Forex Trading Course: The Complete Professional Guide

Introduction

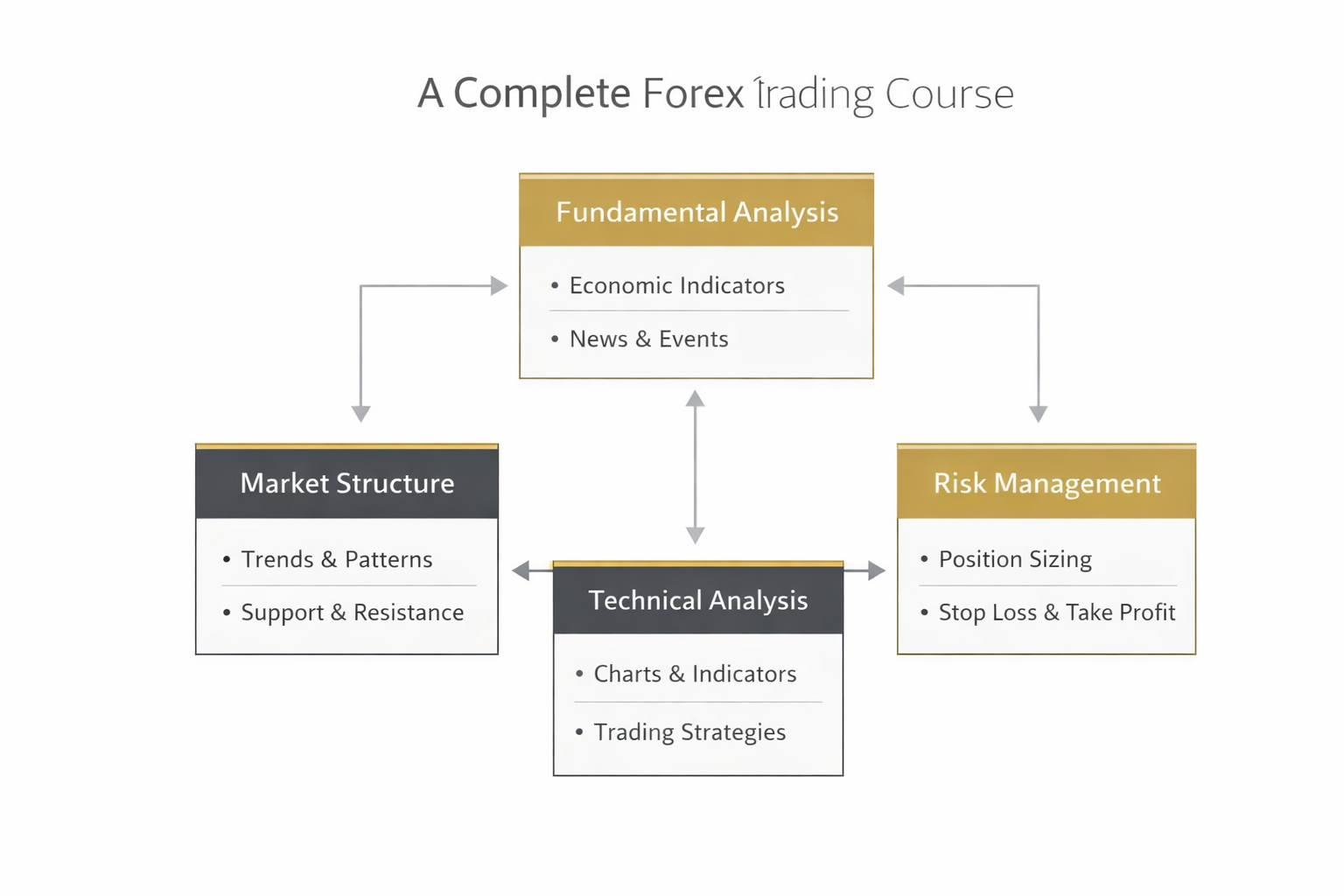

Forex trading course searches come from traders looking for a complete, structured way to learn how the foreign exchange market really works, not fragmented tips or isolated strategies. The best forex trading course explains market structure, analysis, execution, and risk management in a single professional framework that scales from beginner to advanced trader. This guide explains what a complete forex trading course includes, how professional traders use it, and how to evaluate the best online forex trading course objectively.

A forex trading course is a structured educational program that teaches how currency markets operate, how trades are analysed and executed, and how risk is managed across different market conditions.

What a Forex Trading Course Covers

A complete forex trading course is designed to move a learner from foundational understanding to professional decision-making.

First, it explains how the foreign exchange market functions, including liquidity, sessions, leverage, and pricing. This ensures traders understand why markets move, not just when to trade.

Second, it integrates analysis. This includes both fundamental analysis and technical analysis, allowing traders to align macro direction with precise trade execution.

