NASDAQ Trading Masterclass

The NASDAQ Trading Masterclass is a structured educational programme focused on helping learners analyse and interpret the Nasdaq index within a professional market-analysis framework. Across 24 structured modules, the course examines macroeconomic regimes, sector dynamics, liquidity conditions, volatility cycles, earnings context, and behavioural factors that influence Nasdaq price behaviour. The emphasis is on analytical understanding, structured reasoning, and disciplined market interpretation rather than trade instruction, execution guidance, or outcome-based claims.

About This NASDAQ Trading Masterclass

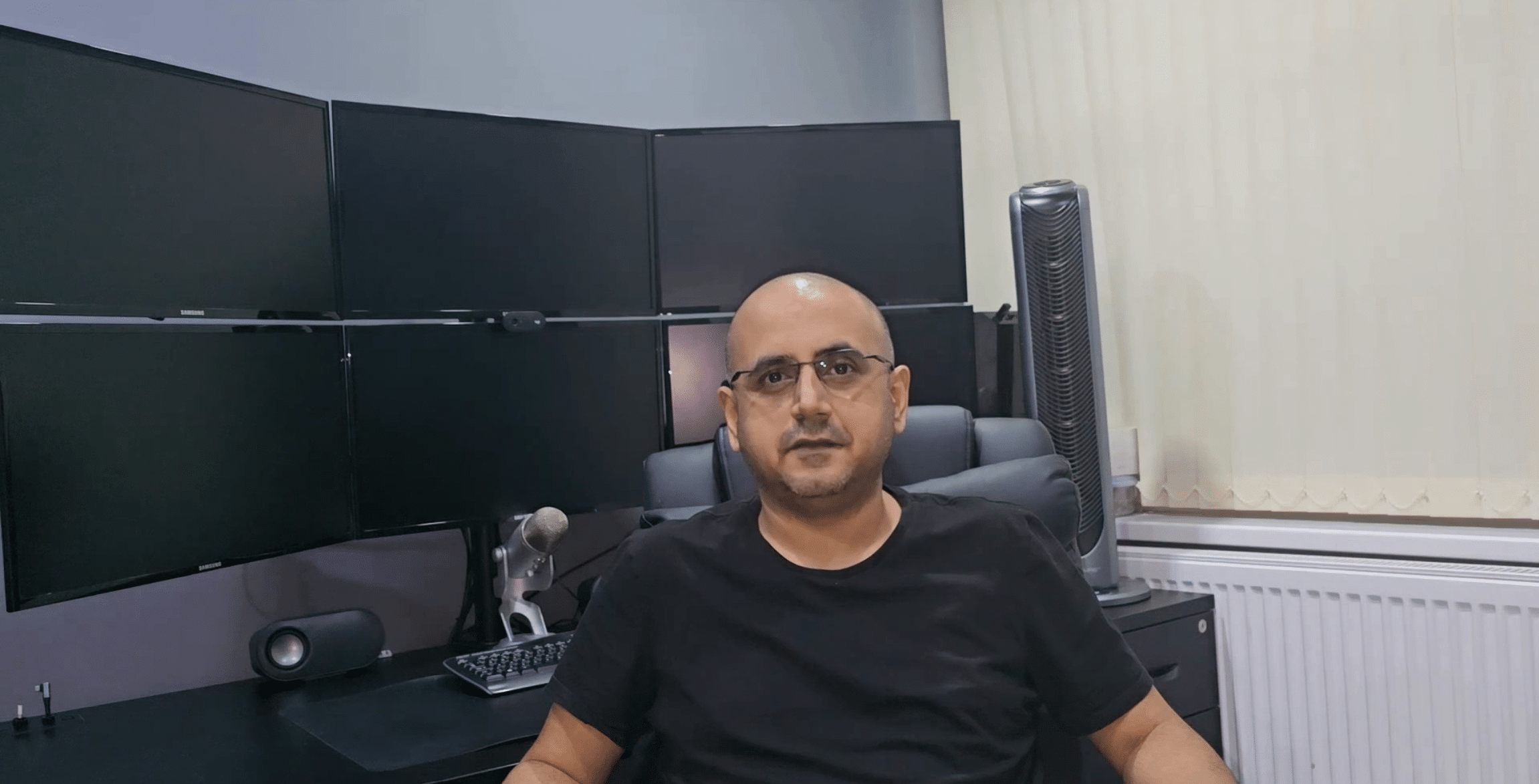

Built around 24 interconnected modules, this programme — created and presented by Sachin Kotecha — provides a comprehensive educational framework for understanding how the Nasdaq index behaves across different market environments. The curriculum covers macroeconomic context, technology-sector fundamentals, earnings dynamics, liquidity and volatility conditions, sentiment indicators, and cross-asset relationships. The course is educational in nature and focuses on analysis, context, and decision discipline rather than trading instruction or execution.

