AI Trading Course

The AI Trading Masterclass is a structured AI Trading Course designed to teach traders how to apply conversational AI — including tools such as ChatGPT — to research, analysis, and decision-support processes across financial markets. Built for traders at all experience levels, this 24-module programme focuses on integrating AI into professional workflows, covering prompt design, data interpretation, risk processes, journaling, and structured execution within an educational framework.

About This AI Trading Course

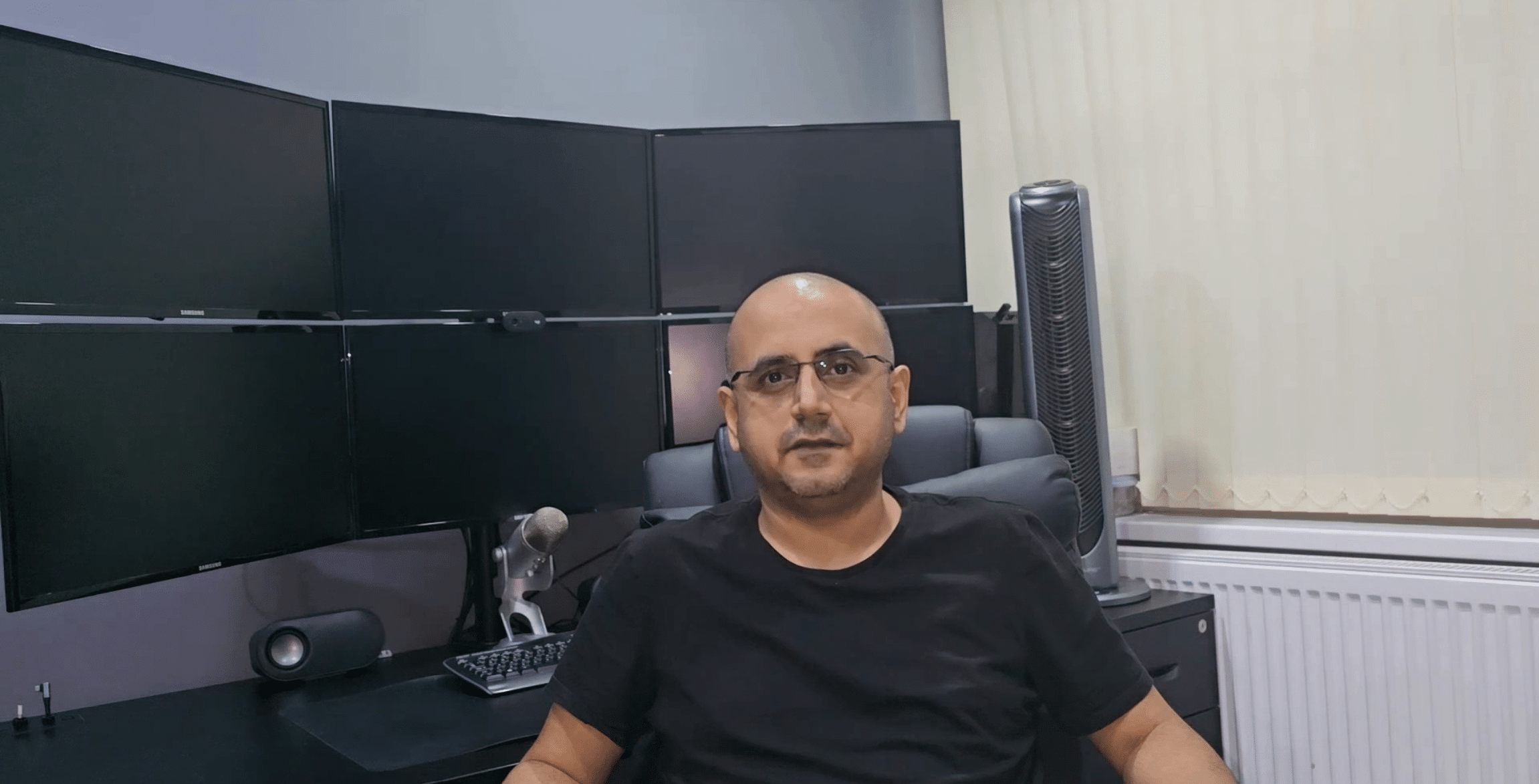

Across 24 professionally structured modules, this programme — created and presented by Sachin Kotecha — explores how conversational AI can be used as a research assistant, analytical support tool, and workflow aid within a disciplined trading process. Designed for practical application, the course requires no coding or quantitative programming and focuses on structured, responsible use of AI to support analysis and preparation.

What You’ll Learn

AI Foundations for Traders – Understand how conversational AI systems work, their limitations, and how they can be aligned with professional trading workflows.

Prompt Engineering – Learn how to design structured prompts, frameworks, and reusable templates to support consistent market research and analysis.

Macro & Fundamental Support – Use AI to organise economic data, policy statements, and macro narratives while maintaining critical judgement and avoiding over-reliance.

Technical Assistance – Apply AI to summarise chart context, build scenario checklists, and support post-analysis review processes.

Sentiment & News Context – Explore how AI can help synthesise headlines and themes while managing information quality and noise.

Risk & Process – Translate predefined risk rules into AI-supported checklists and review routines to encourage consistency and discipline.

Strategy & Execution Support – Develop AI-assisted planning and review workflows that combine structured analysis with independent judgement.

How This AI Trading Course Is Delivered

Each module is delivered through video lectures created and presented by Sachin Kotecha, combining concise slide content with clear, narrative-led explanations. Learners reinforce understanding through practical prompt examples, structured reflections, and end-of-module review exercises.

Who This Course Is For

This AI Trading Course is designed for traders who want to improve research efficiency, support structured analysis, and build repeatable workflows using conversational AI. It is suitable for those starting out as well as experienced traders seeking to formalise their process — without the need for coding.