Finally, it focuses on risk management and process. Without this layer, even the best forex trading course becomes theory rather than a usable trading framework.

Core Components of the Best Forex Trading Course

The best online forex trading course follows a clear, professional structure rather than a collection of disconnected lessons.

Market Structure and Currency Mechanics

A professional forex trading course explains how currencies are quoted, how spreads and liquidity vary by session, and how leverage affects risk. This foundation is essential for both beginner and advanced traders.

Fundamental Analysis in Forex Trading

Fundamental analysis explains medium- to long-term currency direction. A complete forex trading course teaches how interest rates, inflation, growth, and central bank policy influence currency valuation.

Professional frameworks reference data and guidance from institutions such as the International Monetary Fund, the Bank for International Settlements, and central banks including the Federal Reserve and the European Central Bank.

Technical Analysis and Trade Execution

Technical analysis is used to structure entries, exits, and risk. The best forex trading course focuses on market structure, trends, and key levels rather than indicator-heavy systems.

This approach allows traders to adapt across different market conditions, making it suitable for a full forex course rather than a single strategy.

Risk Management and Position Sizing

Risk management is the defining difference between amateur and professional trading. A complete forex trading course teaches position sizing, drawdown control, expectancy, and portfolio risk rather than focusing solely on win rates.

Beginner vs Advanced Forex Trading Courses

Not all forex trading courses serve the same purpose.

A forex trading course for beginners focuses on terminology, basic analysis, and execution mechanics. An advanced forex trading course builds on this by integrating macro context, scenario analysis, and trade portfolio construction.

The best forex trading course is designed to accommodate both levels, allowing traders to progress without changing frameworks.

How Professional Traders Use a Forex Trading Course

Professional traders do not use courses as signal services. Instead, they use them as decision-making frameworks.

A complete forex trading course teaches a repeatable workflow:

- Assess macroeconomic conditions

- Identify directional bias

- Structure trades technically

- Define risk and exposure

This process-based approach reflects how professional desks operate and is why institutional-style education remains relevant across market cycles.

What Makes the Best Online Forex Trading Course Different

The best online forex trading course stands out in three ways.

First, it integrates fundamentals, technicals, and risk management into a single workflow. Second, it explains why trades make sense, not just how to place them. Third, it avoids guarantees and focuses on probability, consistency, and discipline.

Courses that rely solely on tactics or indicators rarely perform well over time.

Common Mistakes When Choosing a Forex Trading Course

Many traders select a forex trading course based on marketing claims rather than structure.

Common mistakes include choosing a course that focuses only on short-term strategies, ignoring risk management, or promising unrealistic outcomes. A professional forex trading course is educational, not predictive.

Understanding these pitfalls helps traders identify the best forex trading course for long-term development.

Example: Applying a Complete Forex Trading Course Framework

Consider an environment where inflation is easing and growth is slowing. A professional framework taught in a complete forex trading course would evaluate how central banks might respond, how yield expectations adjust, and which currencies are likely to weaken or strengthen.

Technical analysis is then used to structure entries and exits, while risk management defines position size. This integrated process demonstrates how the best forex trading course translates theory into practice.

How to Evaluate the Best Forex Trading Course

When comparing forex trading courses, focus on structure rather than promises.

The best forex trading course clearly explains its methodology, covers fundamentals and technicals in depth, and places risk management at the core. It should also align with established macroeconomic frameworks used by global institutions and professional traders.

Internal resources such as a forex fundamentals guide or a risk management framework for traders reinforce this learning and strengthen long-term results.

Why a Forex Trading Course Is a Long-Term Investment

A forex trading course is not a shortcut. It is a long-term investment in understanding how markets function.

The best online forex trading course provides a structured foundation that remains relevant through changing volatility, liquidity, and policy regimes. Traders who complete a full forex course develop skills that compound over time rather than chasing isolated strategies.

FAQs

What does a complete forex trading course include?

A complete forex trading course includes market structure, fundamental analysis, technical analysis, trade execution, and risk management. The best courses also teach professional workflows, scenario analysis, and how macroeconomic data influences currency trends across different market conditions.

Is a forex trading course suitable for beginners?

Yes. A well-designed forex trading course starts with core concepts and progressively builds toward advanced analysis. This allows beginners to learn forex trading step by step while developing a framework that remains useful as experience grows.

How long does it take to complete a forex trading course?

Timeframes vary. Introductory forex trading courses may take several weeks, while a complete professional-level forex trading course often requires months to fully understand and apply the material consistently.

Can the best forex trading course guarantee profits?

No forex trading course can guarantee profits. However, the best forex trading course improves decision-making, risk control, and consistency, which are essential for sustainable performance in currency markets.

What defines the best online forex trading course?

The best online forex trading course integrates fundamentals, technical analysis, and risk management into a single structured framework. It prioritises probability, discipline, and process rather than signals or marketing claims.