What You’ll Learn

Macro Regimes & Technology Cycles – Examine how interest rates, liquidity conditions, yields, and monetary policy are commonly associated with different Nasdaq market phases.

Nasdaq Structure & Market Composition – Understand the composition of the index and how large-cap technology stocks, growth sectors, and innovation themes contribute to index behaviour.

Earnings Cycles & Valuation Context – Explore how earnings seasons, revenue trends, margins, and valuation expectations are interpreted within Nasdaq analysis.

Sentiment, Positioning & Behavioural Factors – Learn how sentiment indicators and behavioural dynamics are analysed as part of broader market context.

Volatility, Liquidity & Market Structure – Review how volatility regimes, liquidity conditions, and market structure are assessed within index analysis.

Sector Rotation & Leadership Themes – Study how leadership can rotate across technology sub-sectors and how this is interpreted within market analysis.

Cross-Asset & Intermarket Context – Examine how yields, currencies, volatility measures, and broader risk conditions are used to contextualise Nasdaq behaviour.

Scenario Analysis & Market Frameworks – Develop structured approaches for forming and reviewing Nasdaq market scenarios using multiple analytical inputs.

How This Nasdaq Course Is Delivered

Each module is delivered through high-definition video lectures presented by Sachin Kotecha, using historical Nasdaq market phases, earnings periods, liquidity environments, and macroeconomic contexts as educational examples. Learners can progress at their own pace, revisit lectures as needed, and build a structured understanding of Nasdaq market behaviour.

Who This Course Is For

The NASDAQ Trading Masterclass is designed for individuals seeking a structured, educational approach to understanding the Nasdaq index. It is suitable for learners developing foundational market knowledge, participants refining analytical clarity, and professionals seeking a more systematic framework for index analysis.

Analytical Outcomes & Skills You’ll Develop

By completing this course, you’ll be able to:

- Analyse Nasdaq market behaviour using macroeconomic, earnings, liquidity, sentiment, and technical context.

- Interpret volatility regimes, sector dynamics, and leadership themes within a structured analytical framework.

- Assess cross-asset relationships and broader risk conditions as part of Nasdaq analysis.

- Apply disciplined scenario-based reasoning to market evaluation.

- Develop a repeatable analytical process for ongoing Nasdaq market interpretation.

Why Choose This Nasdaq Course

This programme is designed as an in-depth educational pathway for understanding the Nasdaq index through structured analysis rather than prediction or execution. It integrates macro context, sector insight, earnings interpretation, and behavioural analysis into a single coherent framework, supporting clearer and more disciplined market evaluation.

Frequently Asked Questions

Is this Nasdaq Trading Course suitable for beginners?

Yes — the programme begins with foundational concepts around index structure and market context before progressing to more advanced analytical frameworks.

Is it a video-based course?

Yes — all 24 modules are delivered through high-definition video lectures presented by Sachin Kotecha.

Who teaches this course?

It is created and presented by Sachin Kotecha.

How long does the course take?

The masterclass includes 24 structured modules, each approximately 20 minutes in length, and is fully self-paced.

Does the course include real Nasdaq case studies?