Outcomes & Skills You’ll Gain

By the end of the programme, learners will have:

- An understanding of how to apply AI tools responsibly within trading research and preparation.

- Reusable prompt frameworks for macro, technical, sentiment, and risk review processes.

- A structured method for scenario analysis and idea validation using AI-assisted checklists.

- A repeatable daily workflow for planning, review, and journaling.

- Greater consistency and discipline through process-led AI decision support.

Why Choose This AI Trading Course

This course focuses on education and process design rather than automation or algorithmic trading. It provides a professional pathway for understanding how conversational AI can support structured analysis, risk awareness, and preparation within an independent trading framework.

Frequently Asked Questions

Is this a beginner-friendly AI Trading Course?

Yes. The programme starts with AI fundamentals and prompt basics before progressing to more advanced research and workflow applications.

Do I need to know how to code?

No. The course is designed around practical use of conversational AI and does not require coding or quantitative programming knowledge.

What tools are used?

Examples are demonstrated using leading conversational AI platforms, such as ChatGPT, with guidance on adapting prompts across different environments.

What’s the duration of this AI Trading Course?

The programme consists of 24 modules and is delivered on a self-paced basis with ongoing access during enrolment.

Does it cover both macro and technical workflows?

Yes. The course covers macro and fundamental organisation, technical context support, sentiment analysis, risk review, journaling, and structured daily routines.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction to the AI Trading MasterclassIntroduces the purpose, structure, and learning journey of the programme, outlining how traders can harness conversational AI to enhance analysis, decision-making, and performance across global markets.1

- Module 1 – The Rise of AI in Modern TradingExplores how artificial intelligence has reshaped global markets, giving traders new tools to analyse data, identify trends, and make faster, more disciplined decisions.1

- Module 2 – Understanding ChatGPT and Conversational AIDemystifies conversational AI models, showing how large-language-model reasoning can be channelled into practical, trading-focused dialogue.1

- Module 3 – How AI Chatbots Think and Process Market InformationExplains how AI interprets context, probability, and language to produce market-relevant insights — and how traders can guide that reasoning effectively.1

