Why Most Trading Courses Fail to Create Consistent Traders

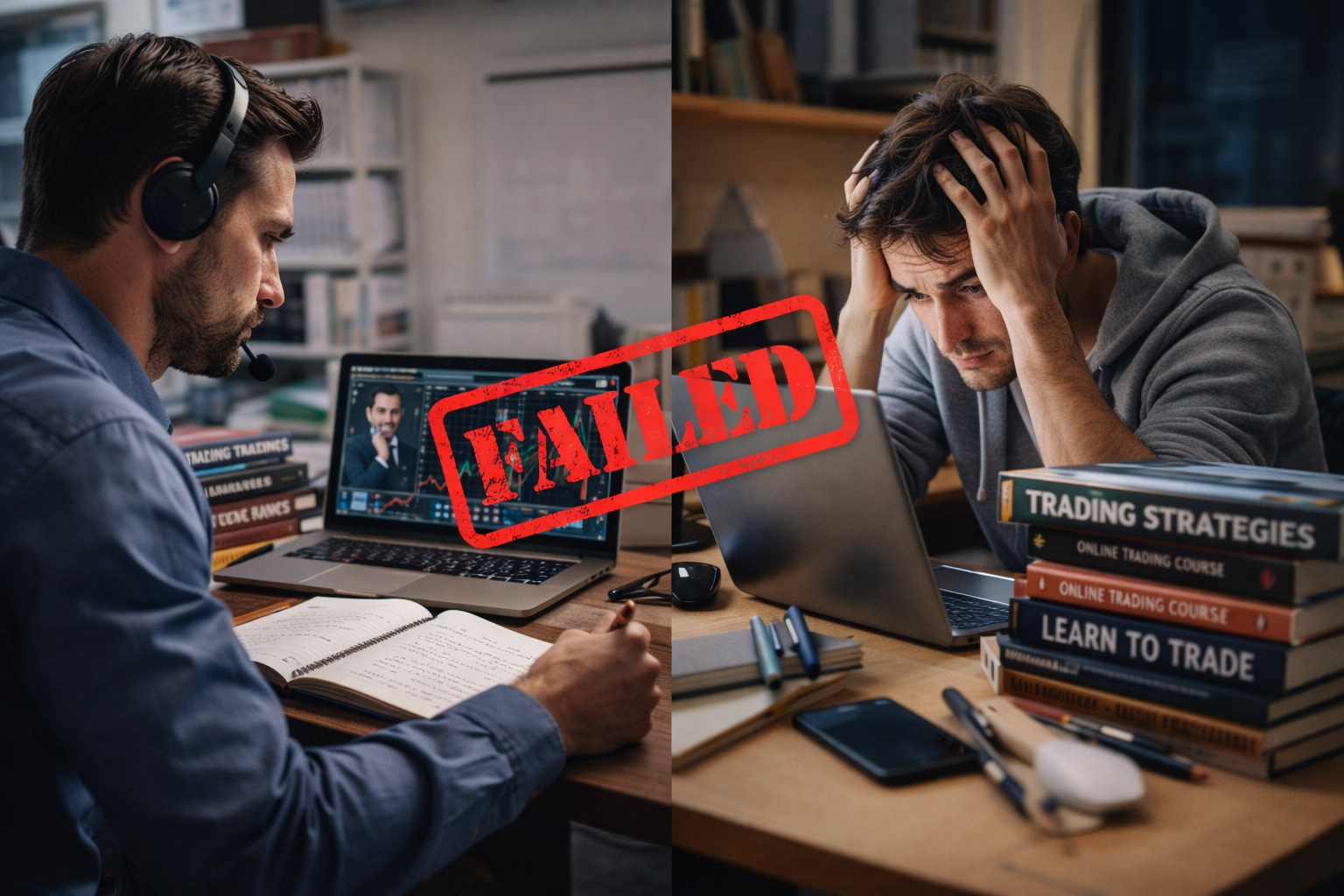

Why most trading courses fail to create consistent traders is a question asked by learners who have already tried strategies, indicators, or short-term systems without lasting success. This article explains the structural reasons trading courses fail, the recurring flaws in retail trading education, and what consistent traders actually need to develop. It is written for serious learners reassessing their education choices and seeking professional standards rather than shortcuts.

Most trading courses fail because they teach tactics without process, outcomes without risk discipline, and confidence without accountability.

