USD/JPY Poised for Renewed Upside

Introduction

The divergence between US and Japanese monetary policy continues to define the USD/JPY outlook. With the Federal Reserve maintaining restrictive interest rates and the Bank of Japan persisting with ultra-loose policy, the pair remains skewed higher. Recent consolidation above support suggests USD/JPY could be preparing for another upward leg.

Fundamental Analysis

The US economy shows robust momentum, with strong GDP growth, resilient services PMI, and a tight labour market. Inflation has eased but remains above target, justifying the Fed’s restrictive stance.

Japan faces weak growth, mounting fiscal challenges, and entrenched ultra-accommodative monetary policy. Yield curve control caps domestic yields, leaving the yen vulnerable against higher-yielding currencies.

Sentiment Analysis

COT positioning indicates speculative shorts remain heavy on the yen. Retail sentiment skews long USD/JPY, yet institutional flows favour further USD strength. Risk sentiment remains mixed globally, but carry trades continue to support the dollar over the yen. Momentum and positioning both lean bullish.

Technical Analysis

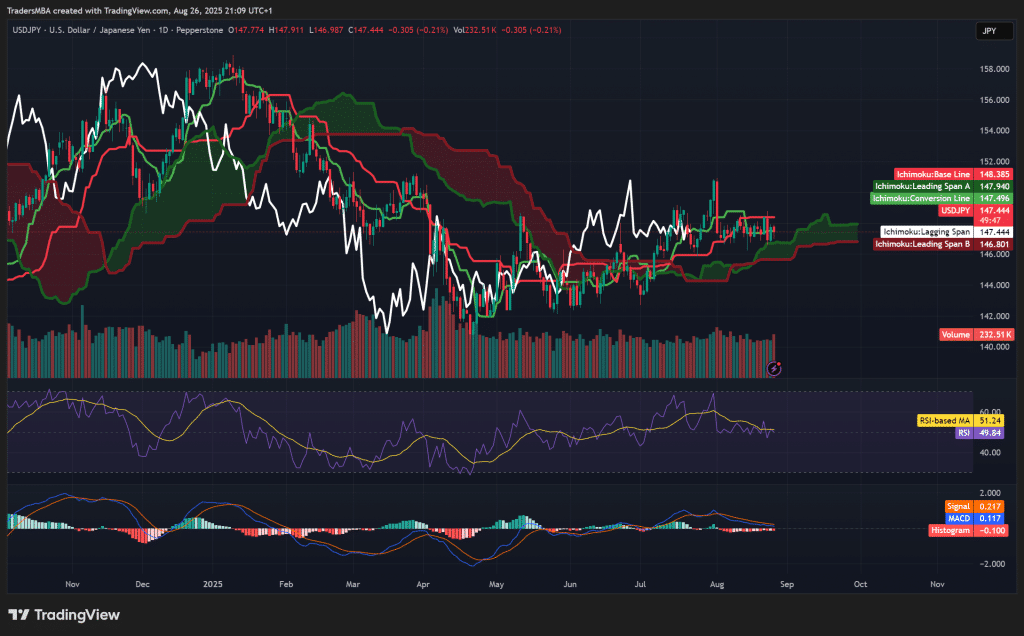

USD/JPY is holding firm above key Ichimoku cloud support near 146.8. RSI sits around 50, stabilising after recent pullbacks, while MACD signals a potential bullish crossover. Price action suggests consolidation before a breakout higher. Buying pressure on upticks indicates strong underlying demand.

Conclusion

Macro fundamentals, sentiment, and technicals all align in favour of renewed USD/JPY upside. With the Fed remaining restrictive and the BoJ anchored to ultra-loose policy, the yield differential should continue to drive the pair higher. Traders may look for opportunities to ride the next leg up.