with sluggish growth and fiscal risks, while the US maintains resilient economic momentum. With inflation gradually easing in both economies, divergent fundamentals, sentiment, and technical indicators increasingly favour a bearish outlook for GBP/USD.

Fundamental Analysis

The UK economy continues to show limited growth, with sticky inflation still above the Bank of England’s target and persistent fiscal imbalances weighing on sterling. While the BoE remains cautious, it is constrained by fragile growth conditions. In contrast, the US economy is expanding at a steady pace, supported by robust GDP growth and labour market strength. The Federal Reserve is taking a measured approach to policy easing, reinforcing dollar support. Safe-haven demand for the USD further strengthens its outlook.

Sentiment Analysis

Positioning data highlights an extreme long bias among retail traders in GBP/USD, with sentiment readings at +45. This contrarian signal implies downside pressure on the pair, as markets are often poised to move against crowded positioning. COT data also supports a stronger USD stance, reflecting institutional flows into dollar assets. Combined with the divergence in macro fundamentals, sentiment clearly aligns with a short trade bias.

Technical Analysis

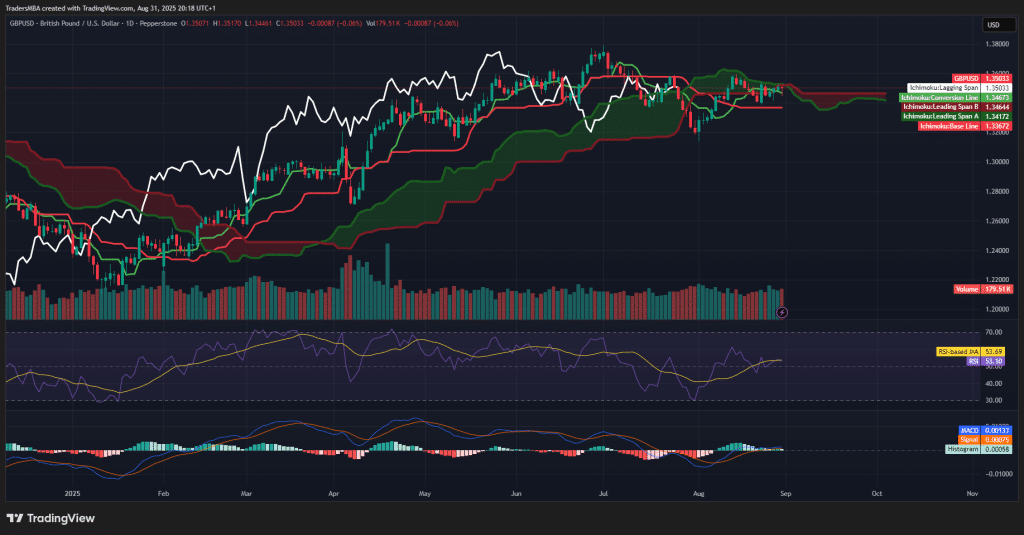

GBP/USD price action has softened, with the pair testing the top of the Ichimoku cloud and showing limited momentum to break higher. The lagging span remains flat, suggesting reduced bullish conviction. RSI sits at a neutral 53, offering no upward momentum signals. MACD is flat around the zero line, reinforcing the lack of trend strength. Key resistance is at 1.3550, while support is located at 1.3350. A break below this support zone could accelerate further downside.

Conclusion

The bearish case for GBP/USD is underpinned by macroeconomic divergence, contrarian sentiment, and weakening technical momentum. With the UK economy facing headwinds while the US maintains resilience, the path of least resistance remains lower for sterling against the dollar. Short positions in GBP/USD appear well supported in the current environment.