USD/JPY Surges as Yield Gap Powers Dollar Strength

Introduction

USD/JPY continues to trade firmly as the divergence between the Federal Reserve’s restrictive stance and the Bank of Japan’s ultra-loose policy sustains upward momentum. With robust U.S. economic data and higher Treasury yields contrasting Japan’s weak fundamentals, the pair remains biased to the upside. Technical indicators also confirm bullish potential, strengthening the case for further gains in the USD/JPY exchange rate.

Fundamental Analysis

The U.S. economy is outperforming with resilient GDP growth, low unemployment, and sticky inflation. This supports the Fed’s restrictive stance, keeping yields elevated. In contrast, Japan faces weak trade balances, high public debt, and negative real yields. The BoJ continues with its accommodative framework, widening the yield gap in favour of the dollar, thereby affecting USD/JPY positioning.

Sentiment Analysis

Market positioning shows continued demand for USD while JPY remains one of the weakest currencies. COT data confirms speculative selling of the yen, while retail traders show persistent attempts to countertrend the rally. Cross-asset risk sentiment also favours the USD in the USD/JPY pair, with geopolitical concerns driving safe-haven flows more towards the dollar than the yen.

Technical Analysis

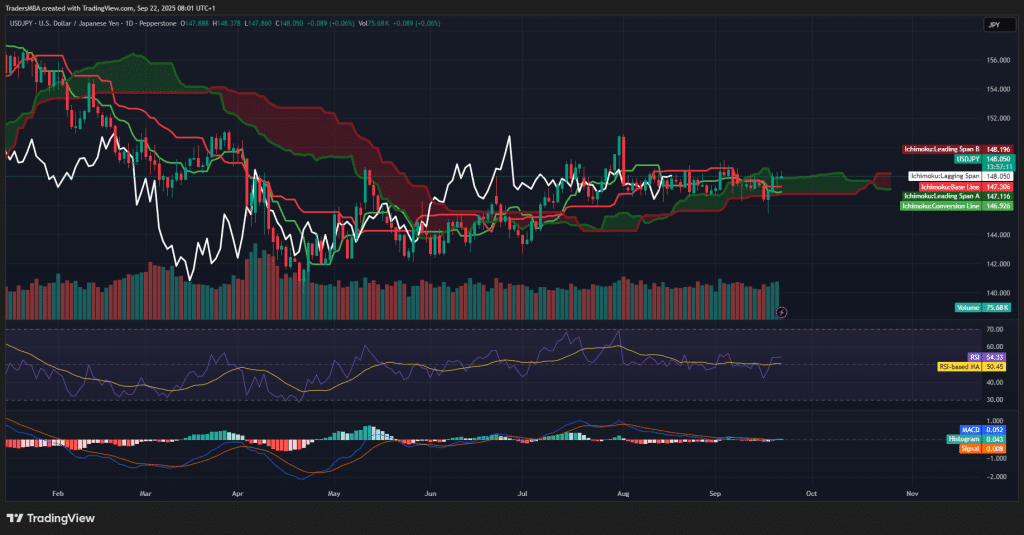

Ichimoku Cloud analysis shows price comfortably above the Kumo, reinforcing bullish structure. RSI sits at 54, leaving room for further upside without overbought conditions. MACD momentum remains positive, supported by a steady volume profile. Key support lies at 147.0 for USD/JPY, with resistance targeted near 149.5. A break higher opens potential for a retest of the 152.0 zone.

Conclusion

The combination of strong U.S. fundamentals, dovish BoJ policy, bullish sentiment, and favourable technicals leaves USD/JPY positioned for further upside. Until Japan shifts policy materially, yield spreads will remain the decisive driver, underpinning dollar strength against the yen in the USD/JPY currency pair.