Why Most Trading Courses Fail: The Core Reasons

Most failed trading education shares the same underlying problems:

- Strategy-first teaching: focuses on setups before decision-making

- Weak risk education: treats risk as an add-on instead of the foundation

- No decision framework: gives rules without context or reasoning

- Unrealistic timelines: implies fast results instead of long development cycles

- Lack of feedback: provides content without review or accountability

These issues explain why many learners gain information but never achieve consistency.

The Consistency Problem in Trading Education

Consistency is the defining challenge in trading. Many learners experience short periods of success, but few maintain stable performance across different market conditions.

Most trading courses teach how to enter trades rather than how to operate as a decision-maker. As a result, learners accumulate knowledge without developing repeatable behaviour.

Consistency requires structure, discipline, and process-led thinking, not isolated techniques.

Strategy-First Education Is a Core Failure

Many trading courses are built around a single strategy or setup. While this approach can appear effective initially, it creates dependency on specific market conditions.

When conditions change, the strategy stops working. Learners then abandon rules, override risk, or search for the next method.

Courses that lead with strategy fail to teach adaptability, which is essential for long-term trading consistency.

Lack of Risk Management Depth

Risk management is often treated as a basic concept rather than a professional skill. Many courses mention stop losses and position sizing without explaining exposure, drawdowns, or capital preservation.

Consistent traders focus on risk before opportunity. Courses that fail to build this mindset leave learners vulnerable to large losses.

Without disciplined risk control, no strategy remains viable over time.

Teaching Outcomes Instead of Process

Many courses emphasise winning trades, profit targets, or performance metrics. This outcome-driven focus encourages emotional decision-making and short-term thinking.

Professional traders judge success by whether decisions followed process, not by individual trade results. Courses that ignore this distinction reinforce poor habits.

Process-led education supports resilience and continuous improvement.

No Framework for Decision-Making

Consistent traders operate within decision-making frameworks that govern when to trade, when to stand aside, and how to manage uncertainty.

Most retail trading courses provide rules without explaining why those rules exist. When conditions deviate, learners cannot adapt.

Without frameworks, learning remains fragile and inconsistent.

Overconfidence and Underpreparedness

Some trading courses simplify complexity or exaggerate success rates. This creates false confidence without competence.

When losses occur, learners feel misled rather than prepared. Confidence built without realism collapses quickly under pressure.

Professional education builds confidence gradually through repetition, discipline, and honest expectations.

Absence of Review and Feedback

Many trading courses are consumed passively. Learners watch content but receive no feedback on interpretation or execution.

Consistent improvement requires structured review. Traders must analyse decisions, errors, and behavioural patterns objectively.

Courses without review loops limit development and reinforce mistakes.

Misaligned Expectations

Trading courses often understate the time and effort required to develop consistency. Learners expect rapid progress and become frustrated when results lag.

Professional trading development takes years, not weeks. Courses that fail to set this expectation contribute to churn and disappointment.

Realistic timelines protect learners from self-sabotage.

What Consistent Traders Actually Need

Consistent traders need structured education that integrates analysis, risk management, execution, and psychology into one coherent process.

They need adaptable frameworks, disciplined standards, and feedback mechanisms that refine decision-making over time.

Most importantly, they need education that prioritises survival and discipline over excitement.

How to Evaluate Trading Courses More Critically

To avoid failed education, traders should assess whether a course teaches process, risk discipline, and adaptability.

Courses should explain why decisions are made, not just what to do. They should also set honest expectations and include accountability.

Critical evaluation prevents wasted time and capital.

Frequently Asked Questions

Why do most trading courses fail

Most trading courses fail because they focus on strategies and outcomes rather than process, disciplined risk management, and repeatable decision-making. Without these foundations, learners cannot adapt as market conditions change, which prevents long-term consistency.

Are trading strategies enough to be consistent

Trading strategies alone are not enough to achieve consistency. Without controlled risk exposure, behavioural discipline, and adaptability, strategies eventually break down when volatility regimes or market structure changes.

Do professional traders use trading courses

Professional traders often use structured education early in development to build frameworks and risk discipline. However, they rely on decision processes, review, and experience rather than copying strategies or signals.

How long does it take to become consistent in trading

Developing trading consistency typically takes several years of structured learning and disciplined practice. Timelines vary based on education quality, risk control, feedback, and the trader’s ability to maintain process under pressure.

What should traders look for in a trading course

Traders should look for courses that teach process-led decision-making, professional risk management, adaptable frameworks, and realistic expectations. Courses that prioritise shortcuts or profit claims rarely support consistency.