- Module 4 – Using ChatGPT as a Trading Research AssistantDemonstrates how to structure requests, extract key data, and turn the model into a reliable partner for daily macro and technical research.1

- Module 5 – Building Better Prompts for Smarter Market InsightsTeaches the art and science of prompt engineering so every question produces targeted, bias-controlled, and actionable trading output.1

- Module 6 – Analysing Macroeconomic Data with AI ToolsShows how AI can simplify complex macroeconomic releases — inflation, growth, employment, and trade — into structured, comparable insights.1

- Module 7 – Using ChatGPT for Fundamental Analysis SupportGuides traders through building AI workflows that interpret earnings, policy statements, and global macro trends with institutional-level structure.1

- Module 8 – Technical Analysis Assistance with AI ChatbotsCovers how to translate chart observations into AI prompts for pattern recognition, momentum analysis, and scenario generation.1

- Module 9 – Generating Trading Ideas and Scenarios with AIExplores how to use AI brainstorming to create structured trade hypotheses, risk–reward outlines, and alternative case assessments.1

- Module 10 – Sentiment and News Analysis through ChatGPTShows how AI can scan, summarise, and classify market sentiment, identifying tone shifts and headline themes before they affect price.1

- Module 11 – AI-Assisted Risk Management and Position SizingTeaches traders to convert risk rules into AI-checklists that reinforce discipline in exposure, sizing, and stop-loss logic.1

- Module 12 – Backtesting Strategies Using AI-Generated ScenariosExplains how to use AI to simulate market conditions, test ideas conceptually, and refine strategies without complex coding.1

- Module 13 – Using AI for Journaling, Reflection, and Performance TrackingIntroduces AI-driven journaling methods that analyse patterns in behaviour, performance, and decision quality over time.1

- Module 14 – Avoiding Hallucinations and Misinterpretations in AI OutputsTeaches how to detect, correct, and prevent errors or false confidence in AI responses using verification and cross-checking techniques.1

- Module 15 – Combining Human Intuition with AI IntelligenceShows how to integrate professional judgement and market intuition with structured AI reasoning for balanced decision-making.1

- Module 16 – Structuring AI-Based Daily Trading WorkflowsOutlines how to embed AI tools into pre-market preparation, trade planning, execution reviews, and post-market analysis.1

- Module 17 – Prompt Templates for Strategy DevelopmentProvides reusable, ready-built prompt frameworks that accelerate market scanning, strategy testing, and idea validation.1

- Module 18 – Building AI-Enhanced Trading PlansExplains how to integrate AI logic into written trading plans, defining objectives, processes, and contingency rules.1

- Module 19 – AI Tools for Multi-Asset and Cross-Market CorrelationCovers how to use AI to compare asset classes, identify inter-market dynamics, and discover diversification opportunities.1

- Module 20 – Ethical and Compliance Considerations When Using AIHighlights data integrity, transparency, and ethical boundaries when applying AI within regulated trading environments.1

- Module 21 – ChatGPT for Macro, Micro, and Cross-Asset OutlooksShows how to structure comprehensive market outlooks combining top-down macro views with sector and asset-specific detail.1

- Module 22 – Creating Automated AI Trading Dashboards (Conceptual)Demonstrates the conceptual design of integrated dashboards that visualise AI outputs, sentiment, and market correlations.1

- Module 23 – Scaling Decision-Making with AI CollaborationExplains how to expand analytical capacity by coordinating multiple AI sessions to cross-check, challenge, and refine trade ideas.1

- Module 24 – Becoming an AI-Empowered TraderConcludes the masterclass with a framework for lifelong integration of AI into trading practice — uniting technology, discipline, and human insight.1

- AI Trading Masterclass ExamThe Exam tests your knowledge across all 24 modules of the AI Trading Masterclass, covering AI-assisted analysis, prompt engineering, sentiment interpretation, workflow design, and ethical application. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your learning and demonstrate your mastery of AI-powered trading.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1