USD/JPY Long Trade: Momentum Builds

Introduction

USD/JPY remains a key macro and technical focus. With the Federal Reserve maintaining a hawkish stance while the Bank of Japan holds ultra-loose monetary policy, yield differentials continue to support the dollar against the yen. Technicals show consolidation just under resistance, setting up a potential breakout. This alignment of fundamentals, sentiment, and chart structure makes USD/JPY an attractive long trade candidate.

Fundamental Analysis

The US economy remains robust with strong GDP growth, resilient labour markets, and sticky inflation above target. The Fed’s “higher for longer” guidance underpins Treasury yields, keeping USD demand intact. Conversely, Japan faces weak growth, rising debt, and persistent deflationary pressures. The BoJ remains committed to accommodative policy, anchoring yields near zero. This divergence sustains upward momentum for USD/JPY.

Sentiment Analysis

Positioning shows retail traders heavily short on USD/JPY, a contrarian bullish signal. COT data highlights continued yen net-longs, leaving USD positioning relatively light, which favours further upside. Yield spreads, market momentum, and geopolitical demand for USD strengthen the case for higher levels.

Technical Analysis

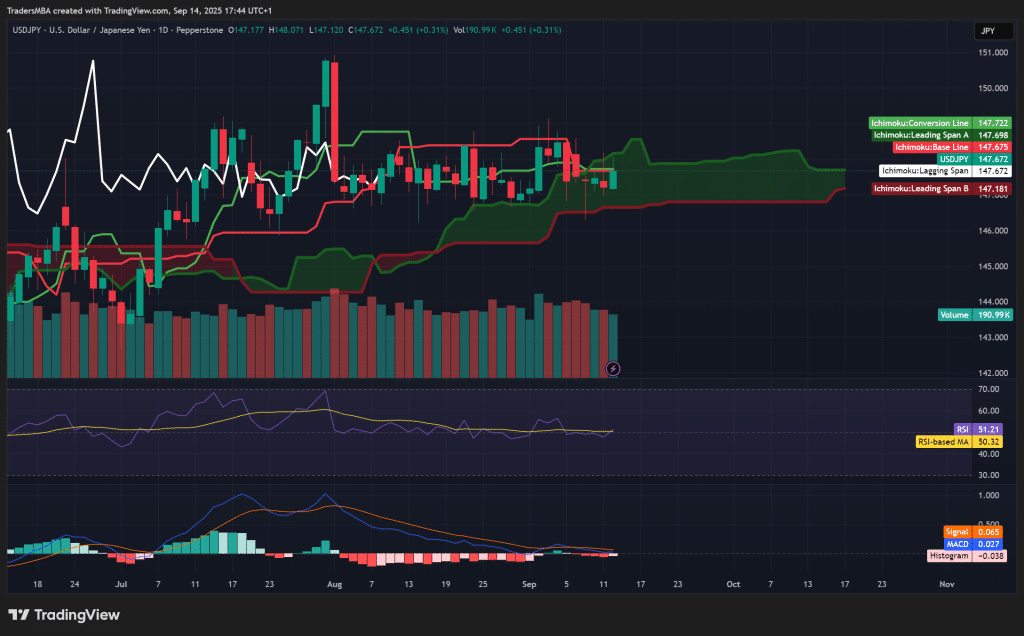

USD/JPY trades within the Ichimoku cloud, pressing against resistance around 147.7. A breakout above this zone would confirm bullish continuation toward 149.0–150.0. RSI at 51 signals neutral positioning, leaving room for upside. MACD is turning positive, suggesting momentum shift. Volume remains steady, indicating market participation is supportive of a breakout. Key support sits at 146.8.

Conclusion

The USD/JPY setup combines strong macro divergence, bullish sentiment, and a near-term technical breakout opportunity. As long as the pair holds above 146.8 and clears 147.7, the outlook favours continuation higher toward 149.0 and beyond. The risk/reward balance remains favourable for long positions.