Yes — modules reference historical Nasdaq market phases, earnings cycles, liquidity environments, and macroeconomic conditions for educational illustration.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction To The NASDAQ Trading MasterclassA high-level overview of the full programme, outlining how the course works, what you’ll learn, and how the Nasdaq will be analysed through macro, sector, sentiment, liquidity, and technical frameworks to build professional-grade trading skill.1

- Module 1 – Introduction to Professional Nasdaq TradingA foundational overview of how professionals approach Nasdaq, what truly drives the index, and the mindset, structure, and analytical discipline needed for long-term success.1

- Module 2 – Structure of the Nasdaq Index and Market CompositionBreaks down the index’s construction, sector weights, mega-cap influence, and how structural concentration affects volatility, momentum, and price behaviour.1

- Module 3 – Understanding Macro Regimes and the Tech–Growth CycleExplains how macro conditions, liquidity cycles and growth/value rotations influence Nasdaq behaviour.1

- Module 4 – Monetary Policy, Bond Yields and System LiquidityShows how interest rates, yields and liquidity conditions directly impact risk appetite and Nasdaq price movement.1

- Module 5 – Earnings Cycles, Valuations and Growth DynamicsCovers earnings trends, valuation models and growth expectations that drive institutional positioning and index repricing.1

- Module 6 – Sentiment, Positioning and Behavioural Market FlowsExplores positioning data, sentiment indicators and behavioural biases that influence Nasdaq momentum.1

- Module 7 – Volatility Structure, Liquidity Conditions and MicrostructureBreaks down volatility regimes, liquidity pockets and microstructure dynamics that affect entries, exits and execution quality.1

- Module 8 – Sector Rotation, Leadership Themes and Relative StrengthShows how leadership rotates across tech, semiconductors, cloud, AI and biotech, signalling directional shifts.1

- Module 9 – Intermarket Analysis and Cross-Asset ConfirmationExplains how yields, the dollar, volatility indices and other markets confirm or challenge Nasdaq trade ideas.1

- Module 10 – Price Structure, Technical Triggers and Timing ConceptsCombines trend structure and technical triggers to identify high-probability timing windows on Nasdaq.1

- Module 11 – Constructing a Nasdaq Trading NarrativeTeaches how to build a clear, evidence-based trading narrative linking macro, sector and technical drivers.1

- Module 12 – Validating a Nasdaq Thesis With EvidenceShows how to confirm a trade thesis using price action, sentiment alignment, catalysts and intermarket signals.1

- Module 13 – Risk/Reward Logic, Asymmetry and Index VolatilityFocuses on structuring asymmetric trades, managing volatility and sizing positions for index trading.1

- Module 14 – Scenario Planning, Macro Sensitivity and Probabilistic ThinkingDevelops professional scenario-mapping skills to assess bullish, bearish and neutral outcomes.1

- Module 15 – Macro–Technical Confluence for Nasdaq TradingTeaches how to combine macro drivers with technical structure to generate high-conviction setups.1

- Module 16 – Event-Driven Nasdaq Trading: CPI, FOMC, Earnings and GeopoliticsCovers how major events affect Nasdaq and how to navigate event-driven volatility safely and strategically.1

- Module 17 – Playbook Patterns and High-Probability Nasdaq SetupsIntroduces repeatable institutional patterns, volatility behaviours and high-probability setups.1

- Module 18 – Identifying Market Inefficiencies and Structural EdgesShows how to detect mispricings, liquidity imbalances and sentiment extremes that create opportunity.1

- Module 19 – Execution Models, Order Flow and Trade ManagementExplains institutional execution styles, order flow interpretation and best-practice trade management.1

- Module 20 – Journaling, Review Systems and Continuous ImprovementBuilds a structured journaling and performance review system for long-term professional development.1

- Module 21 – Building a Professional-Grade Nasdaq WatchlistTeaches how to build and maintain a daily Nasdaq watchlist combining macro, sector, volatility and technical inputs.1

- Module 22 – Multi-Input Synthesis and Full-Stack Nasdaq Thesis ConstructionShows how to merge macro, sentiment, liquidity, earnings and technical data into one cohesive thesis.1

- Module 23 – Advanced Institutional-Style Nasdaq Trading TechniquesExplores advanced institutional tools including regime filters, volatility-adjusted positioning and execution logic.1

- Module 24 – Final Integration and the Professional Nasdaq Trading BlueprintPulls all concepts together into a complete, repeatable framework for professional Nasdaq trading.1

- NASDAQ Trading Masterclass ExamThe Exam tests your understanding of all 24 modules of the NASDAQ Trading Masterclass, covering macro regimes, sector rotation, liquidity flows, sentiment dynamics, volatility structure, and professional Nasdaq trade execution. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your learning and earn your personalised course completion certificate.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1