Stock Market Meltdown: Tech Sell-Off and Recession Fears Shake Global Markets

Stock markets faced a brutal sell-off today as investors grappled with mounting fears of a U.S. recession, escalating trade tensions, and a sharp downturn in technology stocks. The heavy losses sent shockwaves across global financial markets, triggering concerns about the broader economic outlook.

Wall Street’s Worst Day of the Year

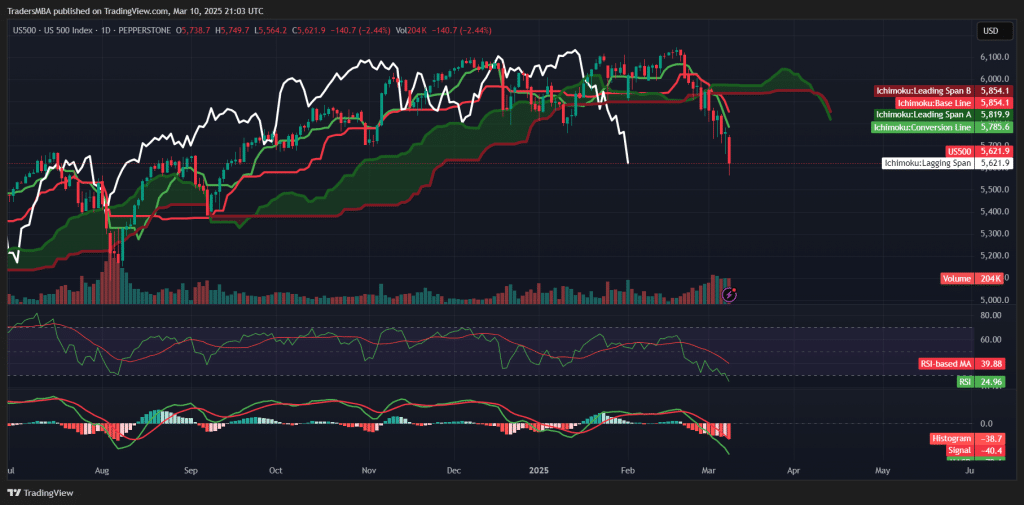

The major U.S. stock indices suffered significant declines, with the S&P 500 plunging 2.7%, marking its worst performance of the year. The Dow Jones Industrial Average tumbled 2.1%, shedding nearly 900 points, while the Nasdaq Composite nosedived 4%, dragged down by a steep sell-off in high-valuation technology stocks. Investors in the stock market were clearly unsettled by these developments.

Recession Fears Grip Investors

Investor sentiment took a major hit following comments from President Donald Trump, who acknowledged the possibility of a recession but referred to the economic situation as a “transition phase.” This uncertainty intensified worries over the potential fallout from ongoing trade tensions and the impact of tariffs. Recent economic data showing a slowdown in consumer spending and manufacturing activity added fuel to the fire, raising red flags about the overall health of the U.S. economy. The stock market reflected these concerns with significant volatility.

Tech Stocks Crushed

The technology sector was at the heart of today’s market carnage, suffering some of its worst losses in months.

- Tesla shares plummeted 15.4%, now trading at more than 50% below their December highs

- Nvidia dropped 5.1%, as investors took profits on its meteoric rise

- Apple, Microsoft, and Amazon all fell by approximately 5%, erasing billions in market value

The sell-off in tech stocks was driven by concerns over stretched valuations, rising interest rates, and slowing growth in key markets. The impact on the stock market was significant and widespread.

Global Markets React

The turmoil was not confined to Wall Street. European stocks fell sharply, with Germany’s DAX sliding 1.7%, while the Stoxx Europe 600 index lost 1.3%. Asian markets also took a hit, as China’s CSI 300 dropped 0.4%, and Hong Kong’s Hang Seng index fell 1.9%, following China’s decision to impose retaliatory tariffs on U.S. goods. The influence of the U.S. stock market was felt worldwide.

Investors Rush to Safe Havens

With risk appetite evaporating, investors rushed into safe-haven assets. The 10-year U.S. Treasury yield dropped to 4.22%, reflecting heightened demand for government bonds. Meanwhile, the VIX volatility index surged, reaching its highest level since mid-December, signalling growing market anxiety. The stock market volatility pushed investors to seek safety.

What’s Next?

The sell-off has left investors on edge, with market participants closely monitoring economic data and policy developments. If recession fears persist and trade tensions escalate further, the volatility seen today could be just the beginning of a more prolonged market downturn in the stock market.

For those looking to navigate volatile markets effectively, Traders MBA offers comprehensive courses on trading strategies and market analysis. Stay ahead of the curve and sharpen your skills to make informed decisions in uncertain times.