USD/CAD Weakens as Canadian Fundamentals Outperform

Introduction

The USD/CAD pair is under pressure as diverging fundamentals weigh on the US dollar and support the Canadian dollar. Despite strong headline growth in the US, underlying imbalances, including persistent twin deficits and weakening consumer confidence, have eroded sentiment. In contrast, Canada’s stable growth, contained inflation, and moderate fiscal position create a stronger macro backdrop for CAD. Technical signals suggest further downside risk for USD/CAD, aligning with macro and sentiment models that favour short positioning.

Fundamental Analysis

The US economy continues to post impressive GDP growth, with quarterly expansion of 3.0% and annual growth of 2.0%. However, structural weaknesses persist. Inflation at 2.7% remains above the Federal Reserve’s target, but recent monthly prints suggest softening momentum. The Fed’s policy rate is steady at 4.5%, yet market expectations point towards easing as 2025 progresses. Fiscal metrics present a major challenge, with debt at 124% of GDP, a fiscal deficit of –6.2%, and a current account deficit of –3.9% of GDP. These imbalances weigh heavily on USD valuation despite growth outperformance.

Canada presents a more balanced outlook. Quarterly GDP grew 0.5%, annual growth stands at 2.3%, and inflation is contained at 1.9% — close to the Bank of Canada’s target. Policy rates remain moderately restrictive at 2.75%, and the current account deficit is limited to –1.0% of GDP. Debt is high at 111%, but fiscal slippage is smaller than in the US. Business confidence has improved, and retail sales are recovering. Overall, the Canadian economy offers more balanced fundamentals than the US, supporting CAD’s relative appeal.

Sentiment Analysis

COT data shows net short positioning in USD, reflecting broader bearish sentiment. Speculative demand has rotated towards higher-yielding or structurally stronger currencies such as CAD. Retail positioning remains skewed, with traders heavily long USD/CAD, creating contrarian risk for further downside. Yield spreads are modestly supportive of CAD, with lower inflation and a more credible fiscal trajectory underpinning investor confidence. Risk appetite across global markets remains constructive, reducing demand for the dollar as a safe-haven.

Price momentum also reflects CAD outperformance. Over recent weeks, USD/CAD has struggled to sustain rallies above 1.38, with repeated rejections reinforcing bearish bias. Sentiment indicators highlight that the dollar is losing traction against commodity-linked currencies as global trade flows stabilise.

Technical Analysis

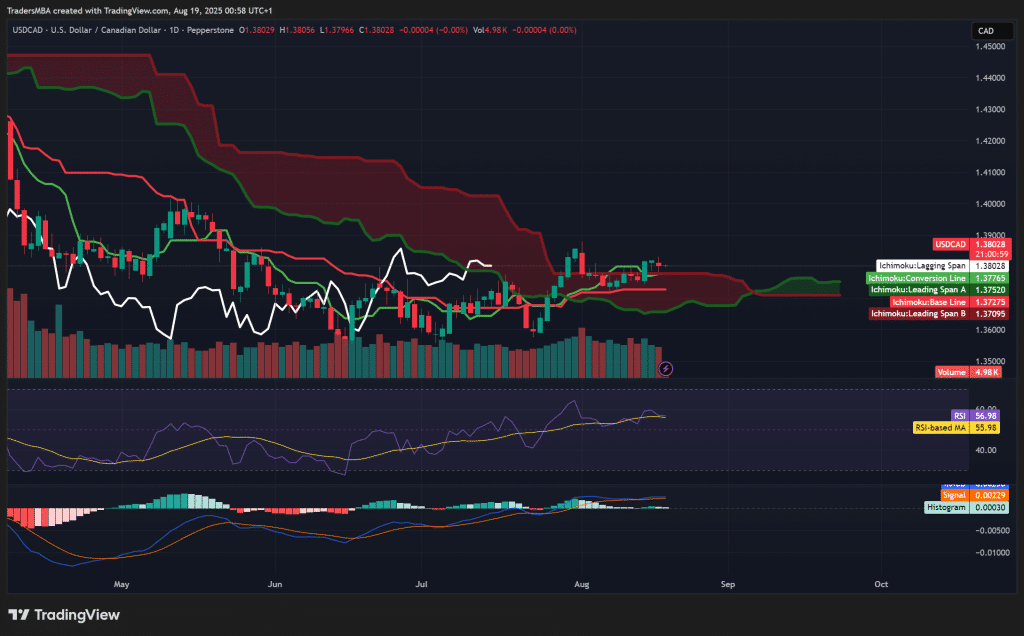

The USD/CAD daily chart reveals a neutral-to-bearish setup. Price trades near 1.3800, sitting on the edge of the Ichimoku Cloud. The base line at 1.3727 and conversion line at 1.3776 sit below price, suggesting limited bullish momentum. The cloud overhead acts as resistance, reinforcing downside potential. RSI at 57 is neutral, but momentum indicators show fading strength. The MACD is flat, with the histogram barely positive, pointing to a lack of conviction. Volume has declined, suggesting that rallies are being sold into rather than accumulated.

Key resistance sits at 1.3850, while support lies at 1.3720. A clear breakdown below 1.3720 would confirm bearish continuation, opening the path towards 1.3650 in the near term. Traders should monitor volume on breakdowns, as a pickup in selling pressure would provide strong confirmation.

Conclusion

USD/CAD faces pressure from both macroeconomic fundamentals and sentiment positioning. While the US economy retains headline strength, deep fiscal and external imbalances undermine dollar stability. Canada, by contrast, offers a more balanced mix of growth, inflation control, and moderate deficits. Sentiment indicators highlight bearish bias for USD/CAD, and technical analysis points towards downside risks if key support levels break. A sustained move below 1.3720 would reinforce the bearish outlook, with targets extending to 1.3650–1.3600. The bias remains firmly short USD/CAD.