USD/CHF Outlook: Dollar Momentum Extends as Swiss Franc Softens

Introduction

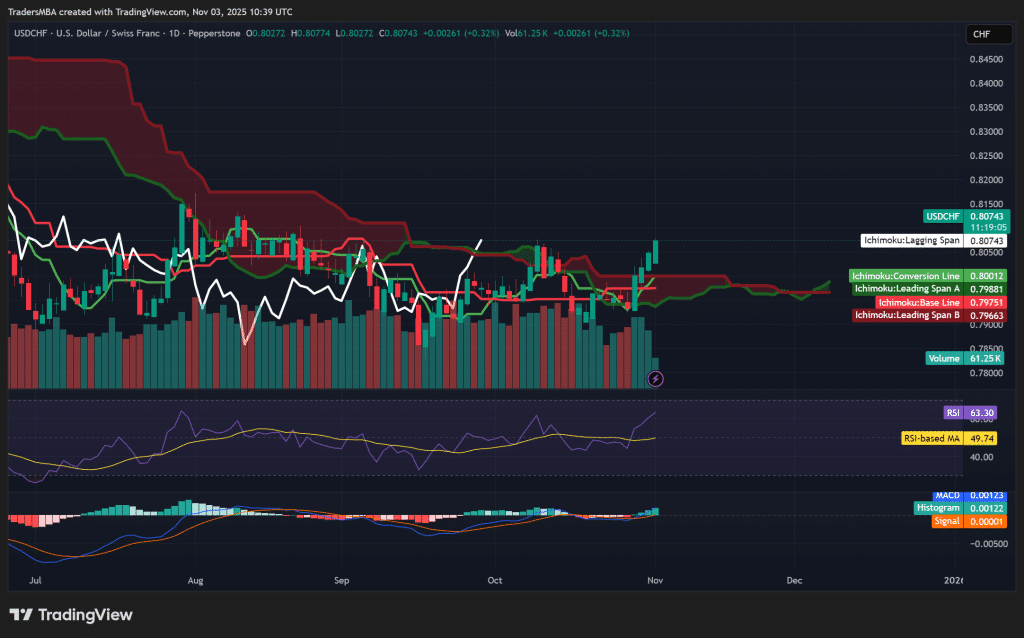

The USD/CHF pair continues its bullish trajectory as the U.S. dollar strengthens on resilient macroeconomic data and firm Federal Reserve policy expectations. Recent price action shows a clear breakout above the Ichimoku Cloud, confirming upward momentum. Meanwhile, the Swiss franc’s traditional safe-haven appeal has faded amid improving global risk sentiment, allowing the dollar to regain dominance. This analysis examines the fundamental, sentiment, and technical forces driving the next move in USD/CHF, including precise trade parameters.

Fundamental Analysis

The U.S. economy remains notably strong, posting 3.8% quarterly GDP growth with steady inflation around 3%. The labour market continues to display resilience, and retail spending remains firm. These conditions support the Federal Reserve’s “higher-for-longer” stance, anchoring the U.S. dollar at elevated levels.

In contrast, Switzerland’s inflation rate sits near zero, with GDP growth softening and the SNB maintaining a neutral tone. While the Swiss franc’s fiscal and current account surpluses remain healthy, the yield differential against the USD continues to widen, sustaining upward pressure on USD/CHF.

Sentiment Analysis

Sentiment indicators mirror the bullish narrative. COT data shows rising long exposure to the dollar, while retail traders remain net short—often a contrarian buy signal. Geopolitical calm and risk-on sentiment further dampen franc demand. Yield spreads, positioning, and momentum all point toward continued USD favouritism, making dips in USD/CHF attractive buying opportunities within the current cycle.

Technical Analysis

USD/CHF has confirmed a bullish breakout above the Ichimoku Cloud, signalling a strong uptrend. The conversion line (0.8001) and base line (0.7975) remain supportive, while the lagging span leads price higher. RSI sits at 63.3, showing bullish strength without overbought conditions. The MACD histogram expands positively, indicating reinforced upward momentum.

Entry; 0.8040 (on minor pullback)

Stop-Loss: 0.7960 (below the Kijun and recent support)

Take-Profit Target 1: 0.8150 (recent swing resistance)

Take-Profit Target 2: 0.8220 (projected measured move)

A sustained close above 0.8100 would confirm trend continuation, while a drop below 0.7960 would invalidate the setup.

Conclusion

USD/CHF offers a technically and fundamentally aligned long setup. The dollar’s yield advantage, resilient U.S. data, and broad franc softness provide solid backing for continued upside. With the pair trading above the Ichimoku Cloud and supported by positive sentiment, pullbacks remain buying opportunities.

Trade Plan Summary:

Bias: Long USD/CHF

Entry: 0.8040

Stop-Loss: 0.7960

Targets: 0.8150 / 0.8220

Overall bias: Bullish (medium-high conviction) – expect a continuation of the uptrend as long as the pair holds above 0.8000.